Business Energy Credit Form

More In Forms and Instructions. Must be an existing home.

Pin On Example Application Form Templates

Pin On Example Application Form Templates

Eligible Projects To be eligible for the business ITC the solar PV system must be.

Business energy credit form. About Form 3468 Investment Credit. The federal tax filing deadline for individuals has been extended to May 17 2021. Due to COVID-19 ADORs in-person lobby services are by appointment only and in compliance with local municipal and county face covering policies.

This form includes rehabilitation energy and reforestation credits. Quarterly estimated tax payments are still due on April 15 2021. Used by a business subject to US.

Who Can Take the Credits You may be able to take the credits if you made energy saving improvements to your home located in the United States in 2020. Also use Form 5695 to take any residential energy efficient property credit carryforward from 2019 or to carry the unused portion of the credit to 2021. If you file electronically you must send in a paper Form 8453 US.

The Federal government wants to encourage citizens to go green which is why they provide a range of energy tax credits. California does not offer state solar tax credits. Non-business energy property credit The non-business energy property credit can reduce your tax bill for some of the costs you incur to make energy-efficient improvements to your home.

Qualified Plug-in Electric Drive Motor Vehicle Credit This tax credit is available for qualified plug-in electric drive motor vehicles which includes passenger vehicles and light trucks. Since Southwest Gas and SDGE did not have net proceeds exceed net compliance costs for this period these utilities had no net. Tax credits for residential energy efficiency have now been extended retroactively through December 31 2021.

The deadline for first quarter tax year 2021 individual estimated tax payments remains April 15 2021. These utilities issued the 2018 credit with the 2019 credit in April 2019. Aug 01 2019 tax credit of 102 Typically a solar PV system that is eligible for the ITC can also use an accelerated depreciation corporate deduction.

Claim the credits by filing Form 5695 with your tax return. Youll need to file the form for the specific credit for which youre applying and if youre applying for more than one youll need to also file a Form 3800 or General Business Credit form. The election to treat a qualified facility as energy property is made by claiming the energy credit with respect to qualified investment credit facility property by completing Form 3468 and attaching it to your timely filed income tax return including extensions for the tax year that the property is placed in service.

Arizona has moved the individual income taxes deadline to May 17 2021 without penalties and interest. Dec 31 2020 You must complete IRS Form 5695 if you qualify to claim the non-business energy property credit or the residential energy-efficient property credit. Apr 06 2017 If your business is eligible you must fill out Form 3468 Investment Credit.

California State Energy Tax Credits. December 31 2021 Details. Oct 19 2020 Energy Credits Tax Forms and Instructions Complete and file IRS Form 5695 with your tax return to claim either the Residential Renewable Energy tax credit or the Non-Business Energy Property tax credit.

The 2018 PGE and SoCalGas credits also include any 2015-2017 allowance proceeds that exceeded compliance costs over the same period. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021 Tax Credit. The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

If you lease property from someone rather than own in and use it in a way that qualifies for one of these credits you may also be able to claim the credit by filling out Part I of the form. Coal gasification and advanced energy projects. Use Part II of the form to claim three specific energy-related credits.

The investment credit consists of the rehabilitation energy qualifying advanced coal project qualifying gasification project and qualifying advanced energy project credits. Use this form to claim the investment credit. Federal income taxes ie it cannot be used by a tax-exempt entity like a.

To claim these tax credits youll need to fill out Form 5695. Prior-Year rounded to the nearest dollar. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction.

10 of cost up to 500 or a specific amount from 50-300. Use Form 3468 to claim the investment credit. The investment credit consists of the following credits.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through December 31 2021. Each credit has specific qualifications spelled out in the instructions for Form. Federal Income Tax Credits and Other Incentives for Energy Efficiency.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Feb 13 2018 Business energy credits are issued based on the carryforward of business credits from the prior year plus your total credits in the current year. Heres what you need to know about it.

Rehabilitation energy qualifying advanced coal project qualifying gasification project.

2017 Irs Tax Forms 1040 Schedule C Profit Or Loss From Business Irs Tax Forms Irs Taxes Tax Forms

2017 Irs Tax Forms 1040 Schedule C Profit Or Loss From Business Irs Tax Forms Irs Taxes Tax Forms

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

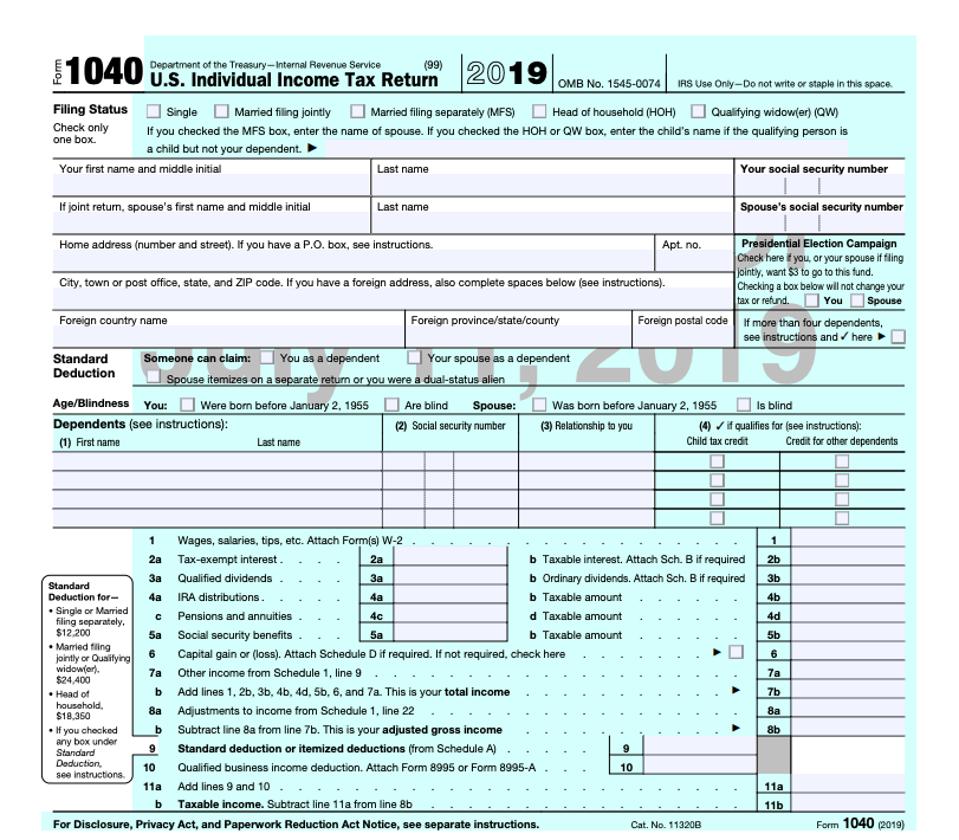

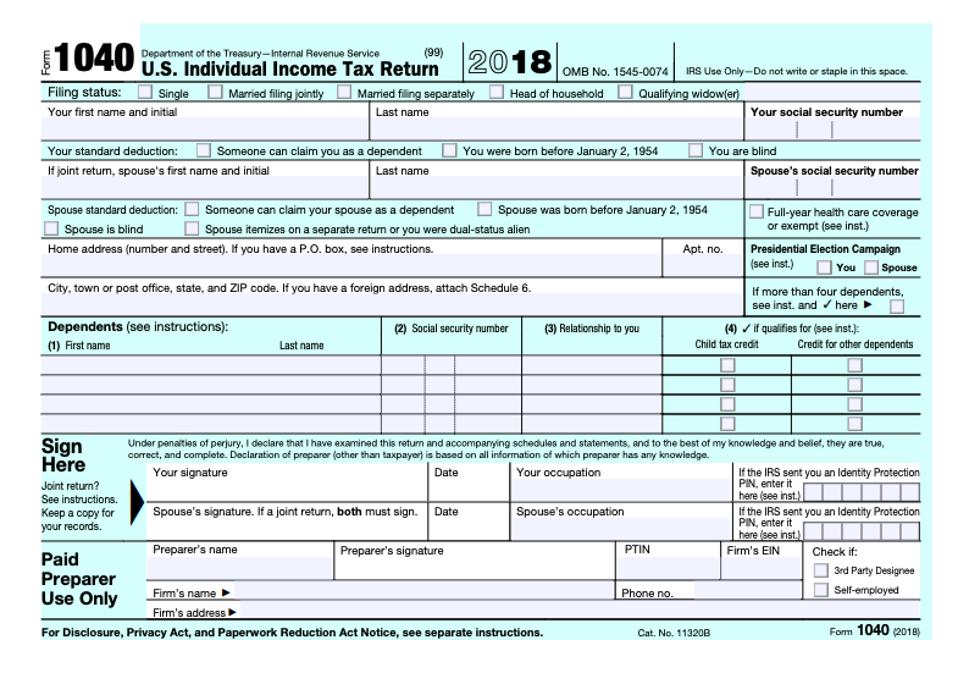

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

Free Business Credit Application Application Form Job Application Form Credit Card Application

Free Business Credit Application Application Form Job Application Form Credit Card Application

Everything Old Is New Again As Irs Releases Form 1040 Draft

Everything Old Is New Again As Irs Releases Form 1040 Draft

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

What Is A W 9 Tax Form H R Block

What Is A W 9 Tax Form H R Block

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

![]() Credit Application Form Templates For Ms Word Excel Word Excel Templates

Credit Application Form Templates For Ms Word Excel Word Excel Templates

Form 5695 Instructions Claiming The Solar Tax Credit Energysage