How To Report Form 1099-div In Canada

If tax was withheld on the income Wealthsimple Tax will. My amounts on 1a and 1b are not the same so which one should I report on the Turbo tax in the place of income from foreign sources Interest on Bank account not.

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

If your mutual fund investment makes a capital gain distribution to you it will be reported in box 2a.

How to report form 1099-div in canada. Im trying to fill out my tax forms this year and the advice I keep seeing is to put it down as a 1099-DIV as 1b income after currency conversion. To report income from a US 1099-DIV form add the Other Foreign Income Foreign Tax Credits section. I have stock in a Canadian company whose US branch I used to work for.

Choose your bank or brokerage from the list to import your 1099-DIV and clicktap Continue or manually enter your 1099-DIV by clickingtapping Ill type it in myself. Report as ordinary dividends in box 1a of Form 1099-DIV payments of 404 k dividends directly from the corporation to the plan participants or their beneficiaries. To help you navigate the form check out the following guides.

In that case it increases to 600. If your only capital gains and losses are from. If you paid foreign taxes on your interest or dividend income you may be able to claim a foreign tax credit when you calculate your federal see line 40500 and provincial or territorial taxes Form.

If you have an amount entered in other boxes of your Form 1099-DIV refer to the Instructions for Recipient of Form 1099-DIV that are attached to your form and the Instructions for Schedule D to see where to report them. Enter any qualified dividends from box 1b on Form 1099-DIV on line 3a of Form 1040 Form 1040-SR or Form 1040-NR. This will appear after you have completed the Profile section of your tax return.

This includes income from dividends and interest from Canada. The financial institution prepares the Form 1099-DIV and submits a. For the downloaded version of the software please see screenshot attached to show you where to enter in your 1099 slip on your Canadian tax return.

This is the form youll receive if you earned dividends and other similar distributions. Section 404 k dividends are not subject to backup withholding. Box 1b reports the portion of box 1a that is considered to be qualified dividends.

While not all your income may be included in a W-2 or 1099 the IRS advises that you are still responsible for reporting income earned from every source. Enter any foreign tax paid. Choose Investment not reported elsewhere as the type of income.

For each fund that paid foreign taxes report the amount from Box 7 of your Form 1099-DIV on Form 1040. This reporting threshold is 10 as well unless youre being paid because the corporation is liquidating. Banks financial institutions and businesses who acquire property in full or partial satisfaction of a debt secured by that property must issue Form 1099-A to the borrower taxpayer and forward a copy.

Hi I have a couple of tax forms 1. Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. When you get to Lets get the details from your 1099-DIV or brokerage statement after entering dividends check the box My form as info in more than just these boxes.

If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From Business. They mailed me an NR4 form for my interest last year. 1099 DIV form where I have 1a Total Ordinary Dividends 1 b Qualified dividends 7 Foreign tax paid 2a Total Capital Gain Distribution000.

Form 1099-DIV exists so that taxpayers and the IRS know the income generated by financial assets in dividend paying accounts. Foreign dividends do not qualify for the dividend tax credit. This form requires the name of the freelancer or business their tax identification information address and signature.

Online version - you would put it under Other income line 130 on the foreign slip and make sure to enter State and Federal taxes paid next to that box. Click start next to Dividends. This form is required for filing your taxes.

How you report 1099-MISC income on your income tax return depends on the type of business you own. Citizen or resident the Internal Revenue Service IRS requires you to report all worldwide income. You do not have to fill out Form 1116 Foreign Tax Credit Individual Estate or Trust.

Use the completed IRS Form W-9 to fill in the information on the 1099-MISC form. Report on line 12100 any foreign dividends you received. Also these dividends are not eligible for the.

Report this data either on Form 4797 or Form 8949 with the net capital gain or loss carried over to Schedule D and Form 1040. When you complete Schedule C you report all business income and expenses. WHO FILES THE FORM.

If you wish to take a deduction instead of a credit. These include stocks mutual funds and exchange traded funds ETFs. Follow the on screen instructions to enter your 1099-DIV.

If your account had more than 10 in dividends or more than 20 in sales during the tax year you received IRS Form 1099-DIV or 1099-B from Computershare. If you are a US. You can report your income and tax paid in Canadian dollars or you can enter the income and tax in a foreign currency and enter the exchange rate in the FX column.

Have the freelancer or contractor complete the IRS Form W-9 as soon as possible preferably their first day of work. Youll typically receive a Form 1099-DIV if you own stock or mutual fund portfolios.

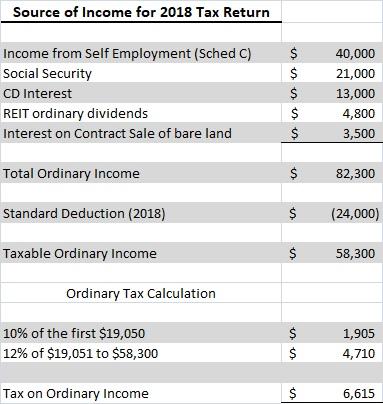

Solved Sally And Charles Heck Received The Following Form 1099 Div In 2018 T Solutioninn

Solved Sally And Charles Heck Received The Following Form 1099 Div In 2018 T Solutioninn

Like Dividends How To Read Your 1099 Div Nasdaq

Like Dividends How To Read Your 1099 Div Nasdaq

Understanding Your 1099 Div And What All Of Those Numbers Mean Seeking Alpha

Understanding Your 1099 Div And What All Of Those Numbers Mean Seeking Alpha

Like Dividends How To Read Your 1099 Div Nasdaq

Like Dividends How To Read Your 1099 Div Nasdaq

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is A C Corporation What You Need To Know About C Corps Gusto

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Unbelievable Facts Reference Letter For Student Printable Job Applications

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Unbelievable Facts Reference Letter For Student Printable Job Applications

Irs Form 1099 Reporting Forms 1099 B 1099 Div 1099 Int And 1099 Oid 1099 S And 1099 R White Paper Lorman Education Services

Irs Form 1099 Reporting Forms 1099 B 1099 Div 1099 Int And 1099 Oid 1099 S And 1099 R White Paper Lorman Education Services

1116 Frequently Asked Questions 1116 K1

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

5 Simple Steps To E File Your 1099 Div Forms With Expressirsforms Youtube

5 Simple Steps To E File Your 1099 Div Forms With Expressirsforms Youtube