Nature Of Business Code For Income From Trading In Derivatives (futures And Options)

Interest from bank deposits annual Rs1 lakh. Given these incomes the tax liability will be calculated as follows.

How Does Profits From Share Trading Should Be Classified Motilal Oswal

How Does Profits From Share Trading Should Be Classified Motilal Oswal

On the other hand profits made from intraday or overnight trading of Futures and Options are considered to be non-speculative income by definition.

Nature of business code for income from trading in derivatives (futures and options). Tax rules treat gains from FO trading as business income and not capital gains ITR-3 is meant for self-employed professionals and individuals with business income Even if you are a salaried person or the FO trading is not your primary business you have to use ITR-3. FO gains are treated as non-speculative business income and hence qualify for presumptive taxation says Karan Batra a Delhi-based chartered accountant. Under the normal rule the applicability of tax audit will be as follows in case of FO Trading.

Income from intraday equity trading for the year Rs2 lakh speculative business income Profits from trading in futures and options Rs2 lakh non-speculative business income Capital Gains Rs1 lakh. Therefore the applicability of tax audit will be as follows in case of FO Trading. According to income tax rules in India gains from FO trading are treated as business income and not capital gains.

Options and futures are alike but when you do an options contract you can choose to not make the transaction. In the following brochure we will introduce you to the fixed income derivatives traded at Eurex and illustrate their most significant applications. Since income from derivative trading is considered as normal business income therefore normal rules as applicable to tax audit as stated in section 44AB will be applicable in case of FO trading also.

Income arising from the trading of Futures and Options could be treated either as business income or as capital gains. Both incomes or losses that arise from trading of futures and options has to be treated as a business income or loss and requires filing of returns using the ITR-4 tax form. Income from FO deals is almost always treated as business income.

Your answer is in your question. MAKKHANLAL SHARMA 1 points Follow. By Karan Batra Filing income tax returns is easy if you have income only from salary and bank interestHowever many taxpayers also have income from other sources including gains from trading in futures and options FO.

Futures on fixed income secu-rities fixed income futures and options on fixed income futures are jointly referred to as fixed income derivatives. Income derived from derivatives ie. Please suggest code for business of trading in shares futures and options - Income Tax.

The due date for filing income tax returns is 31 July but when income from futures and options is considered as business income and is subject to tax audit then the due date becomes 30 September. Tax rules treat gains from FO trading as business income and not capital gains. 22 July 2018 Please provide the business code for trading in futures options intraday tradingshares etc for AY 2018-19.

Since income from FO enjoys the presumptive scheme of taxation you can use the relatively simpler ITR 4 as well. Further income from business can be classified as income from speculative and non speculative business. As per Section 43 5 of the Income Tax Act 1961 intra-day trading shall be considered as speculation business transactions and the income therefrom would be either speculation gains or speculation losses.

Speculative Business Income is the income earned from intra-day equity stocks or currency trading. Any income or loss that arises from the trading of Futures and Options is to be treated and considered as business income or business loss. This is so because certain FO contracts still have a delivery clause whereby the underlying sharescommodities exchange hands between traders on the expiry of contracts.

Income from speculation gains is taxed at the normal rates. Gains from FO are not considered capital gains but business income. If classified as business income and transacted on a recognised stock exchange the income derived from trading of derivatives are taxable as non-speculative.

MAKKHANLAL SHARMA 24 July 2018. Note-Incomeloss from trading in derivatives such as Futures Options etc will generally have nature of Profit and Gain from Business or Profession. Taxable income after deductions is also taxed.

Gains from FO are not considered capital gains but business income according to Income Tax. Start a discussion Unanswered. Filing of income tax returns with regards to any income earned from the trading in Futures and Options is by and large.

According to Section 435 of Income Tax Act 1961 transactions done in the futures and options segment of equity market are speculative business hence it should be treated as business transaction says tax and investment expert Balwant Jain. Rohit Pithisaria I am a Chartered Accountant based in Jaipur Rajasthan. Futures traders benefit from a more favorable tax treatment than equity traders under Section 1256 of the Internal Revenue Code IRC.

As these are considered non-speculative business gains income tax is levied according to. Taxation of Income And Loss Arising From Trading of Futures And Options. Income from derivative trading is considered as normal business income and so regular rules as applicable to tax audit as stated in section 44AB will be applicable in case of FO trading also.

Futures options as well as from Intra-day trading are classified as business income. 1256 states that any futures contract traded on a. Code for business in Derivatives.

1 In case of Profit from transactions of FO trading.

Rbc Investor Treasury Services Market Profiles

Rbc Investor Treasury Services Market Profiles

Interest Rate Markets A Practical Approach To Fixed Income Wiley Trading Book 501 Ebook Jha Siddhartha Kindle Store Amazon Com

Interest Rate Markets A Practical Approach To Fixed Income Wiley Trading Book 501 Ebook Jha Siddhartha Kindle Store Amazon Com

Higher High Lower High Afl Analyze Trading Performance Low High High Low High

Higher High Lower High Afl Analyze Trading Performance Low High High Low High

How To Report F O Trading In Your Income Tax Return

How To Report F O Trading In Your Income Tax Return

How Can I File Future And Option Loss In Itr Tax Benefits Of Reporting Loss On F O In It Returns Youtube

How Can I File Future And Option Loss In Itr Tax Benefits Of Reporting Loss On F O In It Returns Youtube

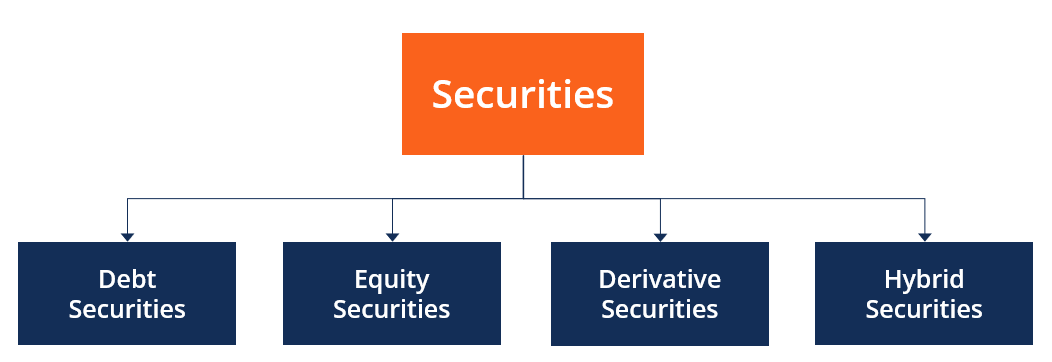

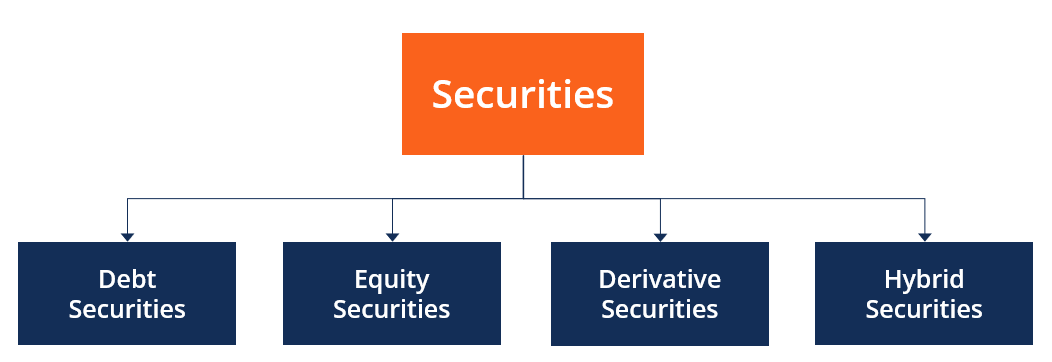

Types Of Security Overview Examples How They Work

Types Of Security Overview Examples How They Work

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

Income Tax Return For Share Traders Intraday Trading F O Trading Capital Gain And Salary Youtube

Income Tax Return For Share Traders Intraday Trading F O Trading Capital Gain And Salary Youtube

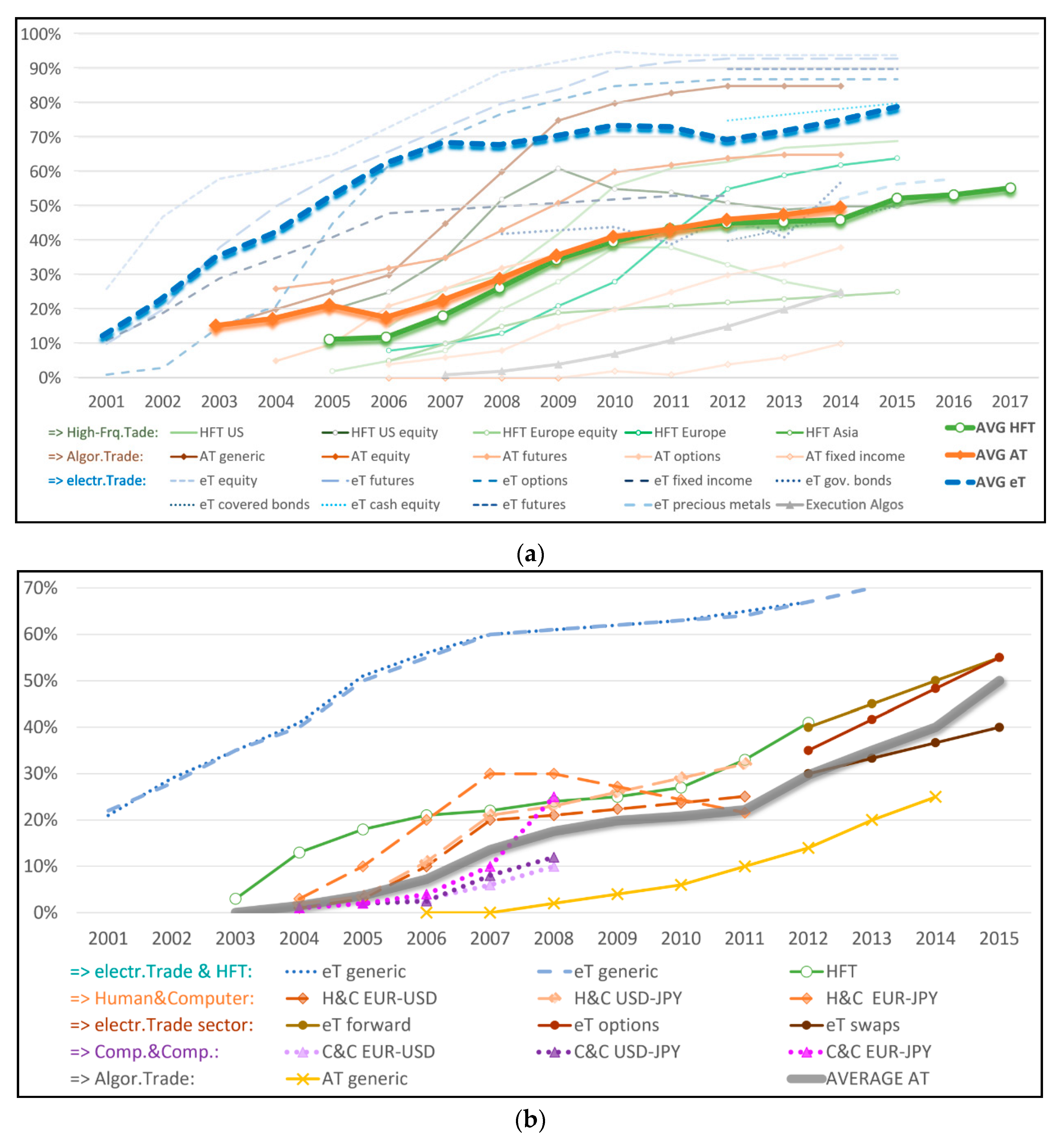

Entropy Free Full Text How Complexity And Uncertainty Grew With Algorithmic Trading Html

Entropy Free Full Text How Complexity And Uncertainty Grew With Algorithmic Trading Html

Ultimate Guide To Sales Trading Wall Street Prep

Ultimate Guide To Sales Trading Wall Street Prep

Different Types Of Stock Trading Intraday Trading Stock Trading Stock Market

Different Types Of Stock Trading Intraday Trading Stock Trading Stock Market

Quantitative Analysis Derivatives Modeling And Trading Strategies By Bin Li Yi Tang Sacred Traders Trading Strategies Analysis Proprietary Trading

Quantitative Analysis Derivatives Modeling And Trading Strategies By Bin Li Yi Tang Sacred Traders Trading Strategies Analysis Proprietary Trading

Trading Income And Bank Charter Value During The Financial Crisis Does Derivatives Dealer Designation Matter Sciencedirect

Trading Income And Bank Charter Value During The Financial Crisis Does Derivatives Dealer Designation Matter Sciencedirect

Intraday Trading Loss F O Loss And Capital Gain In Itr Ay 2020 21 Income Tax Return Share Market Youtube

Intraday Trading Loss F O Loss And Capital Gain In Itr Ay 2020 21 Income Tax Return Share Market Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg) Employee Stock Option Eso Definition

Employee Stock Option Eso Definition

/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

/dotdash_final_Currency_Carry_Trades_101_Dec_2020-01-159e176451ab46fe9eb2917525127277.jpg)