How To Transfer Ownership Of A Sole Proprietorship In India

If you have been operating the sole proprietorship under your own name the bank will likely require you to close that account. Compensation options range from an immediate lump sum to a series of payments over time.

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

You cant sell a sole proprietorship.

How to transfer ownership of a sole proprietorship in india. Unlike a corporation theres no legal difference between a sole proprietorship and its owner. Further for sole proprietorship no separate income tax PAN is required. The sole proprietor can transfer his business by selling its tangible and intangible assets.

But if you are liable for state VAT or service tax registration then you have to obtain VAT andor service tax registration. Conversion of sole proprietorship into private limited company need of the following documents. You simply have to open a bank account with the name style you want to work.

The PAN of the proprietor will be the PAN of the firm and proprietor. 3 in partnership firm your father can retire as partner of the firm. The partners then can add a clause in the partnership deed stating that the proprietorships assets business liabilities and dues creditors and debtors are transferred at book value to the partnership and the sole proprietorship would be dissolved automatically.

2 the licence can be transferred in your name on execution of sale deed. Since a sole proprietorship represents the owner of the business you cannot actually transfer a sole proprietorship to someone else. No legal formalities are required.

Deed of retirement can be executed. To change a Proprietorship firm into a Private Limited Company in India a legally written agreement has to be signed between the Proprietorship and the Private Limited Company for the business sale with some conditions added to it. The company doesnt own assets or sign contracts you do.

The bank will likely require you to bring in a copy of the updated DBA registration. GST Number is linked to a Proprietors PAN. Basic ID and Address proof of the firms directors.

1 your father can execute sale deed for transfer of assets and liabilities of sole proprietary concern by father in name of 2 sons. The sole proprietor owns. GST Authority clarifies on changetransfer in ownership of sole proprietorship.

All the legal obligations and debts that youve undertaken throughout the operation of the business will remain with you and cannot be transferred to someone else. Thereby transferring the responsibility of running the business to a new owner. In case of transfer of business on account of death of sole proprietor the transferee successor will file FORM GST ITC-02 in respect of the registration to be cancelled.

Your spouse will then have to open a new account in his name. To transfer ownership of the business one should transfer the ownership of the relevant assets. Along with a letter of authoritypower of attorney.

For this you will need proof of existence of the firm and the address proof. One can present the testimony of the registered office address in the form. A Proprietorship means single owner with hisher own PAN.

If you are switching from Proprietorship to other business entity then you have to surrender old GST and apply for new one with Company PAN this time. Hence the partnership would now carry on the business of the sole proprietor. In a circular Central Board of Indirect Taxes and Customs CBIC said that the transferee or the successor will be liable to be.

Second establish how the acquiring sole proprietor will compensate you. In the case of Transfer of proprietorship from the transferor to the transferee GSTIN the GST identification number of the transferee is required to be mentioned so as to get the GSTIN of the transferor linked with the GSTIN of the transferee. A solo proprietorship cannot be sold or transferred in the same way that other business entities can be sold.

Register your sole proprietorship. No registration is required for a sole proprietorship. Transfer the business bank accounts to your spouses name.

So the proprietor has to note down the following things before transferring his ownership. You can only sell the business assets. Unlike a company theres no legal difference between a sole proprietorship and its owner.

However the assets of the sole proprietorship business can be transferred from him to another person by way of selling the same it also comes with a drawback that certain government approvals and registrations which are in the name of the sole proprietorship business cannot be transferred to the other person or an entity as they are in the name of the proprietor himself and his. You dont need to register your sole proprietorship in India. First address which assets and rights the acquiring sole proprietor wants.

But in order to receive payments in the name of the business you need to open a current account in a bank. The Goods and Services Tax GST Authority has clarified that transfer or change in the ownership of business will include transfer or change in the ownership of business due to death of the sole proprietor.

To Take Advantage Of The Sole Proprietorship Status You Ll Report Your Income From Your Business On A Sc Sole Proprietorship Legal Services Freelance Business

To Take Advantage Of The Sole Proprietorship Status You Ll Report Your Income From Your Business On A Sc Sole Proprietorship Legal Services Freelance Business

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

Difference B W 1 Person Company And Sole Proprietorship Mindxmaster

Difference B W 1 Person Company And Sole Proprietorship Mindxmaster

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

How To Sell Ownership Of Your Sole Proprietorship Business Quora

How To Sell Ownership Of Your Sole Proprietorship Business Quora

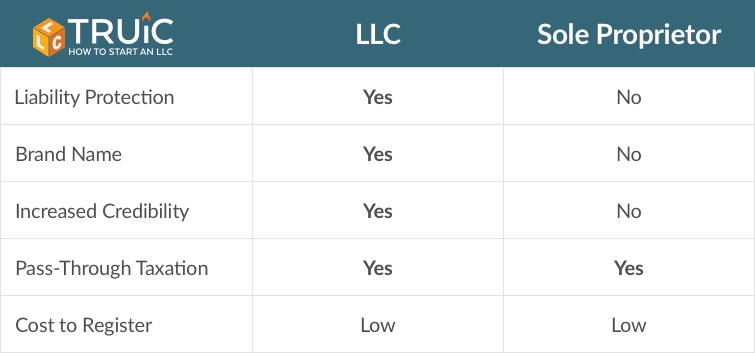

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entit Sole Proprietorship Business Structure Sole Trader

A Sole Proprietorship Also Known As The Sole Trader Or Simply A Proprietorship Is A Type Of Business Entit Sole Proprietorship Business Structure Sole Trader

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Sole Proprietorship Business Do You Have Any 10 Questions Based On A Sole Proprietorship Business Sole Proprietorship Sole Proprietor Sole

Sole Proprietorship Business Do You Have Any 10 Questions Based On A Sole Proprietorship Business Sole Proprietorship Sole Proprietor Sole

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To Convert Sole Proprietorship Into Private Limited Company By Chetan Medium

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Investment Business Structure

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Investment Business Structure

Procedure For Sole Proprietorship Registration In India Sole Proprietorship Sole Online Registration

Procedure For Sole Proprietorship Registration In India Sole Proprietorship Sole Online Registration

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal Sole Proprietorship Business Structure Sole Trader

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal Sole Proprietorship Business Structure Sole Trader

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

9 Disadvantages Of Sole Proprietorships Important In 2021

9 Disadvantages Of Sole Proprietorships Important In 2021