How To Register A Company Efiling

Employer Registration Congratulations on starting a business in the greatstate of Ohio. Civil e-Filing Guidelines Current as of February 222019 Filing a Safe at Home Address Release Petition.

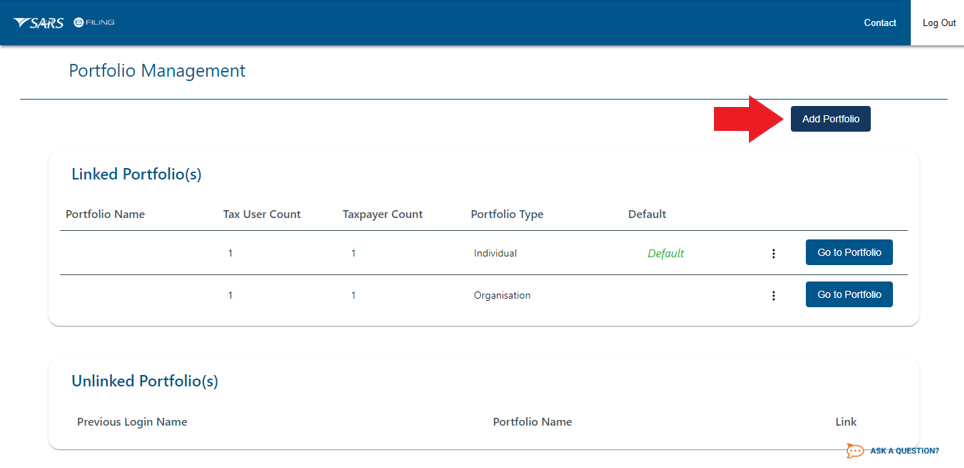

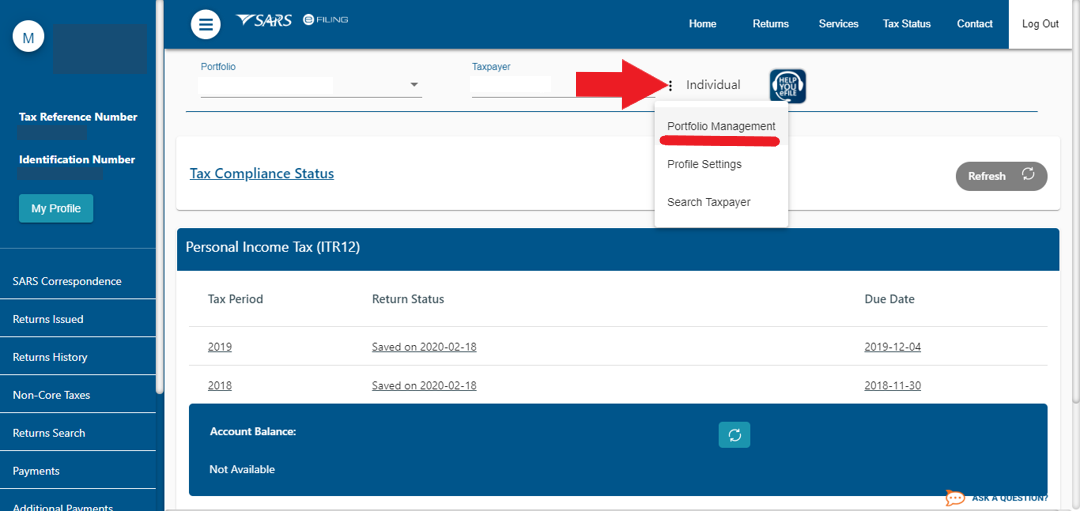

You can then add an organisation to your profile.

How to register a company efiling. On the Individual portfolio select Home to find the SARS Registered Details functionality. On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is. Once you have registered you may log into ERACs e-filing system to file documents.

Choose the correct user from Taxpayer List. Pay via Payment Gateway. Use IRS e-file for Employment Tax Returns Information Returns Partnerships Corporations Estates Trusts plus Exempt Organizations.

General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C. To set up a new eFiling profile for a company you will need to ensure that you have all your valid documents ready to use during the process. Click Register Yourself button located at right side of the Home Page.

Your tax registration numbers. Program Overview Whether youre a business big or small or are self-employed youll find an e-file for business filing option that meets your needs. Under the Ohio Unemployment Compensation Law most employers are liable to pay Unemployment Compensation taxes and report wages paid to their employees on a quarterly basis.

On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the Organisations menu tab. Navigate to SARS Registered Details functionality. Ownership management structure or directors.

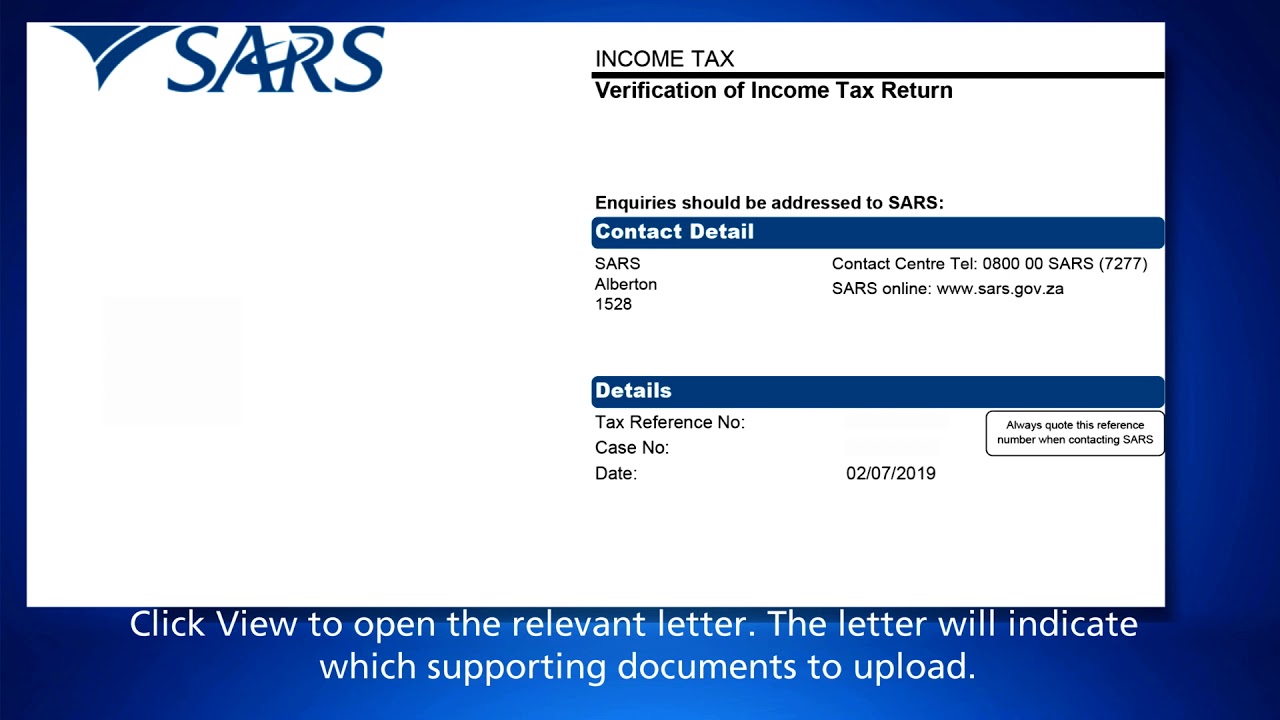

To complete the registration process you will need at hand. Civil e-Filing Guide. Click on the check box for all applicable Tax Types.

The registration number 5. The year end of the company. On the Individual portfolio select Home to find the SARS Registered Details functionality.

Select the User Type as Other than individualHUF and select the Sub-User type as per the PAN. Then a SARS eFiling registration form will open up wherein you will need to input your personal information to authenticate your claim. Navigate to SARS Registered Details functionality.

The companys banking details 6. Please review the instructions below. EFilers will register as Please select and click on the appropriate option below.

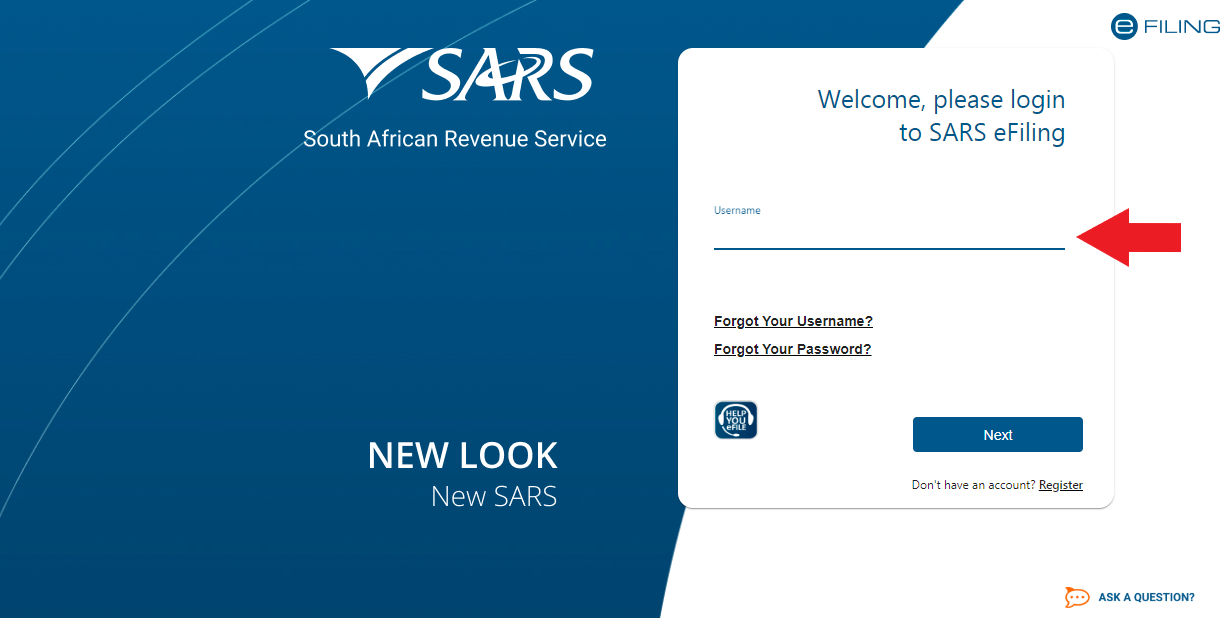

The SARS tax number 4. The efiling profile must be created for an individual. REGISTER FOR SARS EFILINGLONG AWAITED EASY 3 STEP PROCESSAvoid the lines to SARS and do it right the first timeI take you step by step to log into e-filing.

An individual if they are operating in their personal capacity. Track Application Status Online. Highlighted below are two important.

You can also view outstanding balances if any and update certain contact information ie. Instruction Manual for Filing a Public Records Access Dispute. Click Organisation Tax Types.

Mailing address telephone number andor email address with the Department. The address and contact number 3. 15 Days Registration Process.

Get DIN DSC MOA AOA RC. Name of the company 2. In most cases the total cost to register your business will be less than 300 but fees vary depending on your state and business structure.

You will also provide your identification number as well as your cell phone number before clicking on Register. The information youll need typically includes. Allows you to viewprint transcripts of previously filed returns up to 10 years and Ohio 1099-G1099-INT forms up to 5 years.

To use ERACs e-filing system you will first need to register and create an account. This process is completed through our public Case Search portal. If you already have an efiling profile it should be easier to just add the company to your.

New appeals are not accepted through e-filing. Visit the e-Filing Portal httpsincometaxindiaefilinggovin. Pay via Payment Gateway.

You will need the following.