Bank Of Ireland Sme Business Lending Application Form

Personal Loans Business Loans Home Insurance Switch Bank Account Register for 365 online Mortgage Calculator Bank of Ireland Sites Private New Ireland Assurance BOI Mortgages UK Northridge Finance ThinkBusinessie Bank of Ireland Blog Brexit Portal. The interest rate that the Bank will apply to all loans up to 500000 is 4.

Rejection Rates For Smes Business Loans In The Uk 2012 2018 Statista

Rejection Rates For Smes Business Loans In The Uk 2012 2018 Statista

If the SBCI determines that the applicant is eligible the applicant will be notified in writing and will be supplied with an eligibility code.

Bank of ireland sme business lending application form. SME default rates are highest in the Construction and Hotels. Completed SME Business Lending Application Form. Thank you for your recent enquiry in relation to credit facilities.

This information will assist us in providing a professional timely response. SME Business Lending Application Form. Your appeal relates to a lending application declined approved in the last 30 days.

6 months current account bank statements for the business if the current account is held outside permanent tsb. Gather any additional supporting documentation or information that may be required by the Bank Your Business Adviser will inform you if the. The following documents may be downloaded for your own information and guide.

This information will be held on the Central Credit Register and may be used by other lenders when making decisions on your credit applications. If you are looking to apply for a Business Term Loan you can book an appointment now or call our Business Banking Team on 0818 200 100 or 353 1 215 1363. 03 2283 2019.

Your lending request does not relate to Business. BUSINESS DETAILS Please tell us about your business. British Business Bank plc is a development bank wholly owned by HM Government.

Bounce Back Loan Scheme is delivered by the British Business Bank through Bank of Ireland UK as an accredited lender. Arrange a meeting with your Relationship Manager at the branch 2. Three easy steps to applying for business lending with Bank of Ireland 1.

Three easy steps to applying for business lending with Bank of Ireland 1. Complete the enclosed. Confirmation that the tax affairs of the business and named borrowers and or material shareholders are up to date and in order.

Complete the enclosed Application Form in full 3. Your lending request was for an amount between 1000 and 3000000. Trading Name Company incorporated in Country if different from above.

Bank of Ireland is regulated by the Central Bank of Ireland. Financial Accounts for the past 3 years. In order to progress your application you should arrange a meeting with your permanent tsb Relationship Manager and complete this Business Lending Application Form.

Public Bank accepts the ABM SME Loan Application Form and Checklist of Documents submitted by customer. Step 1 The applicant must first submit an Eligibility Application Form to the SBCI to check if it is eligible for the scheme. Restaurants sectors and lowest in the Manufacturing Primary and Other Community Social.

Download fill up the Application Form and send it to the nearest SME Bank branch. Central Bank of Ireland loan-level data for December 2016 show that 187 per cent of SME loans weighted by outstanding balance are in default. Download our SME Business Lending application formwhen applying for finance.

What you will need. SME Business Lending Application Form Republic of Ireland PLEASE COMPLETE IN BLOCK CAPITALS Page 2 of 11 PART 1. You can complete this form.

Locate our branch here. Application Form Republic of Ireland. Your business is an SME You have made a formal lending request to Ulster Bank.

The Central Bank of Ireland has published new regulations for firms lending to SMEs with which regulated lenders other than credit unions must comply from 1 July 2016 or in the case of credit unions from 1 January 2017. Managed by the British Business Bank on behalf of and with the financial backing of the Secretary of State for Business Energy. Under the Credit Reporting Act 2013 lenders are required to provide personal and credit information for credit applications and credit agreements of 500 and above to the Central Credit Register.

AIB SME Business Lending Application Form 1 of 10 SME Business Lending Application Form SME Enterprises which employ fewer than 250 persons and which have an annual turnover not exceeding EUR 50 million andor annual balance sheet total not exceeding EUR 43 million. Business Name Company Registration No. Send form to your branch or business centre to apply for finance.

The COVID-19 Business Loan from Microfinance Ireland is a government initiative to support small businesses Sole Trader Partnership or Limited Company through the current period of uncertainty and protect job creation or sustainment in Ireland. Business Fees and Charges. Depending on your Business Banking needs you will need to provide some supporting documentation to us when applying for your Business Term Loan.

Complete the enclosed Application Form in full 3. Arrange a meeting with your Business Adviser at the branch 2. Find your local branch here.

For loan proposals greater than 500000 the Bank will assess each transaction on its own merits such assessment to include the availability of existing and or additional security which may result in an interest rate marginally below 4. However Public Bank has our own application forms which can be obtained at our bank branches. If your business is impacted or may be impacted by COVID-19 resulting in a reduction of 15 or more in actual or projected turnover or profit AND you are having difficulty in accessing finance from commercial lending.

Gather any additional supporting documentation or information that may be required by the Bank. For Financing Application enquiries please contact. ABMPartner SME Loan Application SME LOAN APPLICATION.

Arrange a meeting with your Business Adviser at the branch 2.

Belgium Interest Rate Smes Statista

Belgium Interest Rate Smes Statista

Lake Secondary School Mwanza Tanzania Phone Address Secondary School Secondary School Education Secondary

Lake Secondary School Mwanza Tanzania Phone Address Secondary School Secondary School Education Secondary

Interest Rate Of Business Loans Smes France 2007 2018 Statista

Interest Rate Of Business Loans Smes France 2007 2018 Statista

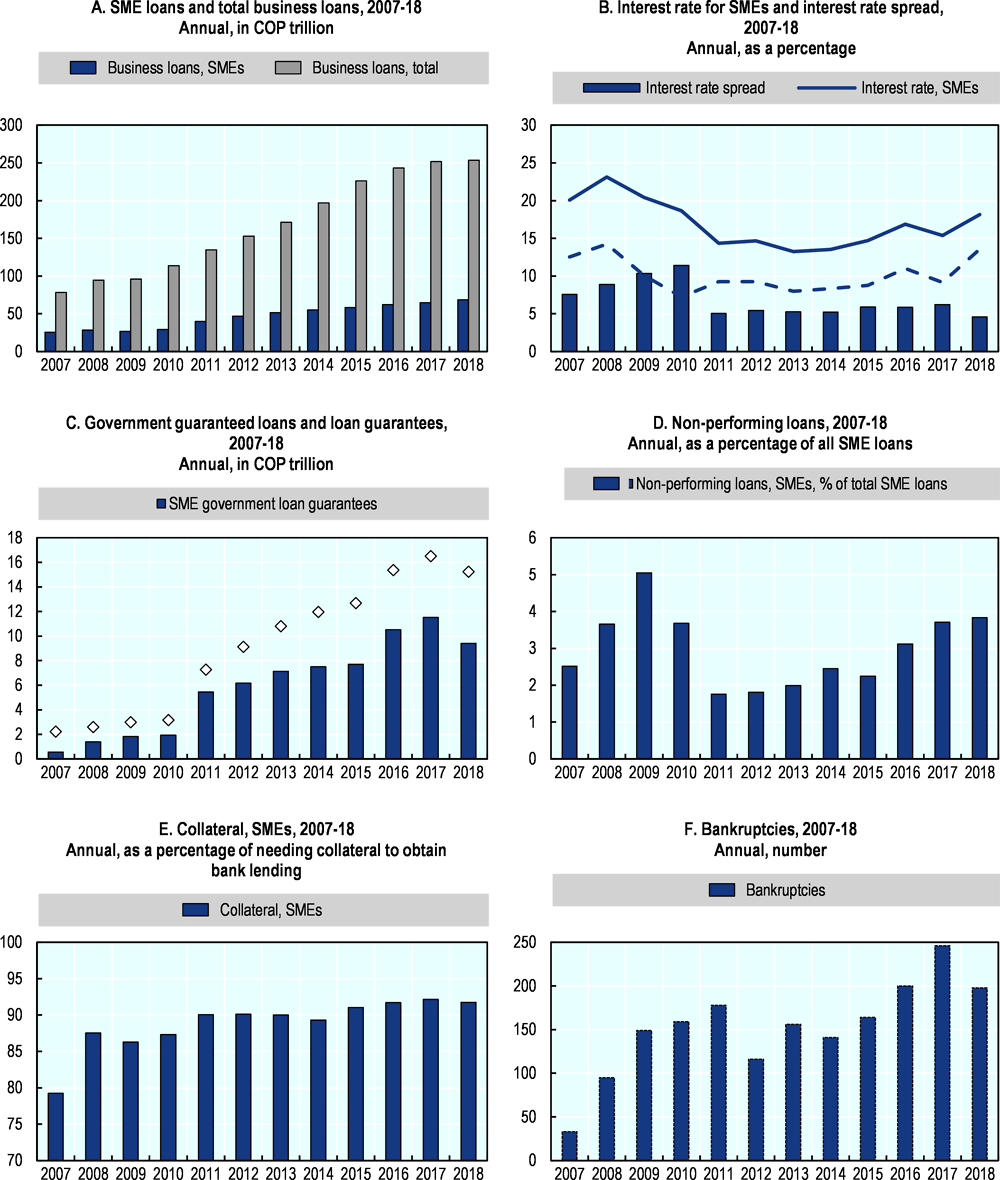

Colombia Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Colombia Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Fillable Online Sme Business Lending Application Form Aib Allied Irish Banks Fax Email Print Pdffiller

Fillable Online Sme Business Lending Application Form Aib Allied Irish Banks Fax Email Print Pdffiller

Alternative Lending Industry 2021 Non Bank Loans Market

The State Of Small Business Growth In The Uk By Sage Infographic Small Business Infographic Business Infographic Small Business Growth

The State Of Small Business Growth In The Uk By Sage Infographic Small Business Infographic Business Infographic Small Business Growth

Which Country Backs Its Entrepreneurs The Most Entrepreneur Business Strategy Infographic

Which Country Backs Its Entrepreneurs The Most Entrepreneur Business Strategy Infographic

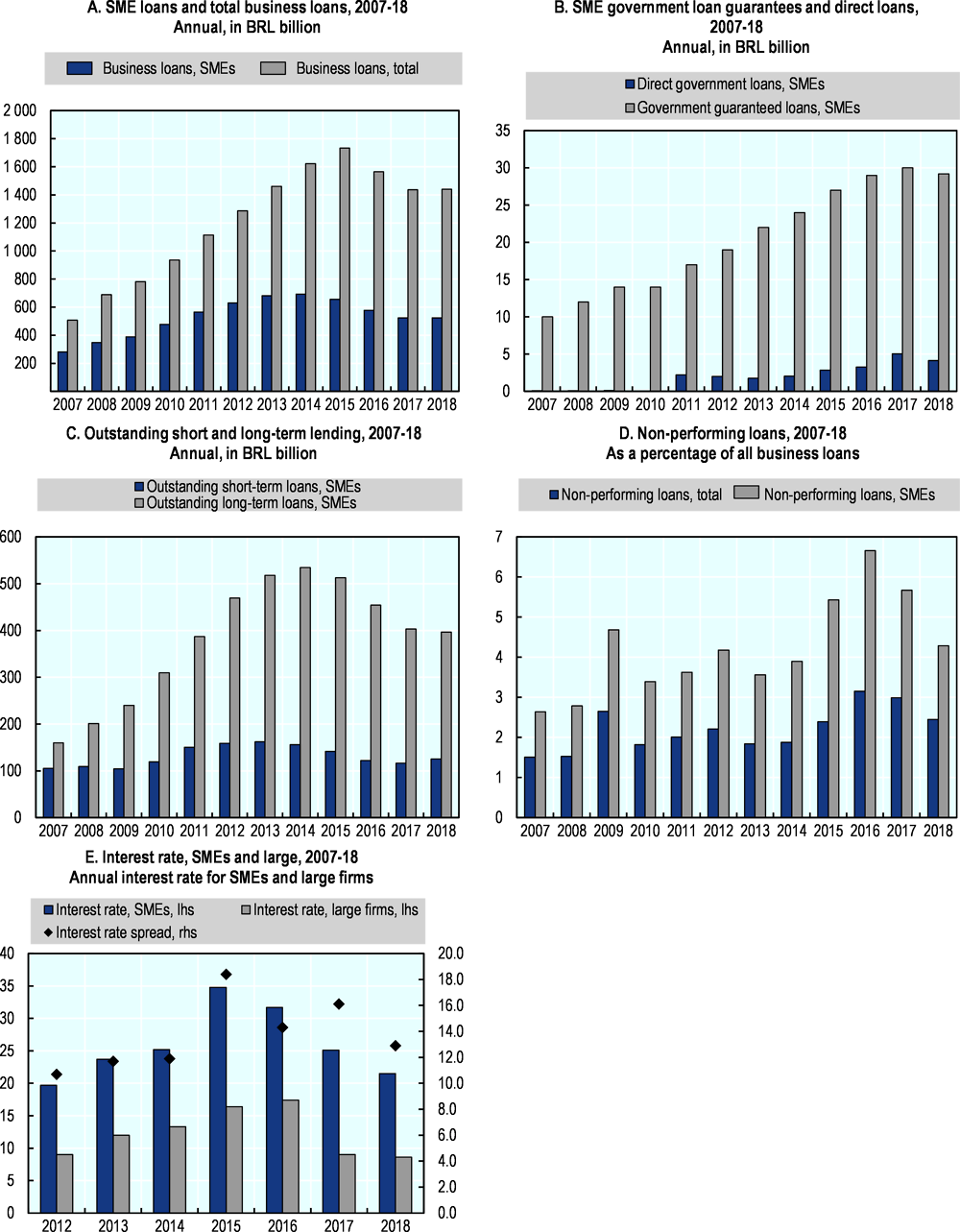

Brazil Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Brazil Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Covid 19 Credit Guarantee Scheme Business Banking Bank Of Ireland

Covid 19 Credit Guarantee Scheme Business Banking Bank Of Ireland

Luxembourg Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Luxembourg Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Due To Increasing Competition In The Lending Industry There Is A Decline In The Commercial Loan Inter Commercial Loans Small Business Finance Business Finance

Due To Increasing Competition In The Lending Industry There Is A Decline In The Commercial Loan Inter Commercial Loans Small Business Finance Business Finance

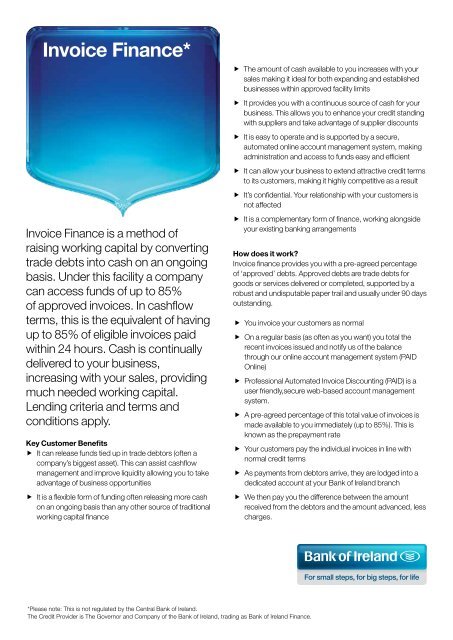

Invoice Finance Business Banking Bank Of Ireland

Invoice Finance Business Banking Bank Of Ireland

Contents Agri Lending Application Republic Of Ireland Ulster Bank

Contents Agri Lending Application Republic Of Ireland Ulster Bank

Invoice Finance Bank Of Ireland Business Banking

Invoice Finance Bank Of Ireland Business Banking

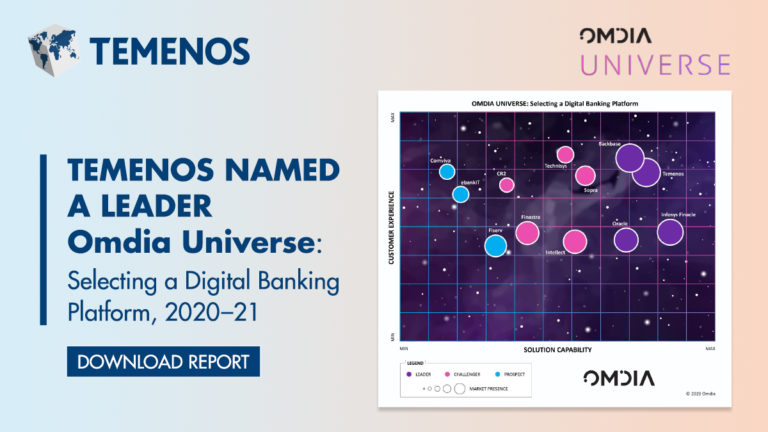

Temenos Infinity For Business Banks Digital Banking Software

Temenos Infinity For Business Banks Digital Banking Software