What Is Irs Form W-8ben-e Used For

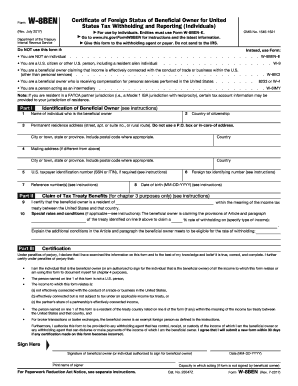

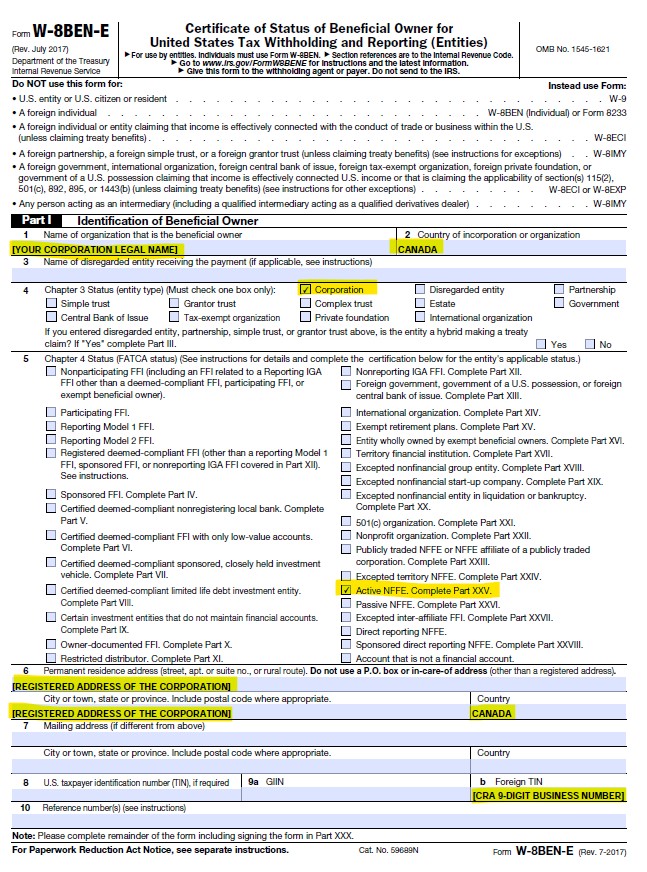

Once completed and signed Form W-8BEN-E becomes a Certificate of Beneficial Owner for foreign entities receiving payments from US clients or dealing with US banks or foreign banks under IGA agreement FATCA. By providing a completed Form W-8BEN you are confirming that you are.

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

Individuals must use Form W-8BEN.

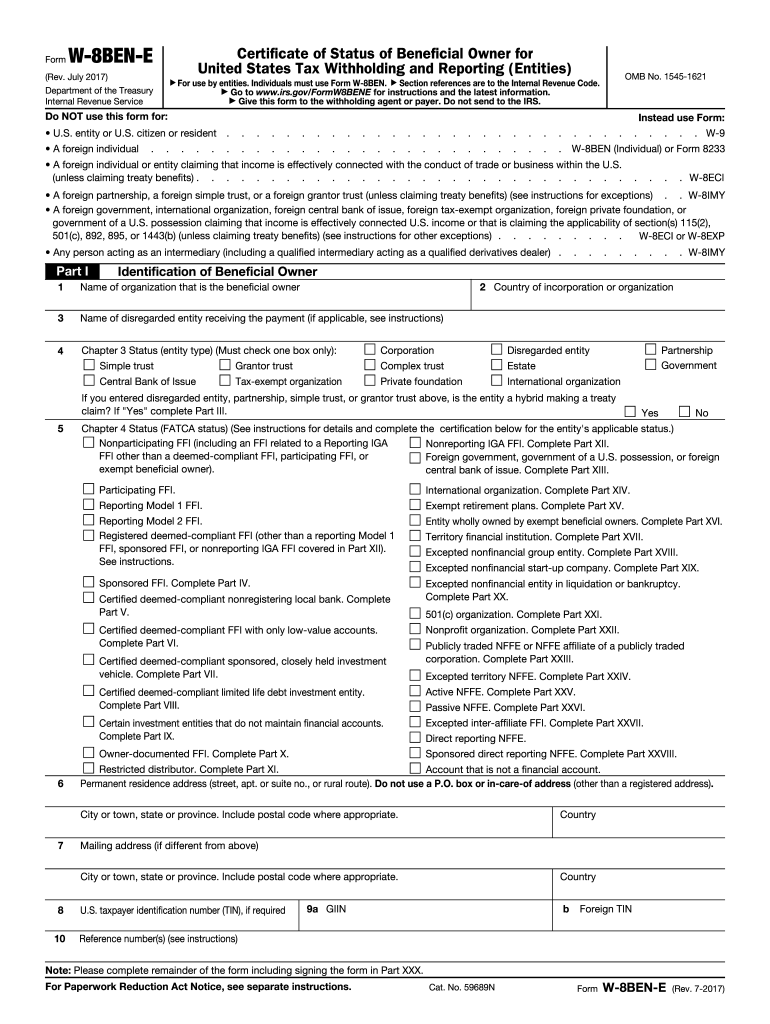

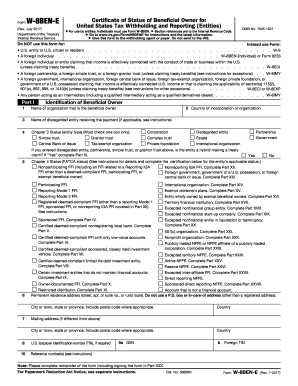

What is irs form w-8ben-e used for. If you receive certain types of income you. All foreign non-US businesses that are receiving payment from an American company must fill out the W-8BEN-E form. Current Revision Form W-8 BEN-E PDF Information about Form W-8 BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities including recent updates related forms and instructions on how.

The W-8BEN-E is a form from the United States tax collection agency the Internal Revenue Service IRS. Instead they must complete Form W-9. Form W-8BEN is used by foreign individuals who receive nonbusiness income in the United States whereas W-8BEN-E is used by foreign entities who receive this type of income.

The Form W-8BEN-E is not sent to the IRS. The W-8BEN-E form is used to prove that the business providing the services is indeed a foreign entity. W-8BEN-E is an important tax document which allows businesses operating outside of the US.

Which obligates Canadian Financial Institutions to provide this information. Rather it is retained by the US payor or withholding agent. A properly completed Form W-8BEN-E to treat a payment associated with the Form W-8BEN-E as a payment to a foreign person who beneficially owns the amounts paid.

Foreign business entities should file Form W-8BEN-E Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting instead of W-8BEN which is for individuals only. They are used to report income calculate taxes to be paid to the federal government and disclose other information as required by the Internal Revenue Code. When the payor of the income has the W-8BEN on file the payor will be apprised that the payee is a non-US person and will undertake its withholding duties.

Internal Revenue Service tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. As with everything with the IRS there is most definitely a form for certification. About Form W-8 BEN-E Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities About Form W-8 CE Notice of Expatriation and Waiver of Treaty Benefits About Form W-8 ECI Certificate of Foreign Persons Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States.

There are over 800 various forms and schedules. What is a W-8BEN-E. Requesting a W-8BEN Form W-8BEN forms are used to certify that foreign individuals not businesses have been paid with the appropriate withholding rate.

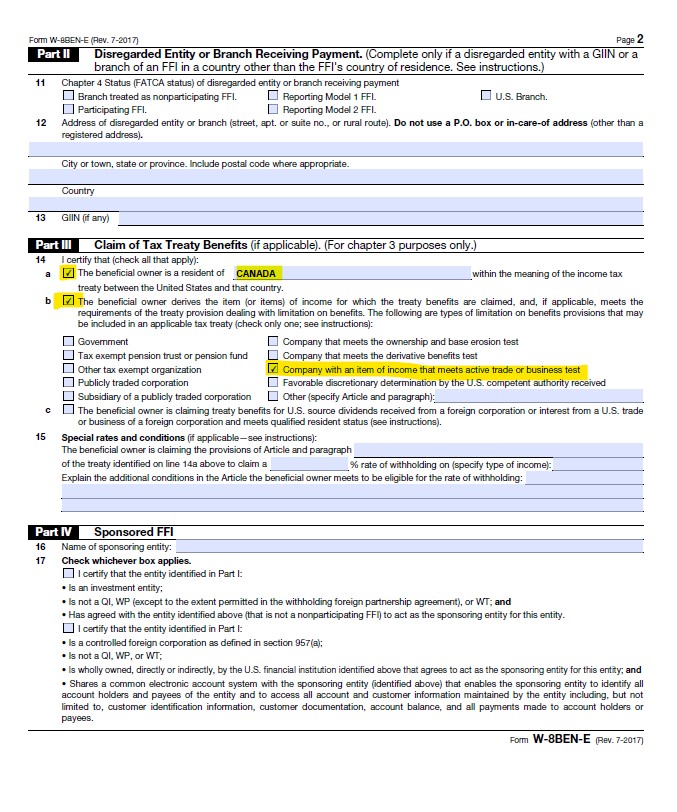

Persons have no responsibility to complete any such form. If applicable the withholding agent may rely on the Form W-8BEN-E to apply a reduced rate of or exemption from withholding. A beneficial owner is the foreign legal entity that is the beneficial owner of the payments received from the US payor.

It is required because of an intergovernmental agreement between Canada and the US. To be used solely by non-US legal entities for companies of any type foundations trusts estates etc. July 2017 Department of the Treasury Internal Revenue Service.

Section references are to the Internal Revenue Code. A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States. You can send a copy of the form to your non-resident alien employees but theyll need to fill it out themselves.

The IRS Form W-8BEN Instructions and other useful information about the Form W-8BEN can be found at the IRS website here. The official document title is Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities. The Form W-8BEN-E is a certificate prepared by the beneficial owner of the payment received from the US payor.

The attachment should also include a. Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals is an IRS tax document. Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities For use by entities.

Foreign persons complete one of the forms in the Form W-8 series eg W-8BEN W-8BEN-E W-8ECI W-8EXP and W-8IMY. Form W-8BEN must be given to each withholding agent. Form W-8 BEN-E is used by foreign entities to document their status for purposes of chapter 3 and chapter 4 as well as other code provisions.

Resident The beneficial owner of the income for which Form W-8BEN is being provided. Foreign businesses are subject to the same tax rate 30 that foreign individuals are subject to and like individuals they too may qualify for a reduced tax rate if their home country has a tax treaty with the US. To claim tax exemption on US-sourced income.

A completed W-8BEN form confirms that. A claim under an IGA must provide an attachment to the Form W-8BEN-E on which it identifies the jurisdiction that is treated as having an IGA in effect describes its status as a Passive NFFE in accordance with the applicable IGA. If you own the income or account jointly with one or more other persons the income or account will be treated by the withholding agent as owned by a foreign person that is a beneficial owner of a payment only if Forms W-8BEN or W-8BEN-E are provided by all of the owners.

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Https Www Phillipcapital Com Au Files Pcau Phillipcapital Guide On Completing W 8ben E Trust Pdf

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

Filing Of W 8ben E By Canadian Service Provider With A Sample

Irs W 8ben E 2017 Fill And Sign Printable Template Online Us Legal Forms

Irs W 8ben E 2017 Fill And Sign Printable Template Online Us Legal Forms

W 8ben E Fill Out And Sign Printable Pdf Template Signnow

W 8ben E Fill Out And Sign Printable Pdf Template Signnow

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Https Events Iofm Com Conference Fall Wp Content Uploads Sites 4 2017 09 Mon 1100 Makingsenseformsw9w8 M Couch Pdf

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme