Business Travel Meal Allowance Policy

HR Manual section 2203 Allowances and Travel Reimbursements provides additional information including travel timeframes fractional day of travel trip of less than 24 hours trip of more than 24 hours etc. The meal must be.

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

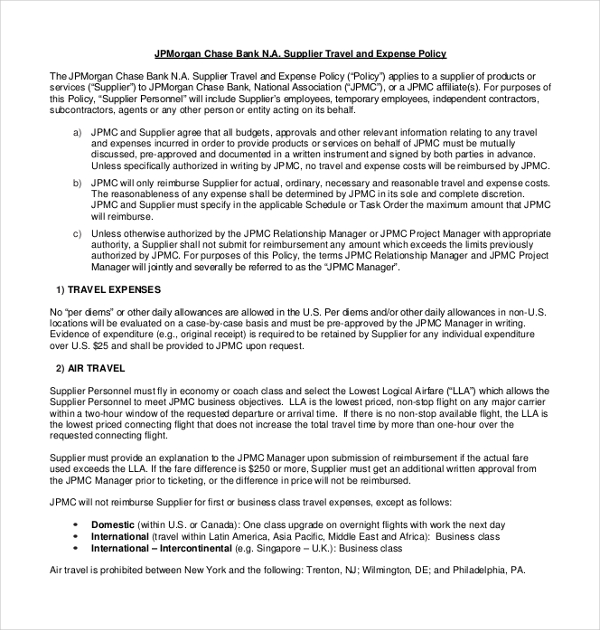

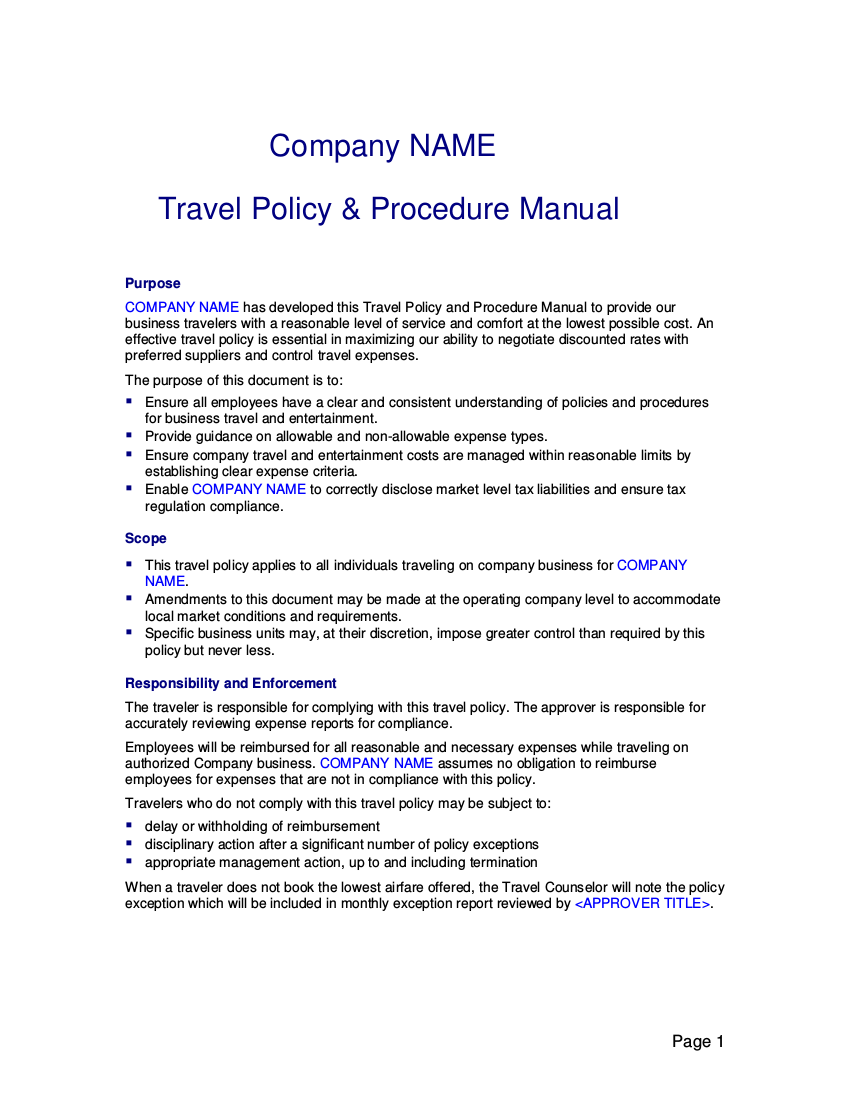

These expenses must be documented in accordance with the procedures specified in this policy with a clear business purpose.

Business travel meal allowance policy. DEFINITIONS Allowance an amount of money granted by an employer to an employee in circumstances where the employer is certain that the employee will incur business. It is not a meal reimbursement. A business travel allowance is a payment made to a corporate traveler by an employer to cover expenses incurred on a business trip.

Updating your travel policy. Traveler qualifies for a single day meal reimbursement limit of 12 if their travel exceeds six 6 hours or more but fewer than twelve 12 consecutive hours. Employees in travel status may be reimbursed for two 2 or three 3 separate meals per day providing that the daily meal limit for the travel area is not exceeded including tax and tips.

Expenses incurred on meals while traveling on OMVIC business are reimbursed up to a daily maximum of 9000 per person following the meal limits of 20 for breakfast 25 for lunch 45 for dinner excluding applicable taxes and maximum gratuity of 15. As of April 7th 2019 the official HMRC meal allowance rates for UK business travel are. There should not be more than 1 stoppage in case of domestic travel and the stoppage must not exceed more than 2 times in the case of international travel.

Traveler qualifies for an extended day meal reimbursement limit of 19 if in travel status twelve 12 or more consecutive hours. The following reimbursement rates for meals and incidentals are maximums not allowances. Travel meals occur when an employee is on an authorized work assignment that requires an overnight stay away from his or her home.

The fixed meal allowance begins the day the traveler departs for business and continues through the day of return as long as all days in between are business-related Generally travel includes the day before business is set to begin and ends the day after business concludes. A daily travel allowance will be paid to travellers. This amount is called the standard meal allowance.

The amount of the allowance varies depending on where and when you travel. Excess meals may be allowed dependent on funding source. Meals Personal meals are defined as meal expenses incurred by the traveler when dining alone on an out-of-town business trip.

The deduction for business meals is generally limited to 50 of the unreimbursed cost. The standard meal allowance is based on what federal workers are allowed to charge for meals while traveling and is therefore relatively modest. In the event of an audit employees must be able to produce receipts substantiating the amount claimed.

The per diem is intended to offset costs for meals when traveling. Business Meals Taken With Other Employees. If youre self-employed you can deduct travel expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or if youre a farmer on Schedule F Form 1040 Profit or.

The travel policy should also spell out which amenities such as checked luggage meals and in-flight entertainment are and are not covered by the organization. Approximate meal expense guidelines are as follows. The approach to an allowance will vary from one company to the next depending on the corporate travel policy that is in place.

Business Meal While on Travel Status. 5 for travel of 5 hours or more 10 for travel of 10 hours or more 25 for travel of 15 hours or more or if the travel is ongoing after 8pm. 12day for breakfast and lunch combined.

See 1502 Policy on Allowable Travel Expenses Lodging and Per Diem Rates for additional information. Per diem is a daily allowance employees receive to cover business travel-related expenses. All air travel andor accommodation requirements will be coordinated through the City Procurement Organisational Services subject to receipt of the necessary approvals.

If you offer employees per diem pay include per diem rates and information in your travel and reimbursement policy. Per diem only covers meals lodging and incidental expenses eg dry cleaning. It covers your expenses for business meals beverages tax and tips.

The most common expenses are accommodation food drink and transportation. Lesedi Local Municipality Subsistence and Travel Allowance Policy Page 3 of 13 1. This policy is to be implemented in accordance with Attachment A Corporate Travel and Accommodation Policy Standards Employees and Contractors.

A University employee can incur a business meal expense while on travel status. It must not increase the travelling time for more than 2 hours in case of domestic travel and more than 4 hours when it comes to international travel.

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

Https Workful Com Blog Wp Content Uploads 2017 10 Expense Policy Pdf

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

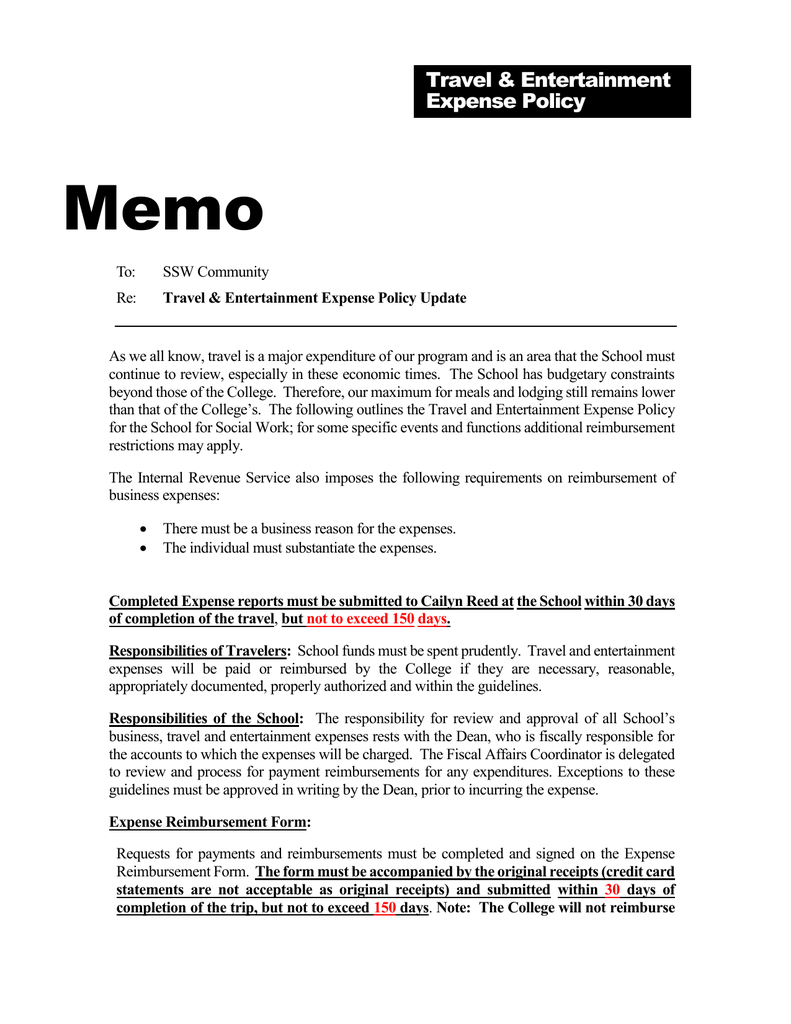

Memo Travel Amp Entertainment Expense Policy

Memo Travel Amp Entertainment Expense Policy

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

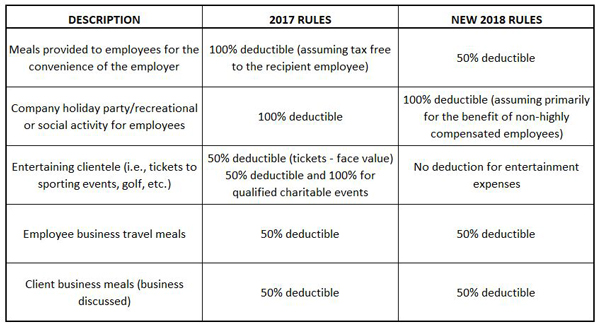

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

4 Employee Reimbursement Policy Templates Pdf Free Premium Templates

4 Employee Reimbursement Policy Templates Pdf Free Premium Templates

Expense Reimbursement Policy Best Practices And 3 Templates

How To Create An Expense Report Policy Free Template

How To Create An Expense Report Policy Free Template

Expense Reimbursement Policy Best Practices And 3 Templates

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

Https Www Smu Edu Businessfinance Officeofbudgetandfinance Travelandexpense Travel Travel Procedures

When Do I Need To Attach A Receipt To My Expense Reports

When Do I Need To Attach A Receipt To My Expense Reports

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples