How To Get My 1099 Form From Unemployment Virginia

Ask Your Own Tax Question. Some states only issue the form by mail so youll have to request it and wait for it to arrive if you never received a copy.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Request Your 1099 By Phone.

How to get my 1099 form from unemployment virginia. If youve lost or cant find your 1099-G select your state below to go to your local unemployment website. If you do not have an online account with NYSDOL you may call. If your responses are verified you will be able to view your 1099-G form.

If 760PY return add both columns of line 1. Add more income by scrolling down to the last option Less Common Income and Show more. If joint return filed for tax year.

If you havent received your 1099-G copy in the mail by Jan. This information is necessary in order to research your. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed.

The 1099-G tax form is commonly used to report unemployment compensation. We will automatically mail paper forms to taxpayers who did not opt to receive them electronically. This is the fastest option to get your form.

1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. You should be able to get an electronic copy if you log into CONNECT and go. Call your local unemployment office to request a copy of your 1099-G by mail or fax.

Lost my pandemic unemployment 1099G form and unable to reset password request copy online. If you choose this option it could take several days to receive your form. From the left menu go to Federal and select the first tab Wages Income.

Scroll down to the last option Miscellaneous Income 1099-A 1099-C and Start. Your Social Security number If you filed jointly youll also need your spouses SSN. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax.

Unemployment Compensation Benefit Rate Table. This is the fastest option to get your form. I cant file my taxes until I get my 1099 G form and cant get any help to resolve this matter.

Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1. How to get your information from the DEO There are three options. 31 there is a chance your copy was lost in transit.

Choose the last option Other reportable income and Start and Yes. If you dont receive your forms in time call your state or local taxing authority or unemployment office. To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link.

If you received 35 weeks of the maximum benefits 713 x 35 in 2020 plus FPUC 17 weeks x 600 plus FEMALWA 6 weeks x 300 your Form 1099-G will show the sum of all of these payments 36955 if you did not choose to have federal taxes withheld from the UI benefits. Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333. Key2Benefits Schedule of Card Fees.

Once there you may be able to sign in to your account and view it or request another one be sent to you. Your written request should include your name printed and signed your mailing address your social security number and personal identification number PIN if you received one. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund.

If youre looking for your unemployment information please visit the VECs website. Then you will be able to file a complete and accurate tax return. You can view or print your forms for the past seven years.

Disaster Unemployment Assistance FAQ. To access this form please follow these instructions. Notice regarding federal income tax withholding debit cards and personal identification numbers WVUC-D-128 Form.

If you cant download your 1099-G online or you have technical issues with it contact your states Department of Revenue. The tax year of your return. If youre owed one you should receive your 1099-G by January 31 giving you plenty of time to complete your taxes by Tax Day typically April 15.

Instructions for the form can be found on the IRS website. This 1099-G does not include. If its convenient consider stopping by the state unemployment office.

Top 10 Things You should Know about Unemployment Compensation. How to Get Your 1099-G online. If you cannot access your 1099-G form you may need to reset your password within IDESs secure website.

Your local office will be able to send a replacement copy in the mail. To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. Line 1 Adjusted Gross Income from your last filed 760 760PY or 763 Virginia return.

We will not mail paper 1099G1099INT forms to taxpayers who chose to receive them electronically unless we receive a request for paper copies of these forms from the taxpayer. Virginia Relay call 711 or 800-828-1120. Get Your 1099 Form Now Electronically To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link.

Select the appropriate year and click View 1099G. Follow the instructions to enter your unemployment.

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Page 1 Line 17qq Com

1099 Form Page 1 Line 17qq Com

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Form Colorado 2018 Vincegray2014

1099 Form Colorado 2018 Vincegray2014

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

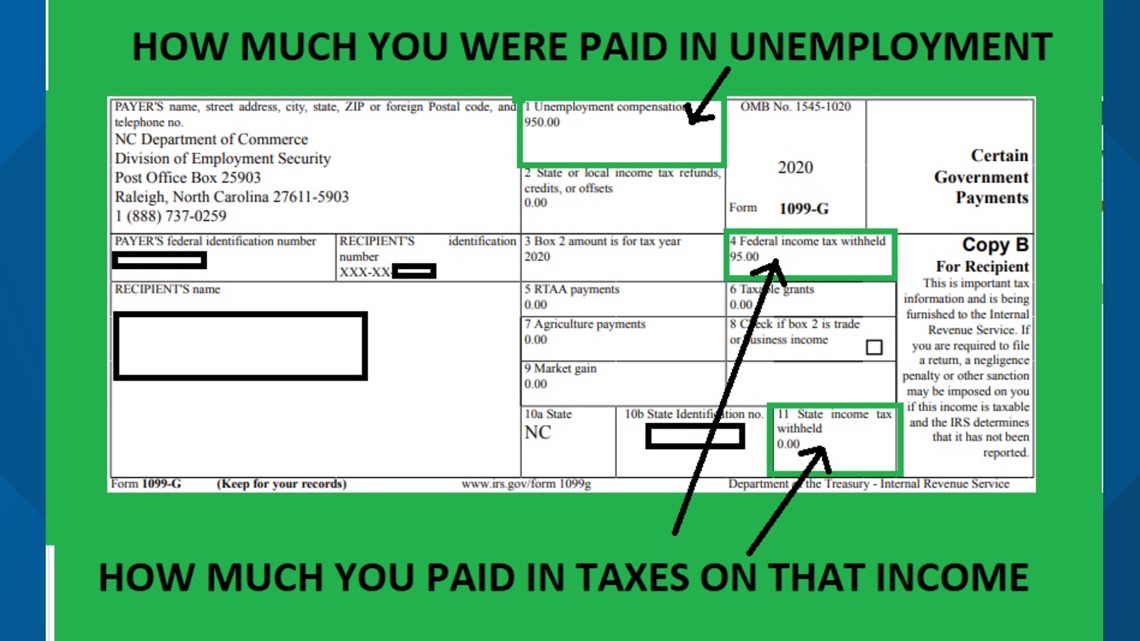

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important