What Can Be Written Off As An Independent Contractor

You dont need to be signing contracts at the table for it to be a tax write off. The fact that you are eating out instead of bringing lunch from home means that the expense is out of the ordinary and.

Read Book Consultant Independent Contractor Agreements Download Pdf Free Epub Mobi Ebooks Independent Contractor Small Business Opportunities Agreement

Read Book Consultant Independent Contractor Agreements Download Pdf Free Epub Mobi Ebooks Independent Contractor Small Business Opportunities Agreement

Tonics lotions gels creams oils straighteners mousse nail polish nail polish remover and hairspray.

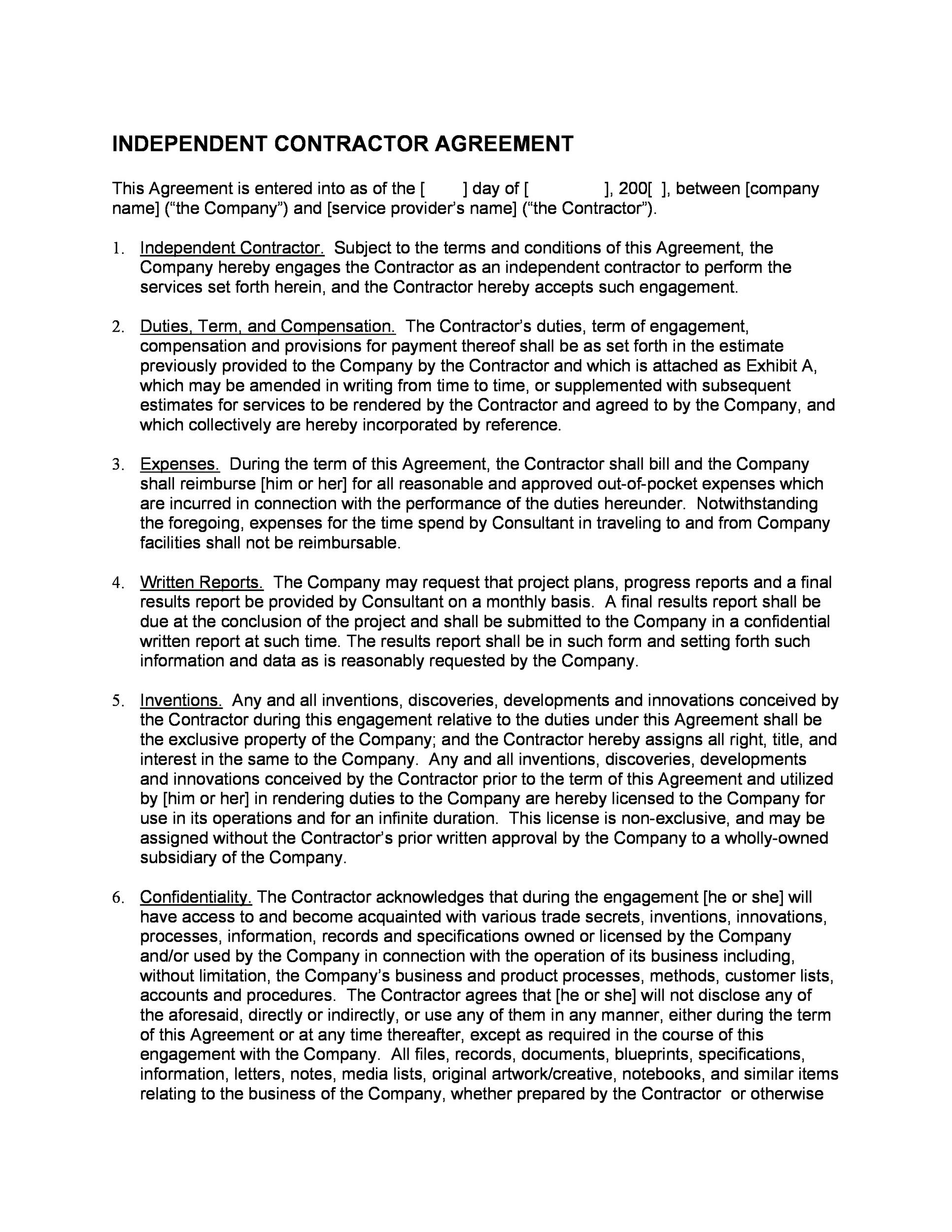

What can be written off as an independent contractor. Shampoo conditioner hair treatments and hair dye. The expenses of your business will be placed inside the deductions area of Form 1040. Necessary Expenses If you are an independent contractor you can deduct any necessary expenses from your taxable income.

IRS Form 1040 is needed to write off your expenses as a Nurse Pharmacist or Healthcare Professional. Almost any items you need to conduct business. Examples of tax write-offs for yoga teachers.

As an independent contractor you can also deduct personal expenses such as mortgage interest paid interest paid to student loans and real estate taxes. You dont even need to be paying for the other persons meal. You can also get a tax break for contributing to a self-employed retirement plan or a traditional IRA.

According to the IRS to be deductible a business expense must be both ordinary and necessary AKA common in your industry and helpful for your business. If youre treated by your babysitting family as an employee however you wont be able to use any expenses on your tax return. Top 10 Write Offs for Independent Contractors 1.

Bobby pins clips and rubber bands. At Independent Contractor Tax Advisors we arm our clients with the tools and expertise to run their business with confidence knowing their financial matters are in good hands. If youre operating as an independent contractor you can deduct expenses you incur while babysitting.

As an independent contractor youre accountable for all. Having said that the independent contractor is like a business of one you also get the expenses deductions such that you can lower the tax amount you pay to the IRS. You can itemize the deductions that affect your business profit or loss stated on the Schedule C when you are calculating the 1099 taxes quarterly or year-end.

The cost of advertising yourself your services or your products would fall into. Keep track of your expenses and save your receipts and deduct them at tax time. Independent contractors can write off legitimate business expenses to help lower their tax burden.

For tax purposes you must provide these individuals with the IRS form 1099-MISC and provide the IRS with Form 1096 to show how much you paid them. Contact us today for a free tax consultation to find out how we can help you save thousands in taxes and learn how to make the most out of your business deductions. Wages paid to independent contractors can be deducted from your taxable income.

Hair dryers curlers and straighteners.

Independent Contractor Tax Tips Tax Deductions Tax Help Business Tax

Independent Contractor Tax Tips Tax Deductions Tax Help Business Tax

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

A 2021 Guide To Taxes For Independent Contractors The Blueprint

A 2021 Guide To Taxes For Independent Contractors The Blueprint

What Can Independent Contractors Deduct

A 2021 Guide To Taxes For Independent Contractors The Blueprint

A 2021 Guide To Taxes For Independent Contractors The Blueprint

Independent Contractor Agreement Template Approveme Free Contract Templates

Independent Contractor Agreement Template Approveme Free Contract Templates

Deductions Of Independent Contractors Business Tax Independent Contractor Business Finance

Deductions Of Independent Contractors Business Tax Independent Contractor Business Finance

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Tax Deductions For Independent Contractors Youtube

Tax Deductions For Independent Contractors Youtube

How To File Taxes As An Independent Contractor Filing Taxes Independent Contractor Small Business Tax

How To File Taxes As An Independent Contractor Filing Taxes Independent Contractor Small Business Tax

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

6 Contract Agreement Templates Word Excel Pdf Templates Contract Template Independent Contractor Contractor Contract

6 Contract Agreement Templates Word Excel Pdf Templates Contract Template Independent Contractor Contractor Contract

6 Tax Write Offs For Independent Contractors Utdu There Are A Great Deal More Take A Look At This Http Www Tax Write Offs Small Business Tax Business Tax

6 Tax Write Offs For Independent Contractors Utdu There Are A Great Deal More Take A Look At This Http Www Tax Write Offs Small Business Tax Business Tax

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Employee Infographic Independent Contractor Contractors

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Employee Infographic Independent Contractor Contractors

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

Free One 1 Page Independent Contractor Agreement Form Pdf Word Eforms

Free One 1 Page Independent Contractor Agreement Form Pdf Word Eforms

How To File Taxes As An Independent Contractors H R Block

How To File Taxes As An Independent Contractors H R Block

Can I Claim State Sales Tax Deduction If I Do Not Pay State Income Tax Business Expense Bookkeeping Services Independent Contractor

Can I Claim State Sales Tax Deduction If I Do Not Pay State Income Tax Business Expense Bookkeeping Services Independent Contractor

Free Independent Contractor Agreement Free To Print Save Download

Free Independent Contractor Agreement Free To Print Save Download