Qualified Business Income Deduction Former Employer

It also includes up to 20 of qualified real estate investment trust dividends and. Rental real estate qualifying as a business for the QBI deduction.

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Heres how the new qualified business income deduction works.

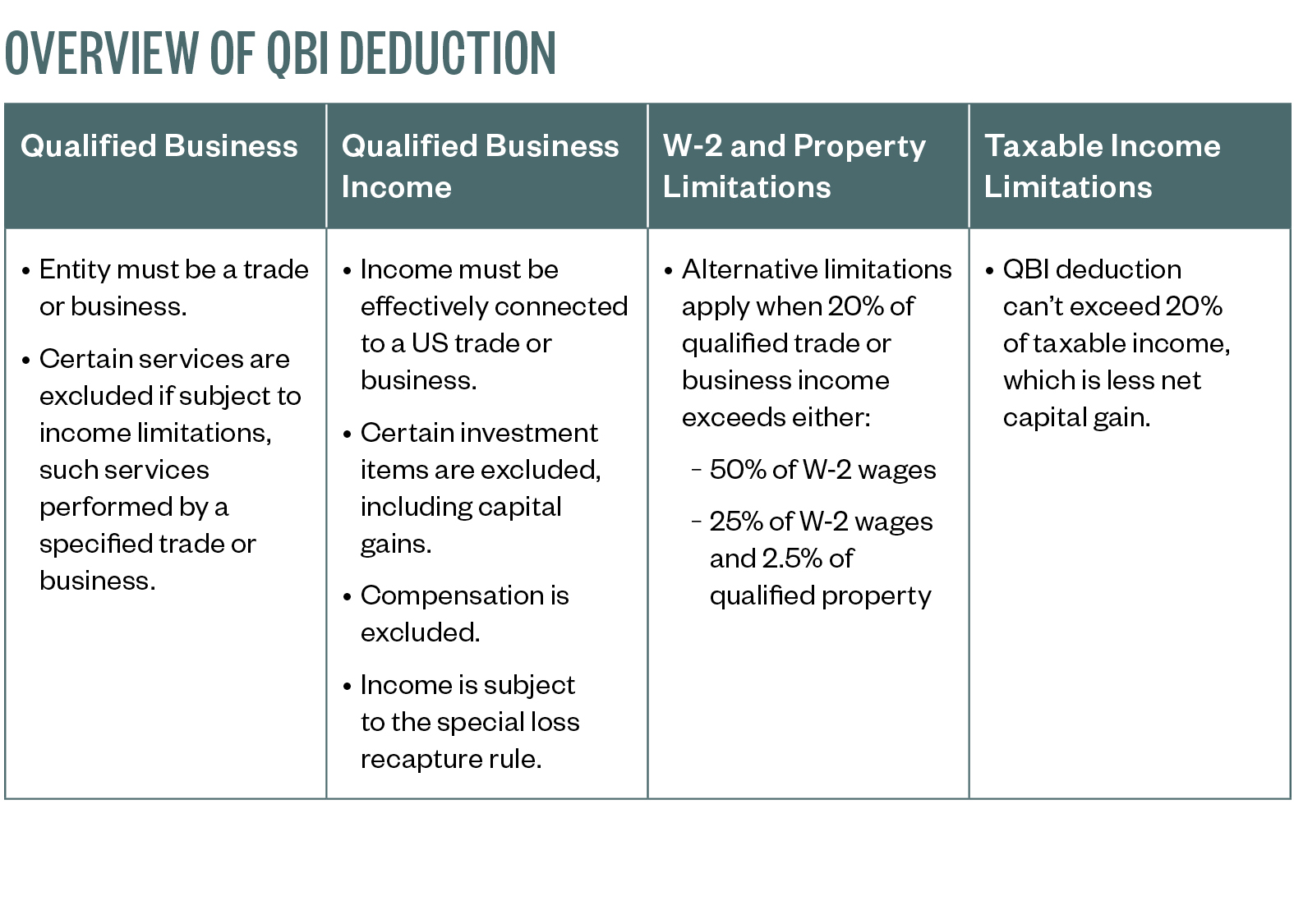

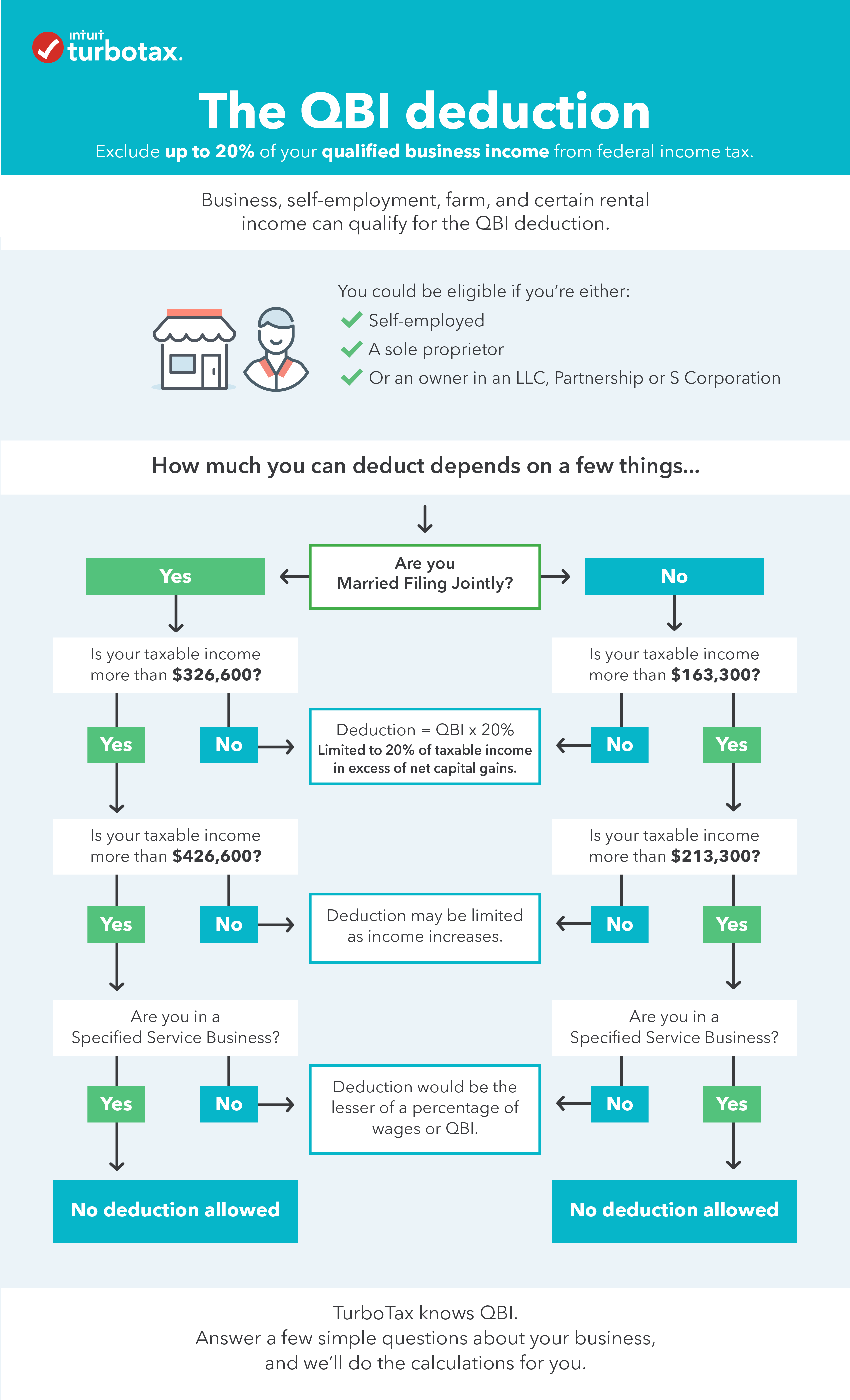

Qualified business income deduction former employer. The QBI is introduced via Section 199A of the Internal Revenue Code and it permits most smaller businesses that are classified as pass-throughs to claim a 20 deduction on their earnings. 199A provides a limit on the QBI deduction of 50 of W-2 wages paid with respect to the qualified business or 25 of W-2 wages paid with respect to the qualified business plus 25 of the unadjusted basis of qualified property. This deduction is claimed on the business owners individual return.

Generally this deduction is the lesser of the combined qualified business income amount and an amount equal to 20 percent of the taxable income minus the taxpayers net capital gain. The deduction is available for taxable years beginning after December 31 2017. The deduction allows them to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income.

This deduction is passed through to an individual owner who pays any tax due. QBI does not include W-2 income guaranteed payments to partners or investment income. If you were previously an employee of a business and continue to provide substantially the same services to that business after you are no longer treated as an employee there is a presumption that you are providing services as an employee for purposes of section 199A for the 3-year period after ceasing to be an employee.

Generally the qualified business income deduction or QBID is only available to individuals and certain trusts and estates who have qualified business income QBI from a qualified trade or business from a QTP QTB excuse me or qualified real estate investment trust dividends REIT dividends andor qualified publicly-traded partnership income or PTP income. A nonresident whether you are a G-4 visa holder or other nonresident should be entitled to a 20 QBI deduction on your consulting income provided you earn Qualified Business Income within the United States and your taxable income is less than 157500 nonresidents generally must file a nonresident income tax return. The QBI deduction is up to 20 of QBI from a pass-through entity conducting a trade or business in the US.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT. The qualified business income deduction QBI deduction allows some individuals to deduct up to 20 of their business income REIT dividends or PTP income on their individual income tax. Business owners can deduct up to 20 of their qualified business income or if lower 20 of their taxable income net of any capital gain.

Income earned by a C corporation or by providing services as. Employer but suddenly becomes an independent contractor while providing substantially the same services directly or indirectly to the former employer it is presumed for the next three years that they are still an employee for purposes of 199A thus no 199A deduction. One of the more important provisions in the Tax Cuts and Jobs Act passed in December of 2017 is the new Section 199A - the deduction for qualified business income QBI.

The qualified business income deduction QBI is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20. Starting in 2019 the IRS issued Revenue Procedure 2019-38 that has a safe harbor allowing certain interests in rental real estate including interests in mixed-use property to be treated as a trade or business for purposes of the qualified business income deduction. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017.

Generally qualified business income refers to the businesss profits. Section 199A allows a deduction for up to 20 of QBI from partnerships limited liability companies LLCs S corporations trusts estates and sole proprietorships. An individual with income attributable to one or more domestic trades or businesses other than as a result of owning stock of a C corporation or engaging in the trade or business of being an employee and with taxable income before computing the section 199A deduction at or below the threshold amount is entitled to a section 199A deduction equal to the lesser of i 20 percent of the.

The first deduction is the one that likely brought you to this article. That means that sole proprietors partnerships limited liability companies and any other form of pass-through entity can deduct 20 of their taxable income before. If your SE income is from a former employer it doesnt count.

Its an income tax deduction of 20 of Qualified Business Income QBI reduced by 179 depreciation deductions. The Qualified Business Income deduction. The 20 pass-through deduction In its most simple terms Section 199A grants an individual business owner -- as well as.

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Tax Geek Tuesday Making Sense Of The New 20 Qualified Business Income Deduction

Tax Geek Tuesday Making Sense Of The New 20 Qualified Business Income Deduction

Irs Publishes Final Guidance On The 20 Pass Through Deduction Putting It All Together

Irs Publishes Final Guidance On The 20 Pass Through Deduction Putting It All Together

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

New Qualified Business Income Deduction

New Qualified Business Income Deduction

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

What Is The Qualified Business Income Qbi Deduct

What Is The Qualified Business Income Qbi Deduct

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Income Tax Deduction Worksheet Promotiontablecovers

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf