Can A Partner Get A 1099

Information about Form 1099-DIV Dividends and Distributions Info Copy Only including recent updates related forms and instructions on how to file. Form 1065 Schedule K-1 at tax time.

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Who are considered Vendors or Sub-Contractors.

Can a partner get a 1099. Since the payments were under this persons name then you can issue and file a 1099. If the amount loaned to the LLC is actually contributed capital the interest-like payments are taxed as guaranteed payments. A LLC member that loans money to the company as a true loan might get a 1099 INT but that is about it.

The partnership must furnish copies of Schedule K-1 Form 1065 to the partner. Members also report their shares of the expenses and losses on this schedule. At worst if a partnership the K-1 will indicate change in equity or guaranteed payments.

If a Subchapter S or LLC electing S status then the owner is on payroll and gets a W2. Unlike in an S-Corporation another pass-through entity members or partners of this type of entity are not eligible to be paid as a W-2 employee but they make take owner draws. From there you should be able to click Download next to.

Instead it passes through profits or losses to its partners. D reports the interest payment on his individual return as interest income. Generally if you receive a Form 1099 for amounts that actually belong to another person or entity you are considered a nominee recipient.

A pship can issue a 1099-INT to a partner if that partner loans the pship funds in his capacity as a lender not a partner and the pship pays interest on that loan. You must file a Form 1099 with the IRS the same type of Form 1099. 1099s are given to independent contractors or single vendors that youve paid 600 or more in a year.

Who Receives Form 1099-MISC Form 1099 goes out to independent contractors if you pay them 600 or more to do work for your company during the tax year. Additionally those whom you pay at least 10 in royalties or broker payments in lieu of. A pship should not issue a 1099-MISC to a partner for services.

It would have been helpful if you had said which type of 1099 it is. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. The most common is Form 1099-MISC which can cover just about any kind of income.

Ds Schedule K-1 Partners Share of Income Deductions Credits etc from the LLC does not reflect the interest payment from the LLC. 1099-misc 1099-k Related to sales activity andor payments made to you for participation in Microsofts marketplaces Printed forms will be postmarked on or before January 31 and pdf copies will be available in Partner Center in Partner Center Account settings under Payout and tax Payout and tax profiles at the same time. If you qualify to receive a 1099 the easiest way to access your document is to download it directly from your Driver Dashboard.

This will eliminate the IRS looking for the money on the wrong tax return. Each partner reports their share of the partnerships income or loss on their personal tax return. A 1099 form is a tax document filed by an organization or individual that paid you during the tax year.

You can nominee the Forms 1099-MISC to the partnership from yourselves by using the instructions below. Form 1099-DIV is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. Partners are not employees and shouldnt be issued a Form W-2.

Additionally the partners can deduct their shares of expenses and losses on their personal tax returns. Members of the taxed as partnerships report their distributions on Partners Share of Income Deductions Credits etc. A partnership or LLC is a type of pass-through entity where the profits and losses of the business pass through to the partners.

Consulting income is a big category for 1099-MISC. This is the equivalent of a W-2 for a person thats not an employee. Yes you can send a 1099 to a single member dpic44.

A partnership is not a legal entity separate and apart from the partners and each partner who devotes.

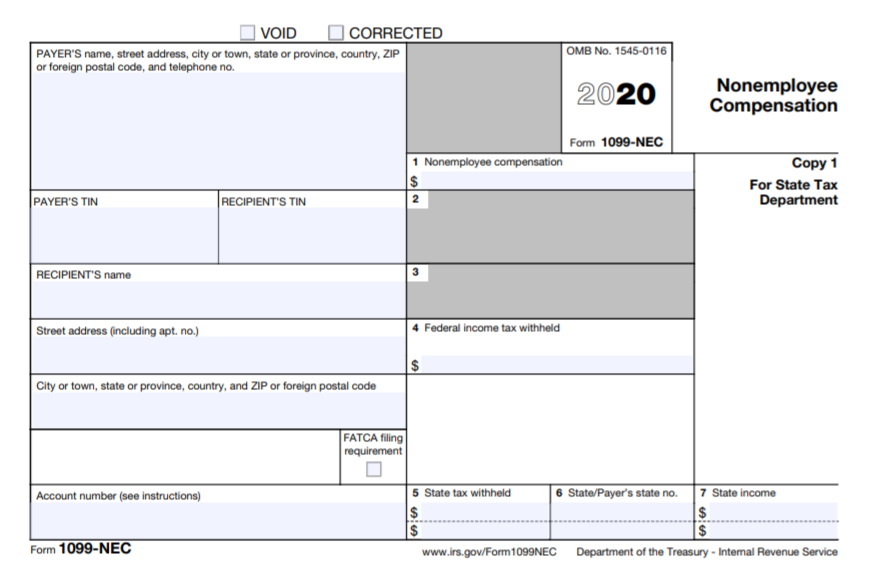

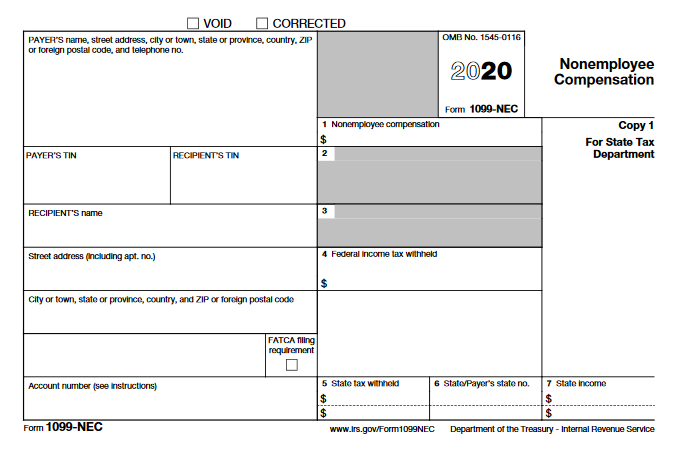

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Pin By Beyond Just Numbers On Moonstonepros Taxes Employer Identification Number Business Tax Tax Checklist

Pin By Beyond Just Numbers On Moonstonepros Taxes Employer Identification Number Business Tax Tax Checklist

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

1099 Int Form File 1099 Int Online Irs 1099 Int Irs Efile Form

1099 Int Form File 1099 Int Online Irs 1099 Int Irs Efile Form

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

What Is A 1099 Misc Form W9manager

What Is A 1099 Misc Form W9manager

Form 1099 Div Dividends Distributions Form1099online Efile Dividend Form

Form 1099 Div Dividends Distributions Form1099online Efile Dividend Form

With So Many Numbered Tax Forms In The Mix It Can Be Hard To Keep Track Of Which Number Applies To What One That Is Online Bookkeeping Tax Forms Filing Taxes

With So Many Numbered Tax Forms In The Mix It Can Be Hard To Keep Track Of Which Number Applies To What One That Is Online Bookkeeping Tax Forms Filing Taxes