Can An Llc Have Multiple Dbas

The number of DBAs an LLC or Corporation can have in the United States is limitless although they come with some requirements and more perceived expenses and obligations. Registering DBAs doing business as also known as Fictitious Names.

Can Corporations Have More Than One Dba Incfile

Can Corporations Have More Than One Dba Incfile

Running all the business activities under one LLC name or.

Can an llc have multiple dbas. Worst case if an LLC operates as two DBAs failure of one could result in the company loses both businesses. As a hypothetical example. Instead you file two additional DBAs.

As my fellow counsel has said you can operate multiple dbas under one LLC and as Glenn has suggested you might want to rethink keeping all your eggs in one basket so to speak as a claim against one dba will be a claim against them all and. Both DBAs are registered alongside your initial company Jimmys Bakery LLC. Yes you can have multiple businesses under one LLC.

Entrepreneurs sometimes have more than one business going at the same time. Although it is generally not recommended some business owners may find that it is the best decision for their setup. The short answer to this question is yes.

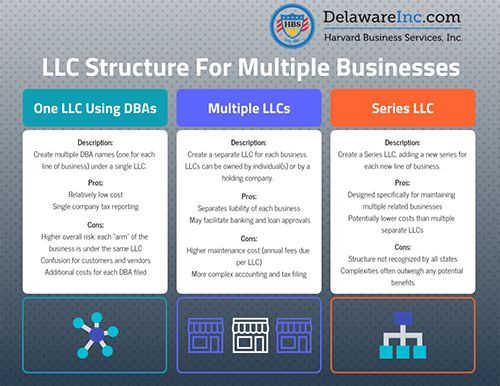

Multiple businesses under one LLC. Whether that LLC has any DBAs Fictitious Names is up to you. Operating multiple DBAs under a parent LLC holding company also adds severe complications in the case you choose to sell one of the companies you own.

It may make sense to give each business its own name but setting up separate LLCs adds a layer of paperwork and complexity. For example a major loss within one DBA could be catastrophic for the other. Because the DBAs books are technically.

Multiple DBAs Having multiple DBAs can be an advantage for businesses that are structured as an LLC. Indeed you are allowed to register as many DBAs as you want there are associated filing costs. You can run two or more businesses under one LLC by either.

A simpler approach is to give the LLC one name and set up DBAs for each of the business lines. Running three different product lines under one name will likely create a marketing nightmare. Can You Have Multiple DBAs on A LLC.

As long as it is not prohibited you can legally have one bank account with multiple DBAs. Use One LLC to Run Both Businesses One common approach involves having one LLC usually named for the originalprimary businessand then setting up a DBA or multiple DBAs Doing Business As also known as fictitious name for the new venture s. The answer is yes--it is possible and permissible to operate multiple businesses under one LLC.

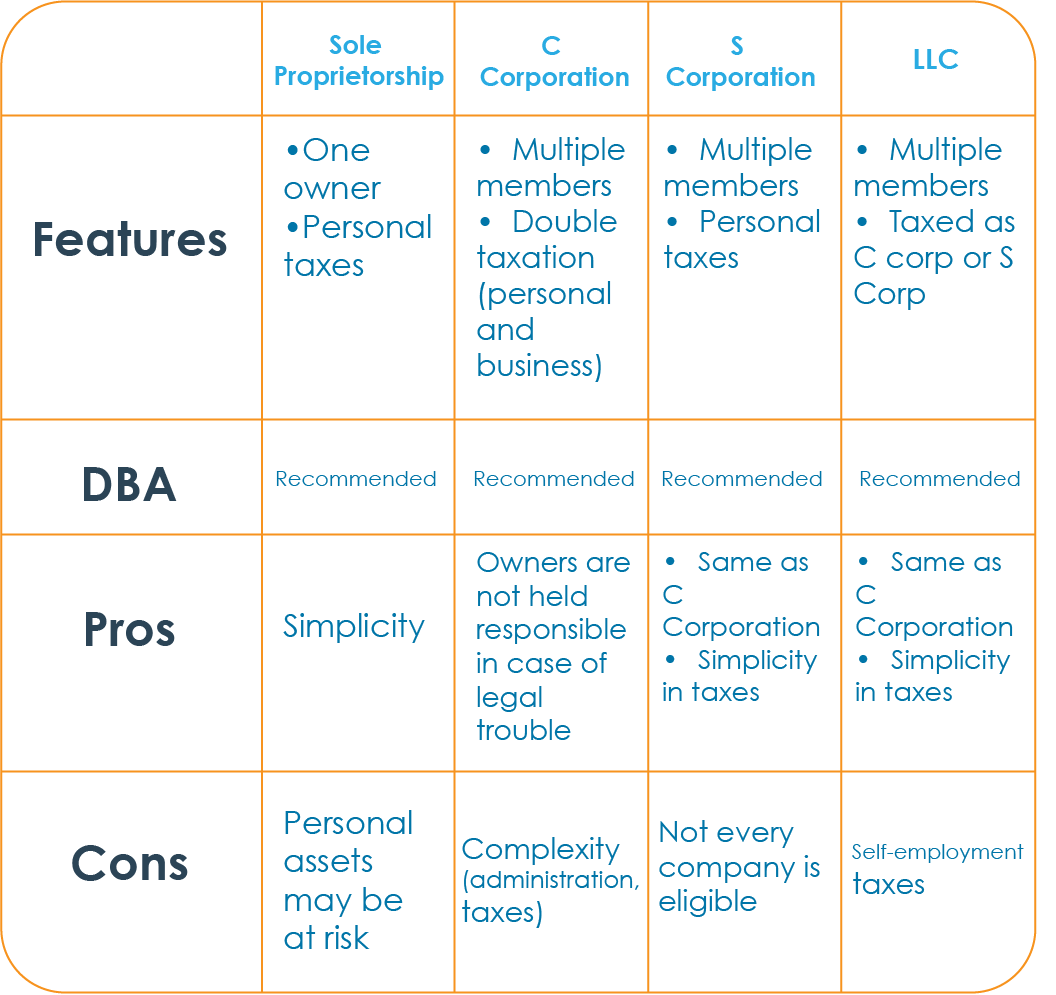

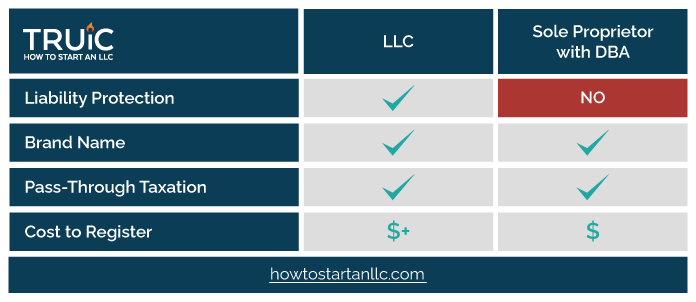

When it comes to a sole proprietorship it is. Yes a DBA can have multiple owners as long as the business is not structured as a sole proprietorship. In fact creating an extra DBA name is a simple strategy that some companies use to diversify their businesses.

Meaning you dont have to file a DBA to run multiple businesses. If you must have one bank account with multiple DBAs keep the. Instead of drafting new articles for each venture multiple DBA filings are submitted and registered with the local government.

Your own personal assets are shielded as well as the assets belonging to Property B Property C etc. Another common option is to file one LLC or corporation and then set up multiple DBAs Doing Business As for each of the other ventures. For instance Mary Moore operates as a sole proprietor graphic designer and she decides to do business as.

Not only can tax time become more complex but multiple DBAs can increase liability concerns. This is the best way to contain liability in potentially risky ventures. Create One CorporationLLC and Have Multiple DBAs Under the Main CorpLLC Your second option is to create one main company as an LLC or corporation.

A Series LLC provides the same benefits as a single master LLC with multiple LLCs organized underneath it but enjoys greater flexibility and simplified administration. Jimmys Fresh Fruit Pies LLC and Jimmys Fresh Pizza Dough LLC. For most people who use a DBA it means that they are operating as a sole proprietor.

Having single LLC to house multiple separate business entities as a Series LLC meaning that both the holding company and operating entities can be formed within a single LLC. Howbeit filing multiple names may be unnecessary based on your companys needs. The main reason being that the LLC can segment different business markets operating each segment with a different DBA.

It is possible and may be necessary to have multiple EINs in the case you the business owner own multiple businesses. Many entrepreneurs who opt to do this use what is called a Fictitious Name Statement or a DBA also known as a Doing Business As to operate an additional business under a different name.

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Doing Business As Dba What Is It And Why Is It Needed Freshbooks Blog

Doing Business As Dba What Is It And Why Is It Needed Freshbooks Blog

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

What S The Difference Between Dba Sole Proprietorship Llc And Corporation Camino Financial

What S The Difference Between Dba Sole Proprietorship Llc And Corporation Camino Financial

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

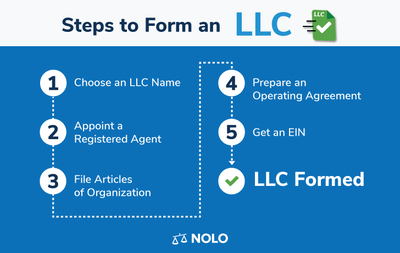

Llc In Florida How To Form An Llc In Florida Nolo

Llc In Florida How To Form An Llc In Florida Nolo

How To Structure A Series Llc Incnow

How To Structure A Series Llc Incnow

Doing Business As Dba What Is It And Why Is It Needed Freshbooks Blog

Doing Business As Dba What Is It And Why Is It Needed Freshbooks Blog

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Can You Have Two Businesses Under One Llc Llc University

Can You Have Two Businesses Under One Llc Llc University

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

Dba Filing Create A Fictitious Business Or Trade Name

Dba Filing Create A Fictitious Business Or Trade Name

Can An Llc Have More Than One Dba Legalzoom Com

Can An Llc Have More Than One Dba Legalzoom Com

Can You File A Dba Online Incfile

Can You File A Dba Online Incfile

Dba Vs Llc A Truic Business Guide

Dba Vs Llc A Truic Business Guide