How To Claim Child Care Expenses Without Receipts

National Resource Center for Health and Safety in Child Care and Early Education provides links to individual states child care regulations as well as licensing and child care-related contacts. It is the 1 selling tax preparation software across the country.

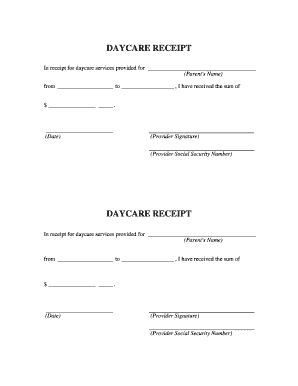

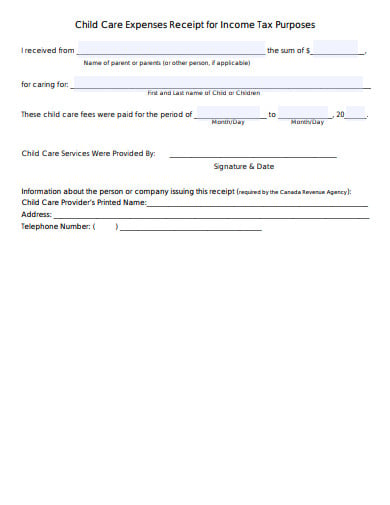

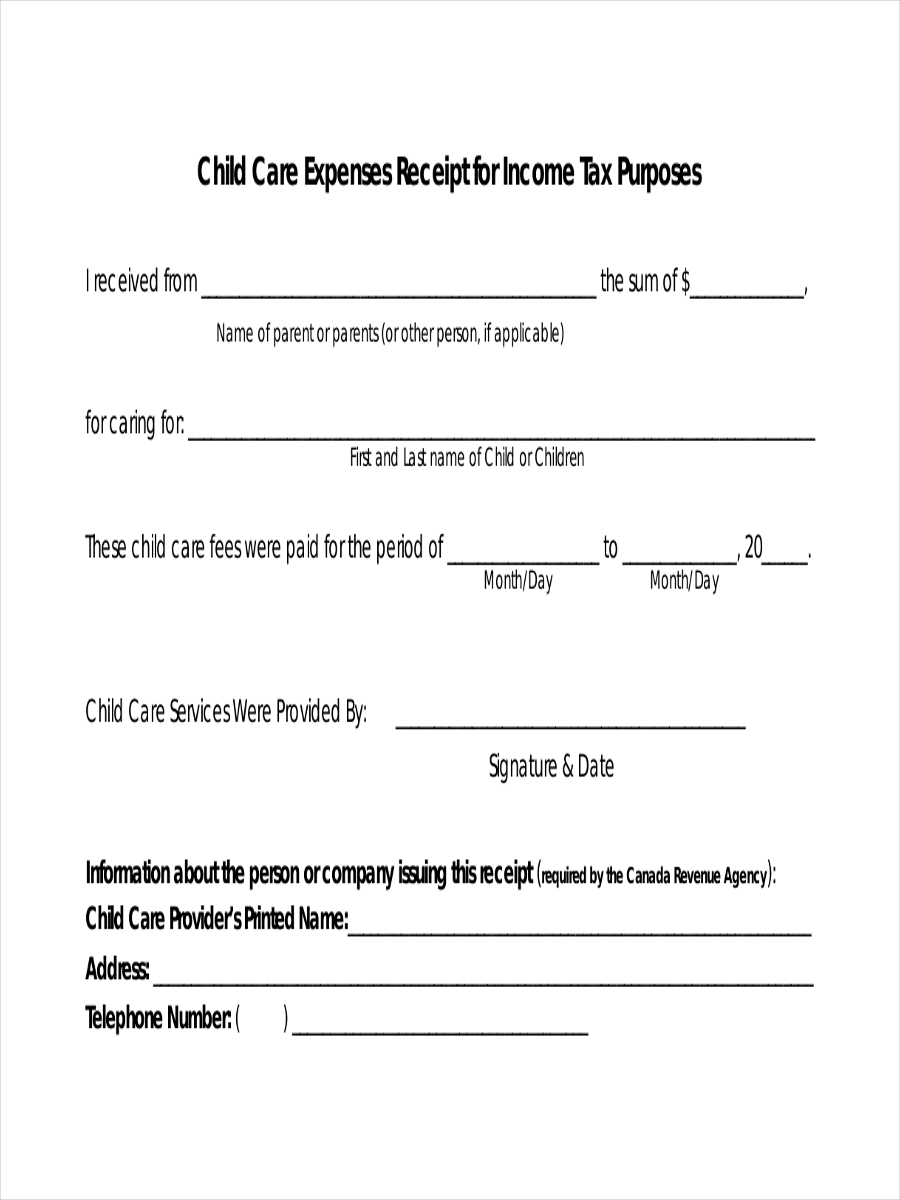

30 Sample Receipt For Child Care Services Pdf Word Template Republic

30 Sample Receipt For Child Care Services Pdf Word Template Republic

I understand that I can wait for my notice of.

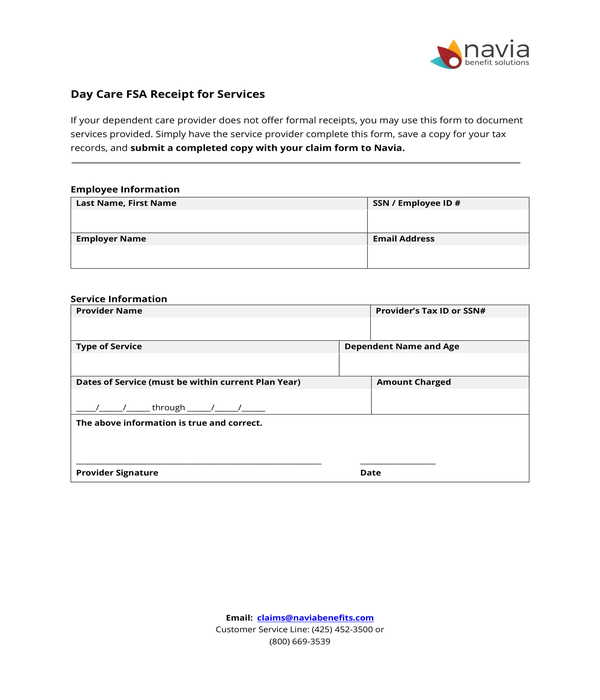

How to claim child care expenses without receipts. Whether youre a contractor sole trader or running a business you claim your business expenses annually in your tax return. Aug 19 2020 You must have earned income. Nov 15 2019 Your child must be under the age of 13 for you to use a Dependent Care FSA for their care expenses.

In Canada if you pay an individual person such as a nanny. Say youre on maternity leave and are the lower income earner in your family. Jan 01 2009 Favorite Answer Yes you can still still claim those child care expenses on your taxes.

But it may take a bit longer is all. Jun 04 2019 The child doesnt have to be your dependent but the child must live with you. Youll pay your dependent care costs directly and then apply for reimbursement.

Childcare expenses can only be claimed against employment income and other earned income. Take the smallest of all these amounts. And to claim the credit the person claiming the expense must have paid it.

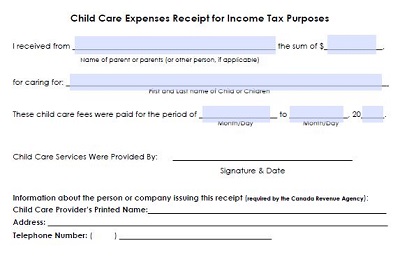

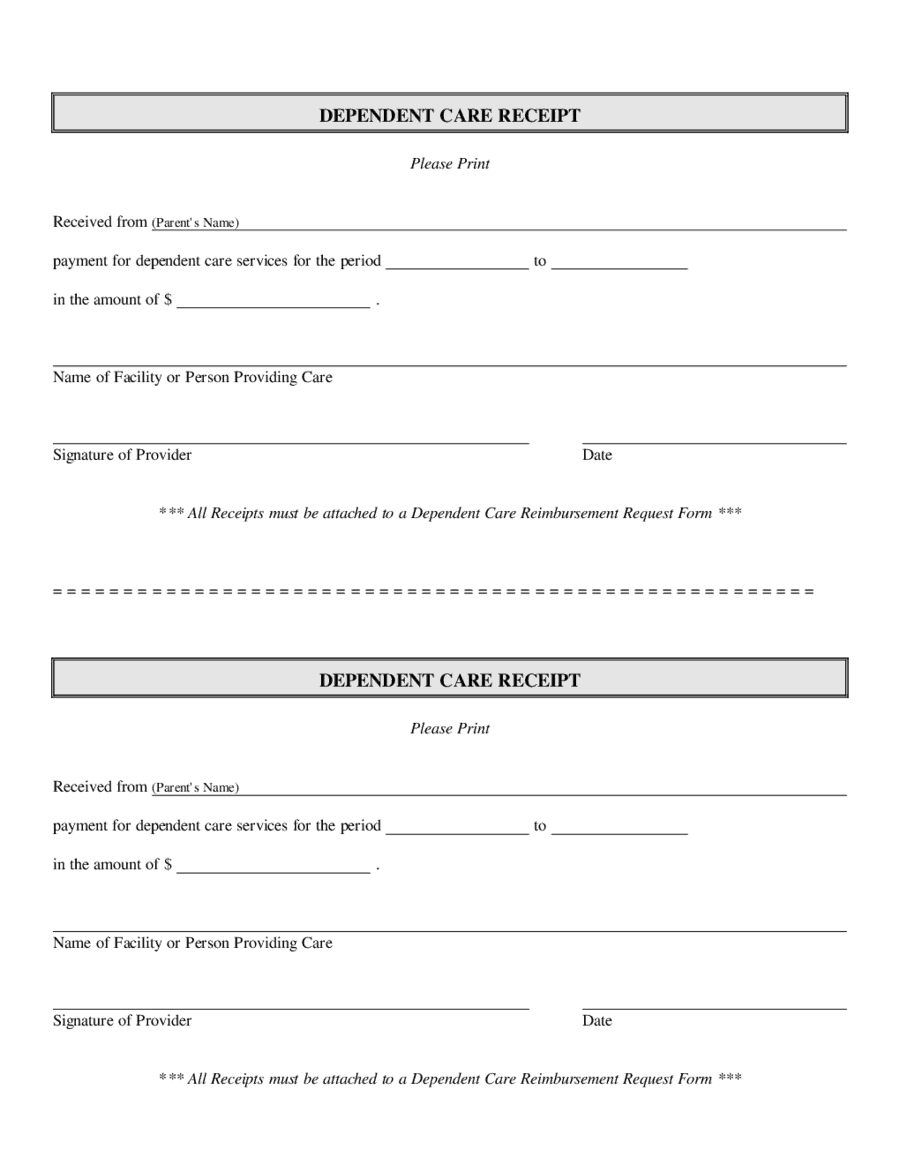

On-site care for their employees children. Child and Dependent Care Expenses and attach it to your Form 1040 to claim the Child and Dependent Care Credit. Jun 08 2019 When you mail it include a copy of the W-9 you sent to the provider along with a copy of the proof that you sent it to them via certified mail.

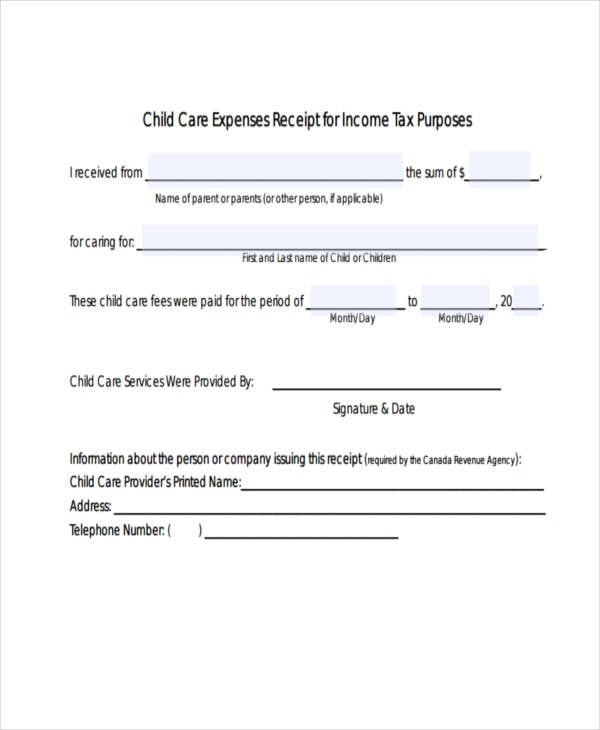

Compare your claimed expenses with your earned income and if youre married your spouses earned income. Dec 04 2019 You can claim child care expenses using form T778. What payments can you claim.

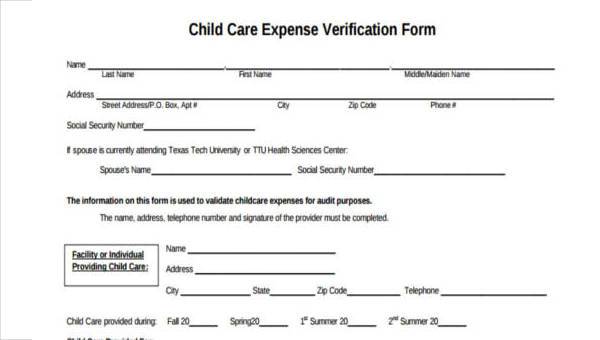

Mar 15 2021 How to claim the Child Care Credit. Information about medical or hospital care. In some states individual daycare centers dont issue receipts to their client since they are not registered.

This credit applies on up to 3000 in care-related expenses for. Definition of an eligible child. These expenses need to be work-related meaning you and your spouse must be working looking for work or attending school full-time.

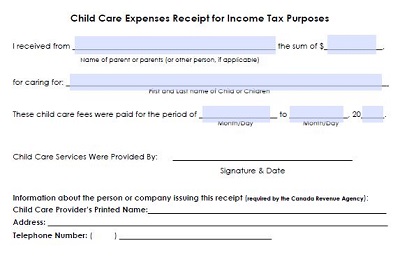

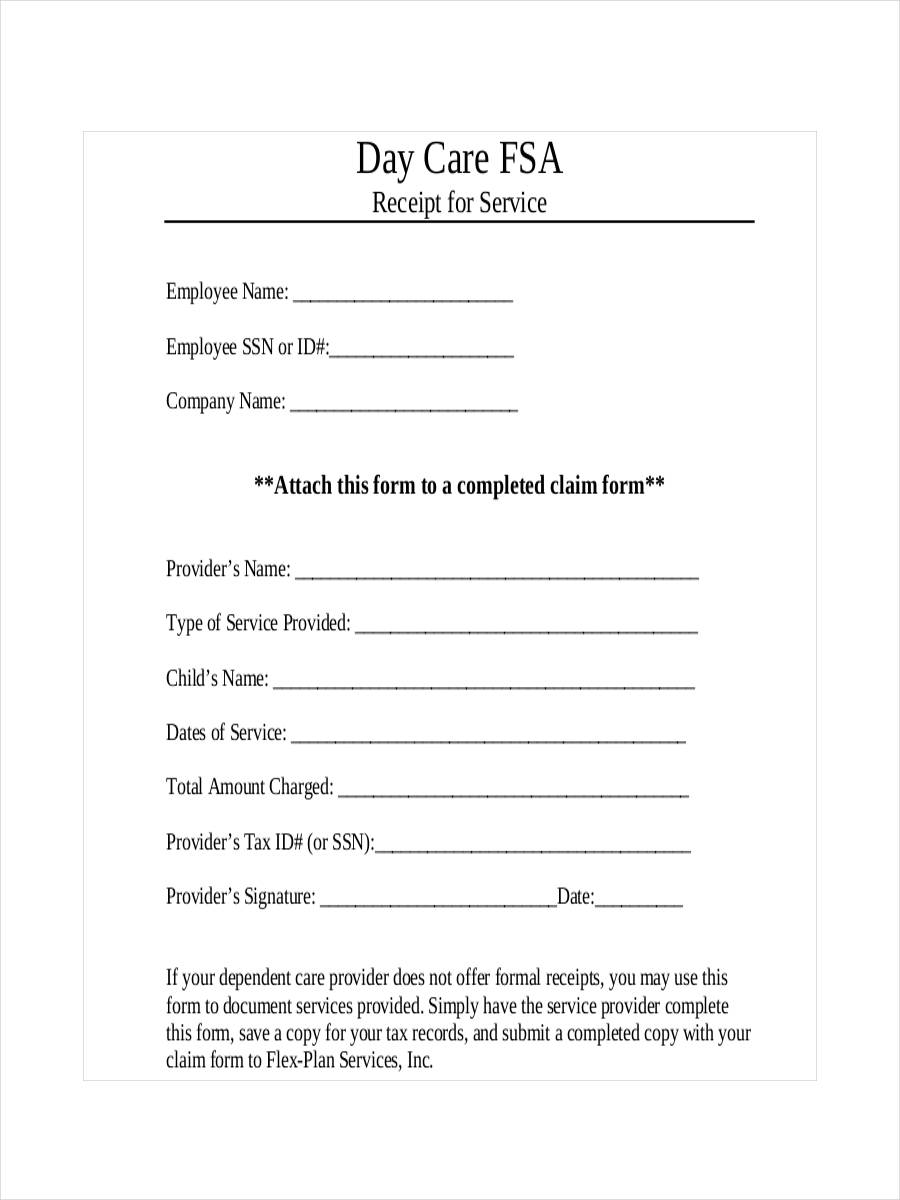

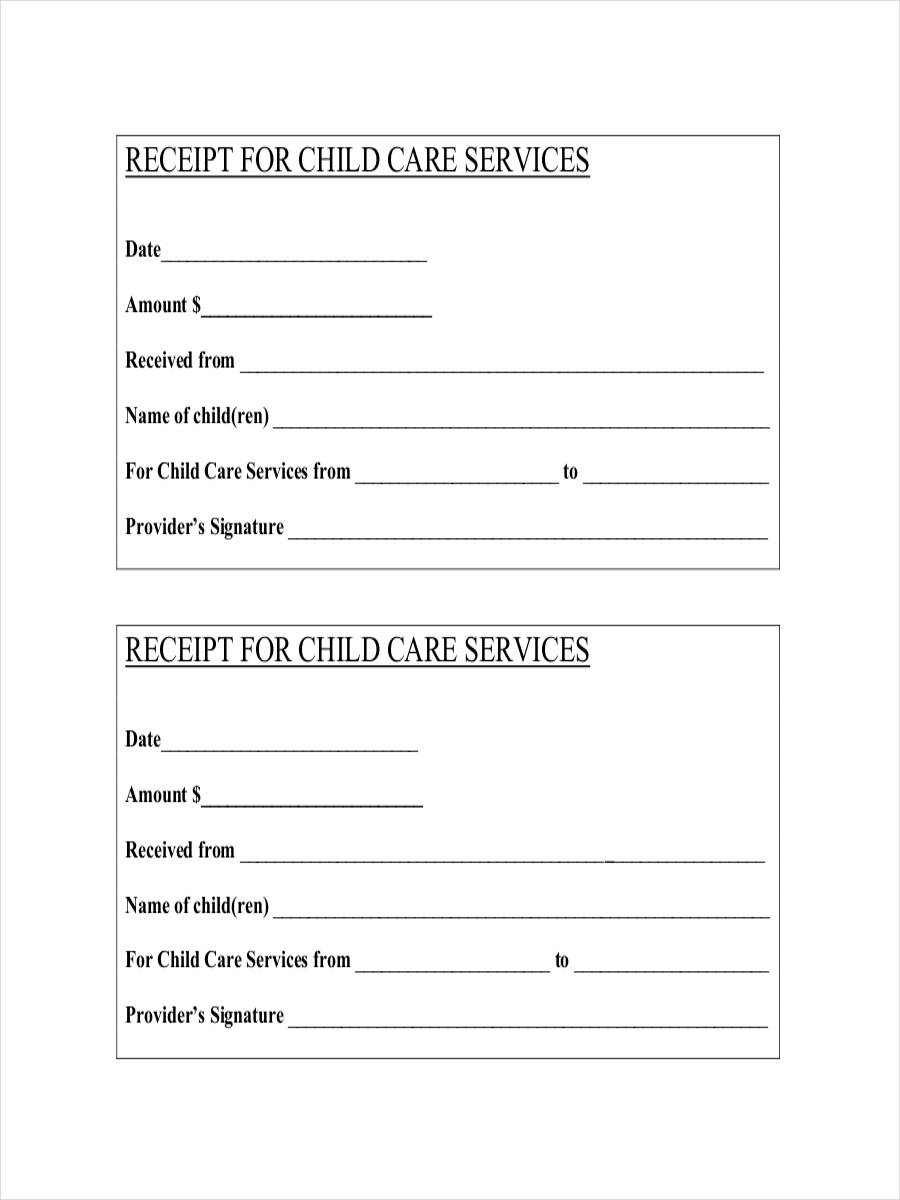

Basically a daycare receipt must have. Deduct expenses from what youve earned from your business during the year. If youre married but filing jointly then either you or your spouse must have a form of earned income.

In most cases the IRS will not audit child care expenses on your child but it. Examples featured in the page show daycare receipts that may be used as basis of making your own daycare receipt. You must be the parent or the primary caregiver of the dependent claimed.

Information about child care services receipts and more. TurboTax has been serving Canadians since 1993. Sep 28 2020 You can claim child care costs paid to day nursery schools and daycare centers caregivers such as nannies overnight boarding schools and camps that provide lodging day camps and day sports schools.

Only the custodial parent can claim the child care credit. I netfiled yesterday and just discovered an unclaimed 2015 child care expense for 200 for which a receipt was issued. For whom can you claim child care expenses.

If your employer gives you money to pay child care expenses or if you have money withheld from your pay on a pre-tax basis you must subtract this money received from your allowable expenses. The daycare providers social security number in order to claim for daycare expenses in the filing of taxes. Youll still qualify to claim the expense and will get your refund.

View solution in original post. The services purchased must have been purchased in order to either work or search for employment. Dec 12 2018 The claim for child care expenses cannot exceed two-thirds of your earned income for the year.

Find out who between you and your spouse or common-law partner if any can claim child care expenses. To be your qualifying child for this credit a child must live with you for more than half the year and meet other requirements. What payments can you not claim.

To claim an expense you must have a record of that expense eg a receipt or Inland Revenue may not allow the expense to be claimed. The full name and contact details of the daycare provider with accompanying signature. To be eligible the primary purpose of the day camp or day sports school must be to provide child care.

Please make sure you keep all receipts in case the CRA requests them later. Direct payment for third-party care. Your maternity leave benefits arent considered earned income by the CRA.

The above limits can be found in the Canada Revenue Agency CRA form T778 Child Care Expenses which is filed with the tax return to make a claim for child care costs. Some employers provide childcare benefits like. This guide will focus on the income and expenses of a child care provider.

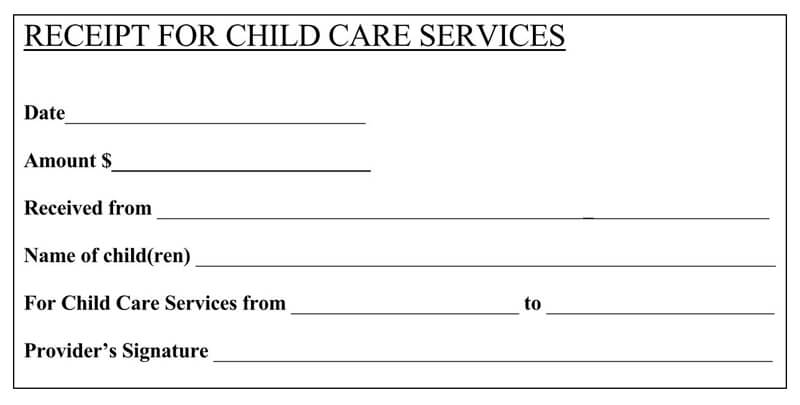

Examination of these returns may result in the following. Feb 19 2020 A valid daycare receipt should include vital details such as the daycare name address date contacts information about the child receipt number name of the parent and the amount paid among other vital information. Take 20 to 35 percent of qualifying dependent care costs as a credit on your tax return up to a limit.

TurboTax tells me that had I included it it would have increased my refund by just under 100.

Explore Our Sample Of Child Care Expense Receipt Template Child Care Services Receipt Template How To Get Money

Explore Our Sample Of Child Care Expense Receipt Template Child Care Services Receipt Template How To Get Money

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Here Is A Pretty Receipt For Year End Daycare Services That Can Be Used For Your Daycare Business You Need To Free Child Care Starting A Daycare Daycare Forms

Here Is A Pretty Receipt For Year End Daycare Services That Can Be Used For Your Daycare Business You Need To Free Child Care Starting A Daycare Daycare Forms

Dependent Care Receipt Fill Out And Sign Printable Pdf Template Signnow

Dependent Care Receipt Fill Out And Sign Printable Pdf Template Signnow

21 Daycare Receipt Templates Pdf Doc Free Premium Templates

21 Daycare Receipt Templates Pdf Doc Free Premium Templates

Daycare Receipt Fill Out And Sign Printable Pdf Template Signnow

Daycare Receipt Fill Out And Sign Printable Pdf Template Signnow

Expense Receipt Templates 8 Free Sample Example Format Download Free Premium Templates

Expense Receipt Templates 8 Free Sample Example Format Download Free Premium Templates

The Truth About Giving Parents A Receipt Tom Copeland S Taking Care Of Business

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Free 8 Sample Child Care Expense Forms In Pdf Ms Word

Free 8 Sample Child Care Expense Forms In Pdf Ms Word

4 Dependent Care Receipt Templates Word Excel Templates

4 Dependent Care Receipt Templates Word Excel Templates

Browse Our Printable Receipt For Child Care Services Template Child Care Services Receipt Template Childcare

Browse Our Printable Receipt For Child Care Services Template Child Care Services Receipt Template Childcare

Unique Childcare Receipt Child Care Invoice Template Child Care Care Child Childcare Invoice Receipt Tem Childcare Receipt Template Invoice Template

Unique Childcare Receipt Child Care Invoice Template Child Care Care Child Childcare Invoice Receipt Tem Childcare Receipt Template Invoice Template

6 Nanny Receipt Templates In Pdf Free Premium Templates

6 Nanny Receipt Templates In Pdf Free Premium Templates

10 Free Daycare Receipt Templates Word Pdf

10 Free Daycare Receipt Templates Word Pdf

Free 5 Expense Receipt Examples Samples In Pdf Doc Examples

Free 5 Expense Receipt Examples Samples In Pdf Doc Examples

Free 7 Expense Receipt Templates In Ms Word Pdf

Free 7 Expense Receipt Templates In Ms Word Pdf

Free 5 Daycare Receipt Forms In Pdf

Free 5 Daycare Receipt Forms In Pdf