Does Pa Require 1099 Filing

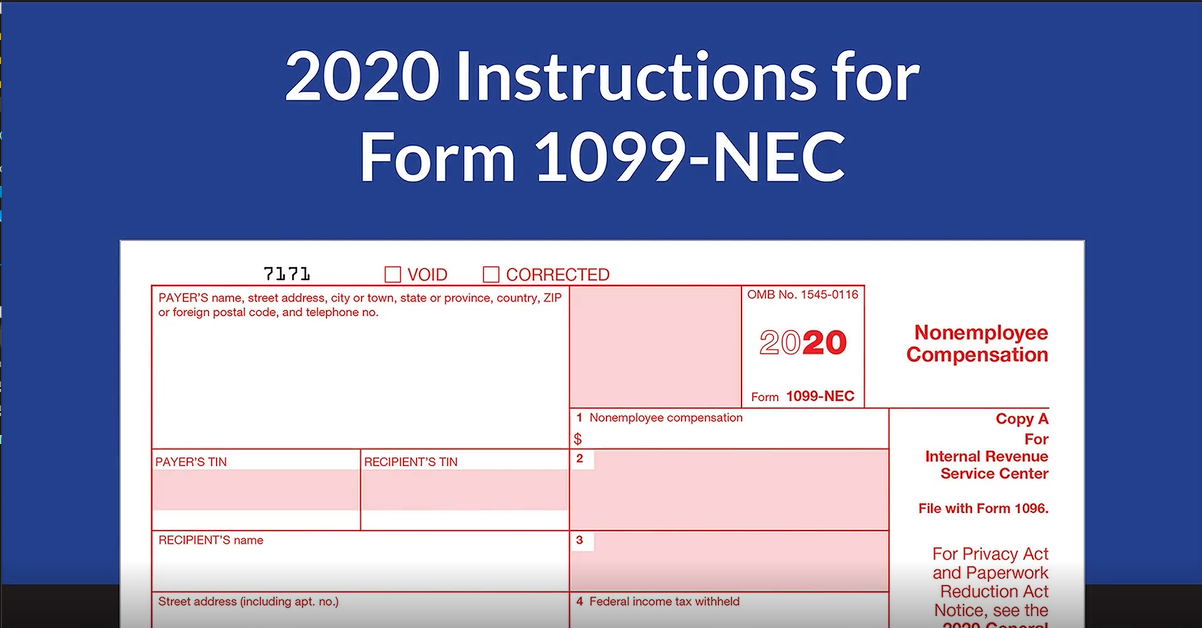

The State of Pennsylvania also mandates the filing of Form REV-1667 Annual Withholding Reconciliation Statement for 2020. Nonemployee compensation was previously located in Box 7 of the 1099-MISC form and is now located in Box 1 on the new 1099-NEC form.

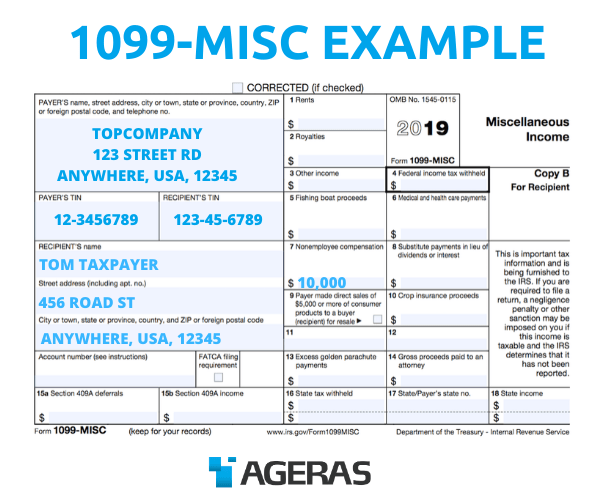

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Pennsylvania offers use of their e-TIDES program to electronically file 1099s.

Does pa require 1099 filing. 1099r do I have to copy the form for the PA Tax and send it with my return and if so how do I do that. Brief Overview and Filing Requirements Who Must File. Youre not required to file Forms 1099-NEC and 1099-MISC with your state.

You may be required to submit Pennsylvania state reconciliation form REV-1667 R. The Pennsylvania Form 1099 Filing Deadline - January 31 2021. File a copy of the Federal Form 1099-MISC with the Department by January 31 of the next year.

Tax1099 offers this form for 499 through the platform. Form 1099-NEC for reporting nonemployee compensation starting with tax year 2020 filing. Every resident part-year resident or nonresident individual must file a Pennsylvania Income Tax Return PA-40 when he or she realizes income generating 1 or more in tax even if no tax is due eg when an employee receives compensation where tax is withheldRefer to the below section on TAXATION for additional information.

If you are unsure attach it and send it in. You can still use the 9 digit FEIN and we will e-file to the state of PA. No need to send 1099R to the IRS if you E-filed per the IRS web site.

PA-based companies that pay non-employee compensation or business income of 5000 or above to a non-PA resident or disregarded entity with nonresident members such as a limited liability company treated as a disregarded entity for federal purposes must now file a 1099-MISC with DOR and withhold PA income tax 307 from such payments. Business owners in Pennsylvania can file Form 1099-NEC with Wave Payroll and Wave completes both IRS and Pennsylvania Department of Revenue filing. Beginning January 1 2018 anyone that makes the following payments is required to withhold from such payments an amount equal to the tax rate specified per 72 PS.

Are required to file Form 1099-R for Pennsylvania personal income tax purposes. You wont be penalized for sending in an extra form but you dont want to have issues with not sending in a required form. 1 We will no longer be filing via paper when using the 9 digit FEIN to the state of PA.

If youre in any of these states listed here use the links below to learn more about how to. This statement shows the total or gross amount of PUA benefits received and the amount of federal tax withheld if any. Does Pennsylvania participate in Combined FederalState Filing.

Payers of distributions from profit sharing retirement arrangements insurance contracts etc. No Pennsylvania does not participate in Combined FederalState Filing. Pennsylvania State Filing Requirements For the tax year 2020 the State of Pennsylvania mandates the filing of 1099 forms including 1099-NEC 1099-MISC 1099-R.

Learn how to generate and file Form 1099-NEC with Wave here. Beginning in 2018 anyone that pays Pennsylvania-source income to a resident or non-resident individual partnership or single member limited liability company and is required to file a Federal Form 1099-MISC is required to. 7302 currently 307.

Pennsylvania requires those who issue 1099-R forms to submit a copy of the form to the Commonwealth. It also expanded the requirements with respect to when a copy of Federal Form 1099-MISC is required to be filed with the Pennsylvania Department of Revenue. File a copy of the Federal Form 1099.

Payments of Pennsylvania source. Whether or not you would need to attach the 1099-R to the state return will depend on whether or not PA tax was withheld. For Pennsylvania personal income tax purposes the 1099-R forms are required to be filed with the department by January 31.

Yes Pennsylvania requires 1099-MISC and 1099-R forms to be filed with the Pennsylvania Department of Revenue. The Internal Review Service IRS requires that Form PUA-1099G be provided to unemployment compensation recipients who were paid Pandemic Unemployment Assistance PUA benefits during the prior year. Yes a 1099-MISC is required to be filed with the Pennsylvania Department of Revenue if compensation is paid for services performed in Pennsylvania.

Federal Form 1099-MISC Filing Obligations. The entity issuing the 1099 forms must have a PA employer withholding account to be able to file the forms electronically through e-TIDES. Pennsylvania requires you to file 1099-NEC forms with the Pennsylvania Department of Revenue.

Having said that there is practical wisdom in.

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

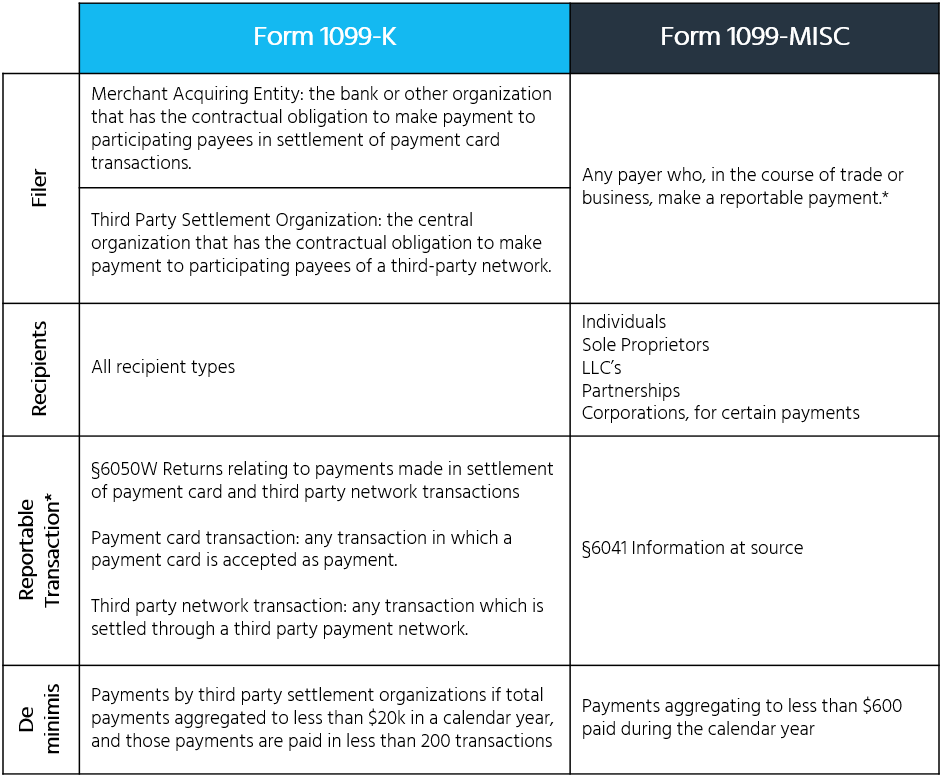

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Https Www Revenue Pa Gov Generaltaxinformation Tax 20types 20and 20information Employerwithholding Documents W2 1099 Csv Reporting Inst And Specs Pdf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Deadlines Penalties State Filing Requirements 2020 2021

1099 Deadlines Penalties State Filing Requirements 2020 2021