Can I Claim Medical Expenses Without Receipts

If you choose this option the. You do not need to submit these receipts this includes Med 2 forms when you make a claim.

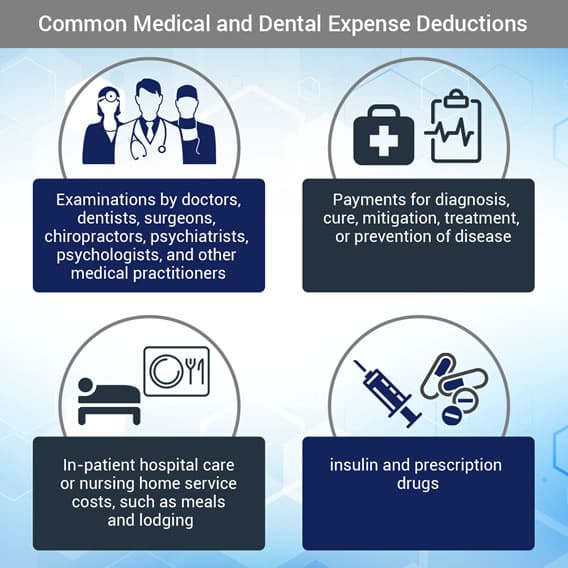

What To Know About Deductible Medical Expenses E File Com

What To Know About Deductible Medical Expenses E File Com

Mar 05 2010 Step 1.

Can i claim medical expenses without receipts. In the UK there is no rule on the amount that you can claim without receipts. There are cases where you can claim a tax deduction without a receipt but there are serious restrictions. Mar 30 2020 You can only claim for medical expenses if you have receipts to prove your claim.

If you dont use this service you must keep your medical receipts for six years because Revenue may investigate your claim. Apr 04 2017 An important detail to understand is that when it comes to deducting medical expenses you can only deduct the portion of qualifying expenses that exceed 10 percent of your adjusted gross income. However it should be reasonable to be accepted by a tax inspector.

The Revenue Receipts Tracker app RRTA is the quickest and easiest option to save your receipt details or images or both to Revenue storage. Qualified deductions include any of the following expenses paid for yourself your spouse your dependents and any children that you could have claimed but didnt because of a divorce or separation agreement. Oct 01 2020 Medical aids including wheelchairs hearing aids and batteries eyeglasses contact lenses crutches braces and guide dogs and their care Receipts are required to claim these costs and should be attached to your tax return if you file a paper copy by mail.

On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or. Find more information about medical expense deductions. Its directly related to and needed for your occupation.

If youre receiving a settlement as well as reimbursements the settlement can be taxed but the reimbursements cant. You do not send these records with your return but you should keep them with your tax records. Apr 06 2011 The IRS never asks for receipts anyway right.

Note that you have to have actual receipts for. You might still be able to claim those items even without a receipt. If youre getting a reimbursement for physical injury and expenses from a legal action you can deduct that amount from your taxes.

You cant deduct medical costs covered by the reimbursement. Jun 14 2017 The nature and purpose of any medical expenses. This means you should be able to answer yes to these questions.

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. Firstly the expense must be allowable. May 16 2018 In fact you can claim up to 300 for these expenses.

Premiums for medical dental long-term care vision Medicare Part B and Medicare Part D. All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. Revenues myAccount service includes a receipts tracker service which allows you to store your receipt details online.

For example if your business is claiming several business expenses and only 5 of them do not have receipts but detailed notes then this should be OK in the eyes of HMRC. Sep 17 2020 a claim for health expenses. You will need to keep the above documents for each medical expense you incur.

To deduct your medical expenses youll have to itemize your deductions. You cant make tax claims without receipts. Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted.

The Internal Revenue Service does allow taxpayers to deduct some expenses without keeping receipts and the agency allows credit card records and paid bills to serve as proof of expenses. However we may request to view them if your claim is selected for checking. The amount of the other medical expenses.

If youre self-employed and use your private vehicle for work-related activities such as traveling between job sites or offices dont worry you wont need to hoard all your fuel receipts. See Deducting Medical Expenses. You should always save your receipts when you claim a deduction whether its for business charity medical expenses or otherwise.

Jan 03 2020 Generally you cant make tax claims without receipts.

Are Health Insurance Premiums Tax Deductible

Are Health Insurance Premiums Tax Deductible

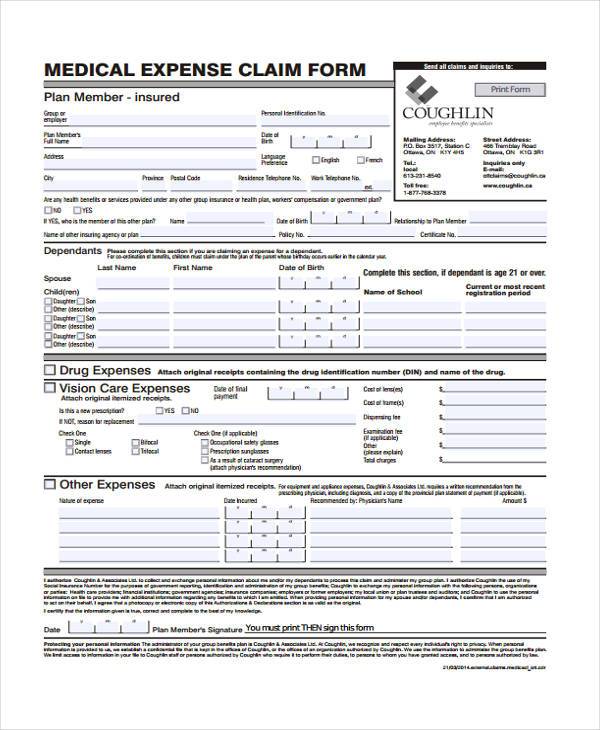

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 11 Medical Expense Forms In Pdf Ms Word

Free 11 Medical Expense Forms In Pdf Ms Word

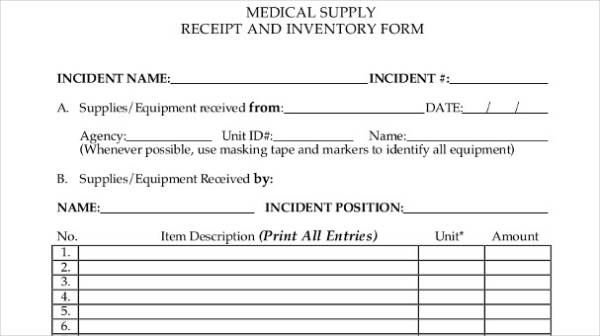

Free 9 Medical Receipt Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf Psd Indesign Ai Publisher

Free 9 Medical Receipt Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf Psd Indesign Ai Publisher

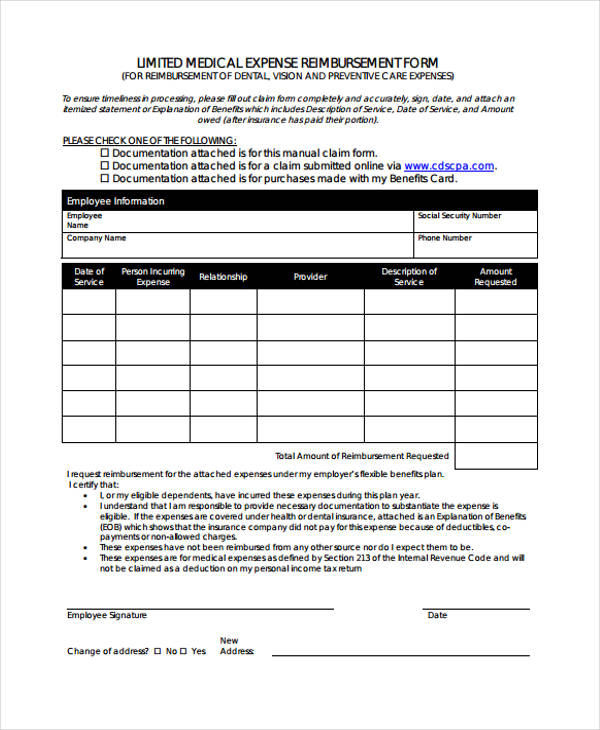

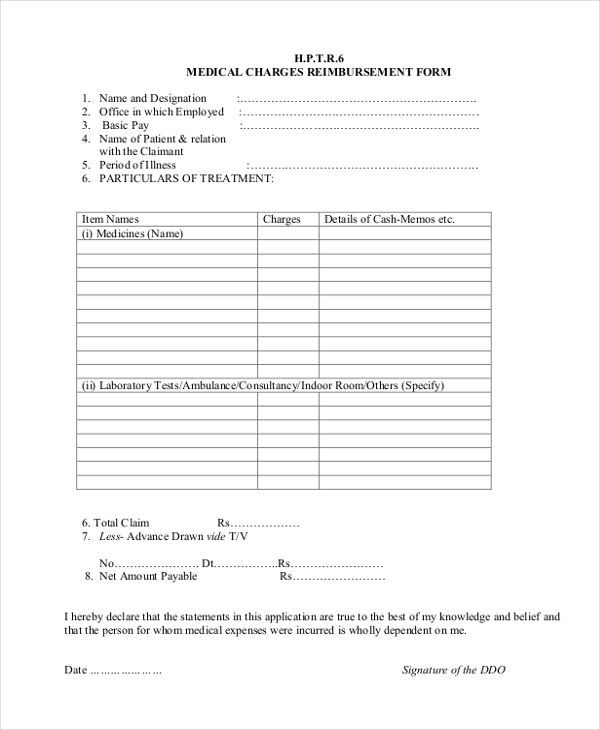

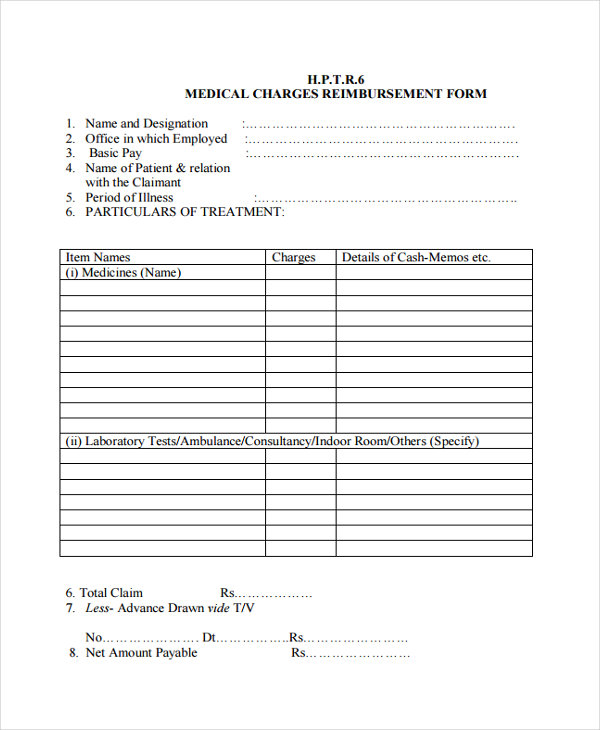

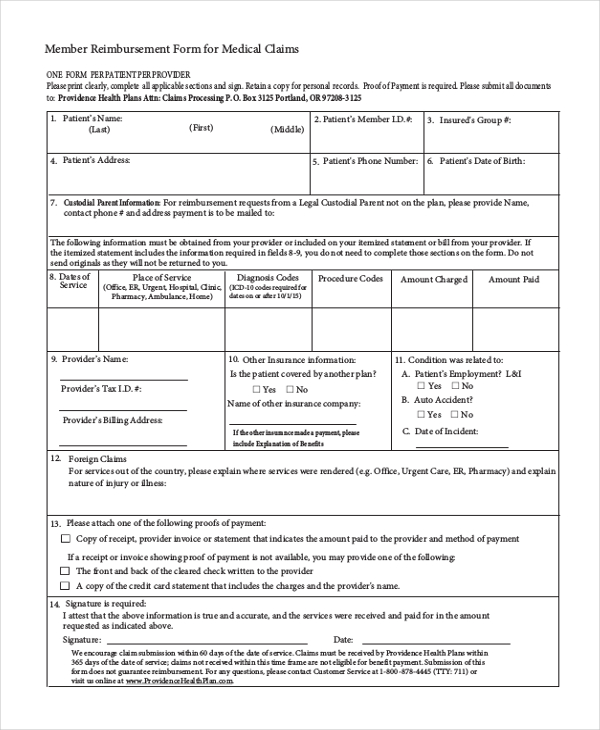

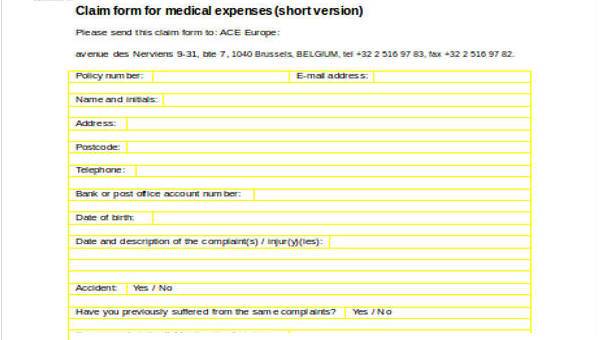

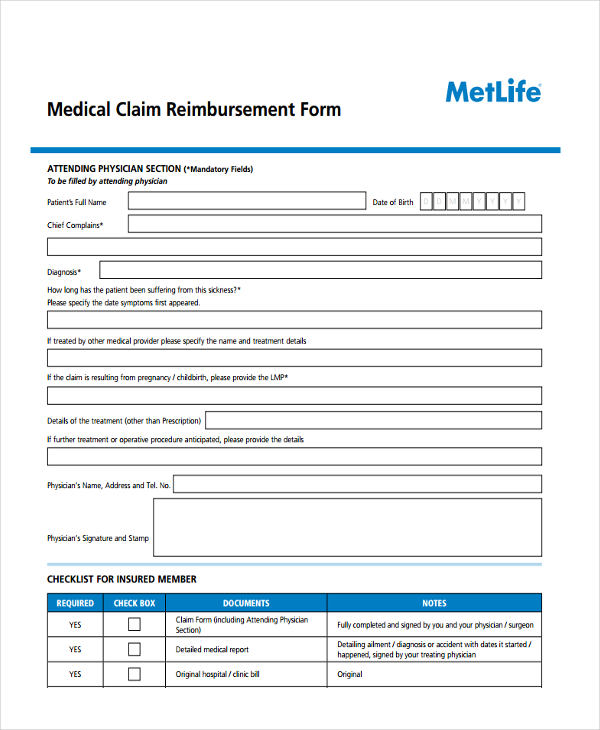

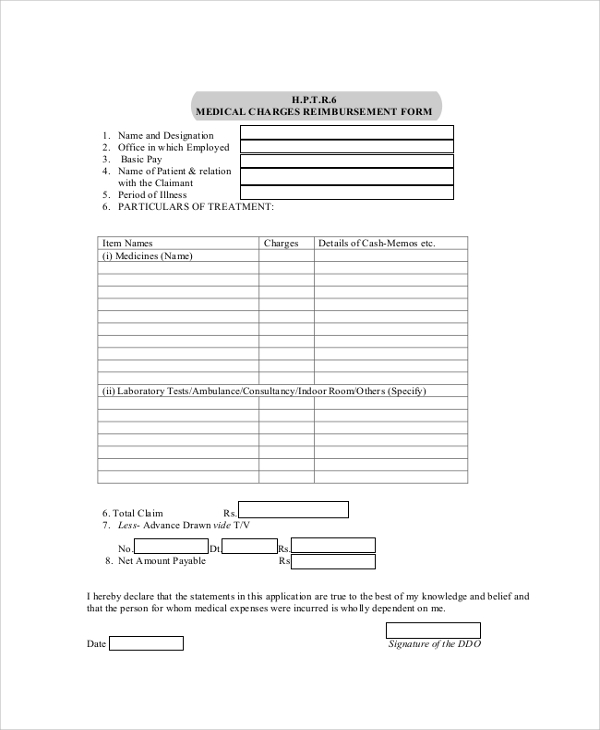

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 11 Medical Expense Forms In Pdf Ms Word

Free 11 Medical Expense Forms In Pdf Ms Word

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

14 Medical Reimbursement Form Templates In Pdf Doc Free Premium Templates

14 Medical Reimbursement Form Templates In Pdf Doc Free Premium Templates

Free 8 Medical Reimbursement Forms In Pdf

Free 8 Medical Reimbursement Forms In Pdf

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Simple Expense Report Template New Medical Expenses Claim Form Sample Forms Expense Template In 2021 Business Card Template Word Report Template Templates

Simple Expense Report Template New Medical Expenses Claim Form Sample Forms Expense Template In 2021 Business Card Template Word Report Template Templates

What Medical Expenses Are Tax Deductible The Turbotax Blog

What Medical Expenses Are Tax Deductible The Turbotax Blog

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

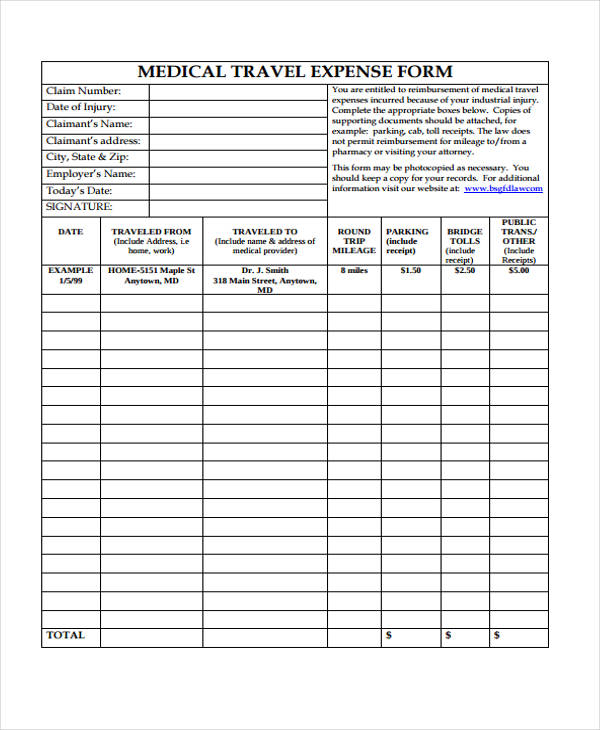

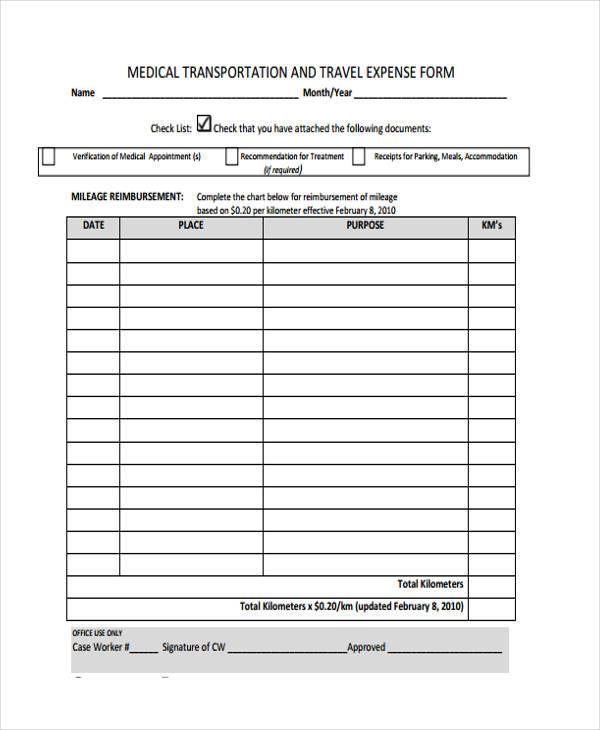

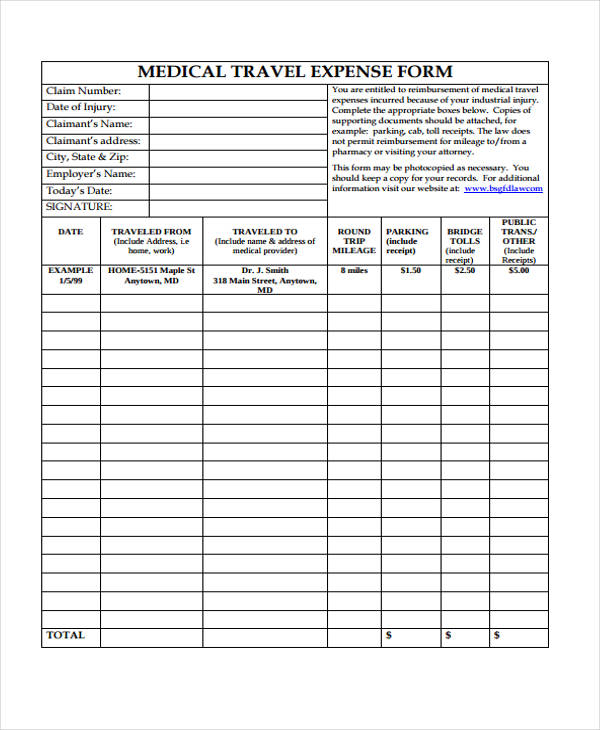

Medical Mileage Expense Form Mileage Expensive Medical

Medical Mileage Expense Form Mileage Expensive Medical

Free 8 Medical Reimbursement Forms In Pdf

Free 8 Medical Reimbursement Forms In Pdf

What To Know About Deductible Medical Expenses E File Com

What To Know About Deductible Medical Expenses E File Com

Free 9 Sample Reimbursement Forms In Pdf Ms Word Excel

Free 9 Sample Reimbursement Forms In Pdf Ms Word Excel