Can I Hand Print 1099 Forms

Is there a template on screen that i can type 1099 MISC information and them print onto preprinted IRS 1099 forms. Say Thanks by clicking the thumb icon in a post.

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

Technically you can fill out 1099 forms by hand if you meet the pre-set guidelines.

Can i hand print 1099 forms. Template for 1099 Misc. The short answer is yes you can fill out a 1099 by hand but theres a little more to it than that. Keep it simple right.

- Click the Print 1099 Forms button to print the different 1099 Copies for this recipient. Well not so fast. Select the 1099 forms you want to print.

You may use the form from IRS website - httpwwwirsgovpubirs-pdff1099mscpdf - but may not use this from to send to the IRS. See the Instructions for Forms 1040 and 1040-SR or the Instructions for Form 1040-NR. You cant print it off the computer even if you have a color printer.

This income is also subject to a substantial additional tax to be reported on Form 1040 1040-SR or 1040-NR. Who gets Forms 1099. However we can reset the payroll update to check if its available on your end.

Adjust the alignment by dragging the square to the place where it appears on your printout. Handwriting your tax forms comes with a long list of rules from the IRS since handwritten forms need to be scanned by their machines. You have to use the real form.

Copy A is sent to the IRS on red-ink forms. For a box-by-box guide to filling out the 1099-MISC by hand this is a guide we think is helpful. You can certainly use the Adobe pdf blank 1099-MISC form available from the IRSgov website to print Form 1099-MISC and give copies B C to your independent contractors as well as others to whom you need to legally issue 1099s such as attorneys etc.

Heres how to print the forms. Copy B of a 1099 form can be printed on plain paper with black ink. Although the IRS will accept handwritten forms they do caution that the writing must be completely legible and accurate in order to avoid errors in processing.

To fill out 1099-MISC forms by hand the forms cant simply be printed and filled in. The IRS still encourages employers to file electronically no matter the number of forms and doing so requires the information to be typewritten. However if youre thinking about handwriting a 1099 form we urge you to reconsider.

Template for 1099 Misc. Independent contractors can use Form 1099-NEC to get the necessary information to file their personal tax returns. Copy B of a 1099 form can be printed on plain paper with black ink.

Any amount included in box 12 that is currently taxable is also included in this box. EzW2 can print forms 1099-nec copy A B C 1 and 2 - Click the Print Instructions button to print 1099 instructions. Those forms are scanned so it has to be the right paper.

Preparing the Forms The good news is as long as youre distributing fewer than 250 of the 1099 forms handwritten copies are allowed. You might be wondering can I print 1099 on plain paper and whether or not your 1099s W-2s and other tax forms can be handwritten. People are supposed to use the red forms.

Form 1099-NEC as nonemployee compensation. The payer could hand-write all of Copy B and send that to the recipient. Print your 1099 forms.

1099- MISC forms. Approved forms need to be ordered from the IRS or bought at an office supply store. The payer could hand-write all of Copy B and send that to the recipient.

On the other hand Form 1099-NEC Nonemployee Compensation is solely for reporting payments to independent contractors. I do not want to hand write 1099. You can purchase your 1099 kit for the pre-printed forms.

Yes you may fill the form 1099-misc by hand. See the text under Paper Document Reporting in the General Instructions for Certain Information Returns 2019. Who is required to receive a 1099.

Preview and print sample. Yes you can handwrite a 1099 or W2 but be very cautious when doing so. - Click the save button to save the 1099 information.

In terms of handwritten forms the IRS says Although handwritten forms are acceptable they must be completely legible and accurate to avoid pro. Once you issue 250 forms or more youll need to e-file your forms. You must use pre-printed forms - you may purchase them or pick from the local library.

However Form 1099-MISC Copy A which should be kept by you and then filed along with Form. At the moment only supported versions of QuickBooks Desktop can generate and print the form 1099 NEC. The IRS says Although handwritten forms are acceptable they must be completely.

You can order your 1099-MISC and your 1096 transmittal from for free from the IRS. Handwritten tax forms are often flagged for mistakes and inaccuracies which can lead to penalties. This form works similarly to Form W-2.

Copy A is sent to the IRS on red-ink forms. The handwriting must be completely legible using black ink block letters to avoid processing errors. Select vendors to print then choose Next.

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

2020 Quickbooks 1099 Misc 3 Part Pre Printed Tax Forms With Envelopes

2020 Quickbooks 1099 Misc 3 Part Pre Printed Tax Forms With Envelopes

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

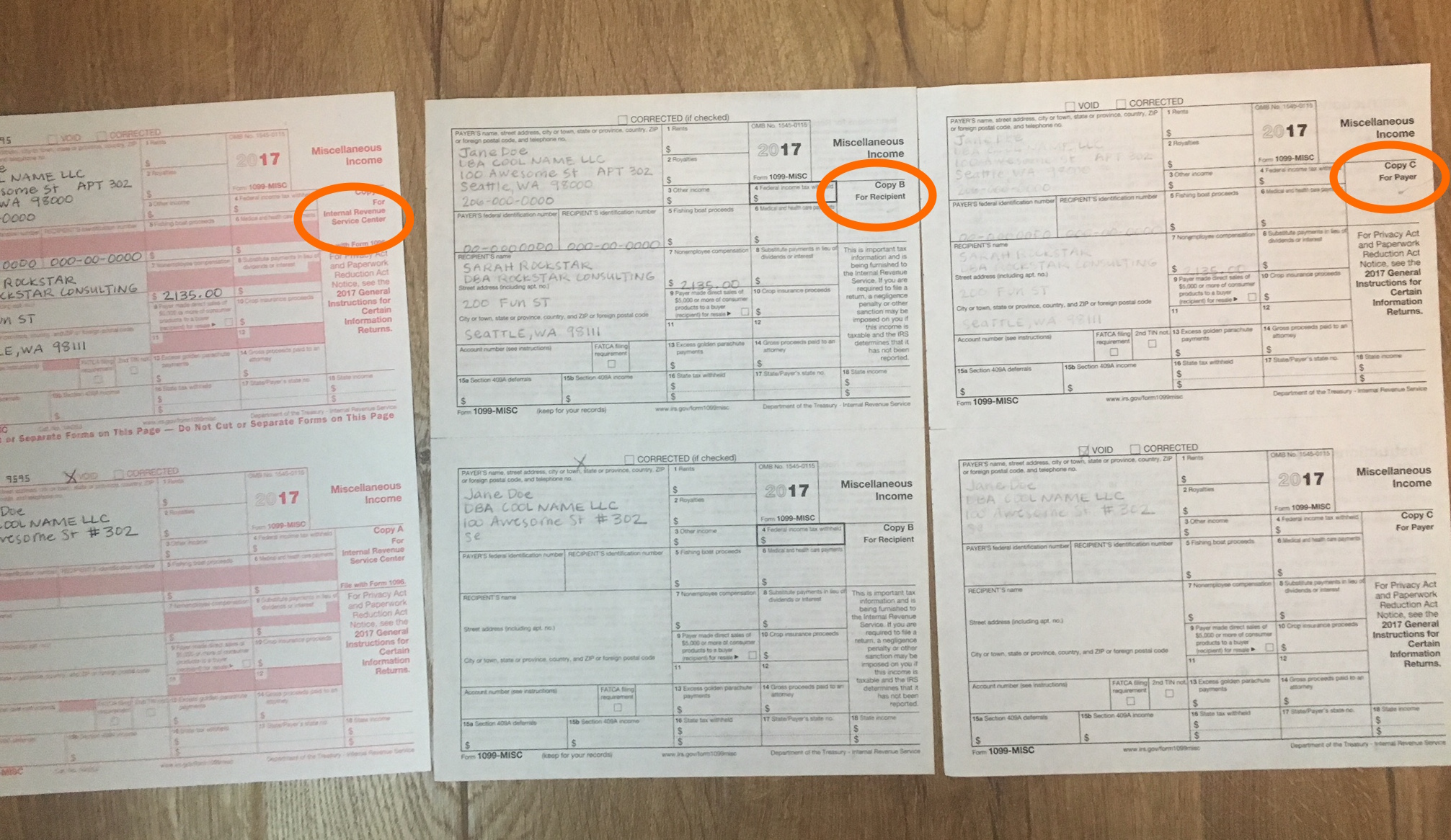

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

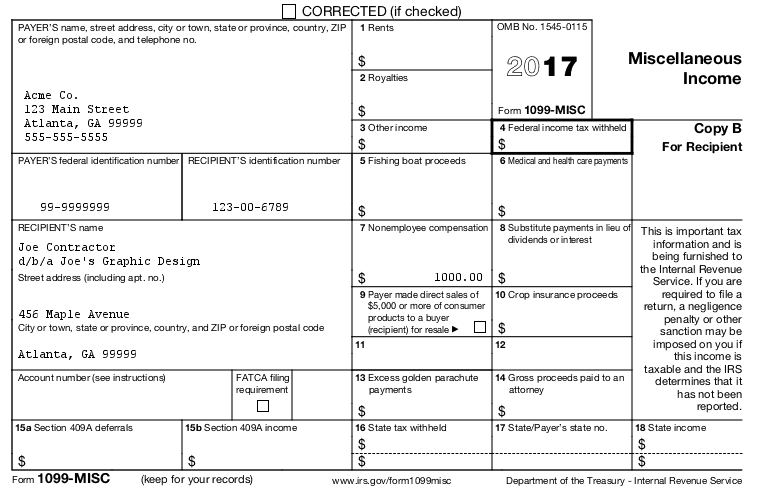

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

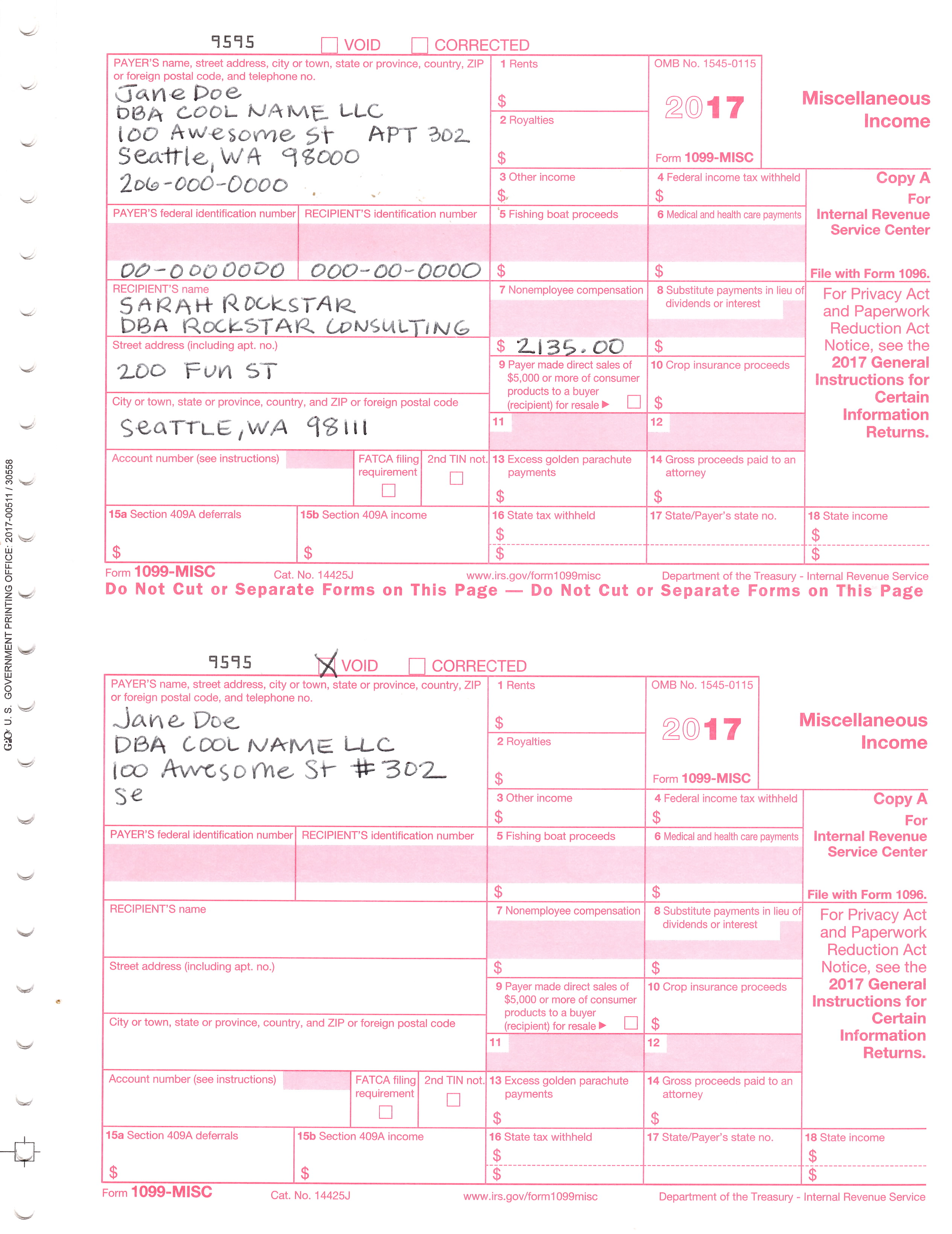

Sample 1099 Misc Forms Printed Ezw2 Software

Sample 1099 Misc Forms Printed Ezw2 Software

Amazon Com 1099 Nec Tax Forms Replaces 1099 Misc For 2020 4 Part Form Sets For 5 Vendors 2x 1096 Summary And Confidential Envelopes Filings For 5 Office Products

Amazon Com 1099 Nec Tax Forms Replaces 1099 Misc For 2020 4 Part Form Sets For 5 Vendors 2x 1096 Summary And Confidential Envelopes Filings For 5 Office Products

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Quickbooks And Irs 1099 1096 Forms For 2013 Insightfulaccountant Com

Quickbooks And Irs 1099 1096 Forms For 2013 Insightfulaccountant Com

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

How Do You File 1099 Misc Wp1099

How Do You File 1099 Misc Wp1099