Value Of Stamp Paper For Rental Agreement In Bhopal

You can make Rent Agreement on e-Stamp Paper of any amount still it is always recommended to make Rent Agreement on a Stamp paper of Rs. Although the state did introduce it a major chunk of the population still stick to the use of conventional stamp.

What Is Stamp Duty On Gift Deed Of The Property Paisabazaar Com

What Is Stamp Duty On Gift Deed Of The Property Paisabazaar Com

The market value of farmland is calculated in hectares and residential real estate in square metres.

Value of stamp paper for rental agreement in bhopal. This is the most common way of paying stamp duty. Stamp duty is 1 of the total rent plus deposit paid annually or Rs. The stamp duty applicable is the same as a gift deed which is 25 percent of the market value of the property for the transfer to a family member and 5 percent for the transfer to a non-family member in Madhya Pradesh.

Calculate the Registration Expenses and Stamp paper Value duty towards property registration When we try to buy new old property in any part of India we must undergo the registraion process. The value of stamp paper to be used for an agreement depends on rate of stamp duty applicable in particular state. Stamp paper can be bought from authorised sellers.

Therefore stamp duty will be Rs 4800. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. Instruments that transfer or assign a decree or order of Court for a value exceeding INR 100 and immovable property.

Ques What if we will not pay the prescribed Stamp Duty to the Government. The Stamp Duty Amount is. At present you can use a non-judicial stamp paper of value Rs5 Rs10 Rs20 Rs50 Rs100 Rs500 Rs1000 Rs5000 Rs10000 Rs15000 Rs20000 or Rs25000 for the documents mentions above.

In late 2012 the Govt announced that e-Stamp papers may be introduced at the beginning of the next financial year. The Rental agreement document shall be printed on the stamp paper of the requisite amount. For registration document should be prepared in stamp paper or e-stamp while we need to pay the stamp duty based on the state tax structure.

Who should buy a stamp paper for a rental agreement. Either the landlord or the tenant can buy the stamp paper and it will continue to be the purchasers. Get doorstep delivery The stamped rental agreement shall be.

500- whichever is lower. Get doorstep delivery The stamped rental agreement shall be. Fees and transfer fees are levied.

However if the stamp duty charges are high then this method becomes inconvenient as you will need to purchase a number of stamp papers. Lease deed of an immovable property where the lease exceeds a year. As the State Govt.

In this case it would be Rs 4800 x 3 Rs 14400. So if you need to be on a safer side you can make the agreement on a Stamp paper of. Physical Stamp Paper.

Documents that need to be made on stamp paper but need not be registered. To increase the revenue in the state Haryana government has increased stamp paper charges. When issuing gifts to family members stamp duty is 2 per cent 1000 to Rs.

09 July 2020 Standard Stamp Value would be Rs 100- to execute such agreements. Yearly rent will be 240000. The value of the stamp paper would depend on the state in which it is executed as well as the duration of the lease and the lease rent.

In the state of Madhya Pradesh Stamp Duty for lease documents is charged at 8 of total rentdeposit. Document to adopt a son executed other than through a will. Each state in India has provisions in respect of the amount of stamp duty payable on the lease deed and the same would need to be determined based on.

The Stamp Duty Amount is calculated based on the Madhya Pradesh where stamp paper stamp uty is 5. The Rental agreement document shall be printed on the stamp paper of the requisite amount. After the change the stamp duty is 5 the deposit tax is 1 the amount of the transfer is 15 of the market value.

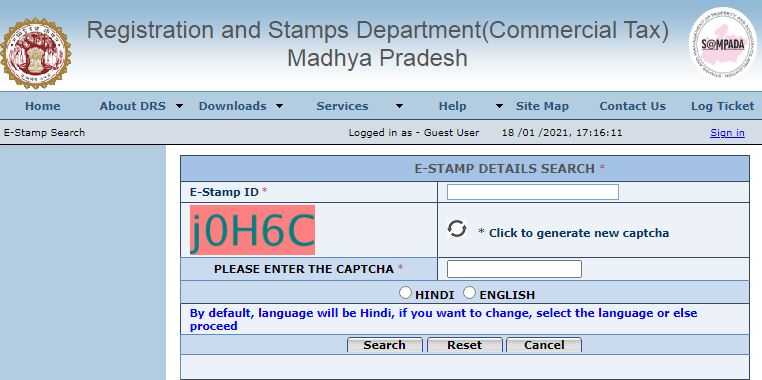

In this system stamp duty is collected through e-stamps. Stamp Duty is the tax levied on the legal acknowledgment of documents. In Delhi stamp duty on agreements not specifically provided for is Rs.

The details of the property registration or agreement are then written on this paper. What is the stamp duty on a backdated rental agreement. Stamp duty - Applicable for All.

Latest Stamp duty in Madhya Pradesh is 5 based on our records. 50- or on higher value to avoid any misshapen in terms of Legal Crises Later. SAMPADA SAMPADA is a comprehensive computerization project for registration and E-stamping of documents.

However if the rent agreement is made for a period greater than 1 year and less than 5 years then stamp duty will be 2 of the total rent for first 3 years. Has power to decide stamp duty applicable in its state. Document Value is differ based on the State.

A rental agreement can be given retrospective effect within the terms of the agreement. However stamp duty charges cannot be backdated. It is mostly required in various types of agreements power of attorney divorce papers.

All officers are subordinate to the Inspector General of Registration whose headquarter is at Bhopal.

Create E Stamp For Affidavit Lease Tenancy Sales Deed From Egrashry Haryana Youtube

Create E Stamp For Affidavit Lease Tenancy Sales Deed From Egrashry Haryana Youtube

Igrs Mp Registration And Stamp Department Madhya Pradesh

Igrs Mp Registration And Stamp Department Madhya Pradesh

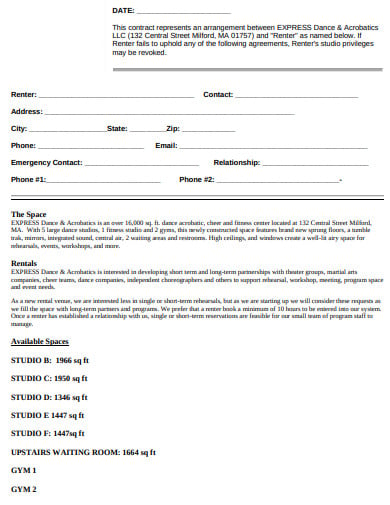

Rent Agreement Format Sample Registration Process Terms Conditions

Rent Agreement Format Sample Registration Process Terms Conditions

Claim Hra While Living With Parents

Claim Hra While Living With Parents

Madhya Pradesh Stamp Duty And Registration Charges 2020 21

Madhya Pradesh Stamp Duty And Registration Charges 2020 21

Stamp Duty And Registration Charges In Bhopal Madhya Pradesh

Stamp Duty And Registration Charges In Bhopal Madhya Pradesh

If I Am Doing Rent Agreement Of Rs 500 Stamp Paper Then Is It Valid Quora

If I Am Doing Rent Agreement Of Rs 500 Stamp Paper Then Is It Valid Quora

24 Studio Rental Agreement Templates In Pdf Free Premium Templates

24 Studio Rental Agreement Templates In Pdf Free Premium Templates

What Are All The Agreements That Need Stamp Duty

What Are All The Agreements That Need Stamp Duty

What Is Stamp Paper Stamp Duty

What Is Stamp Paper Stamp Duty

Can I Print On Stamp Paper At My Home Quora

Madhya Pradesh Stamp Duty And Registration Charges 2020 21

Madhya Pradesh Stamp Duty And Registration Charges 2020 21

E Stamp Paper In Bangalore Get It Online Edrafter In

E Stamp Paper In Bangalore Get It Online Edrafter In

Buy A Stamp Paper Online Buy An Essay

Buy A Stamp Paper Online Buy An Essay

Stamp Duty And Registration Charges In Bhopal Madhya Pradesh

Stamp Duty And Registration Charges In Bhopal Madhya Pradesh

Madhya Pradesh Stamp Duty And Registration Charges 2020 21

Madhya Pradesh Stamp Duty And Registration Charges 2020 21

How Does It Cost To Make A Rental Agreement In Indore Quora