How To File 1099 Misc In Pennsylvania

File a copy of the Federal Form 1099-MISC with the Department by January 31 of the next year. If you prefer e-filing TaxBandits is here to help you with that.

You can file your W-2 wage records 1099-R distributions 1099-MISC1099-NEC income and REV-1667 Annual Withholding Reconciliation Statement Transmittal in e-TIDES using the File ReturnPayment link.

How to file 1099 misc in pennsylvania. If the entity issuing Form 1099-MISC is required to perform electronic filing for Pennsylvania employer withholding purposes the Federal Form 1099-MISC shall be filed electronically with the Department. Beginning in 2018 anyone that pays Pennsylvania-source income to a resident or non-resident individual partnership or single member limited liability company and is required to file a Federal Form 1099-MISC is required to. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

Box 280412 Harrisburg PA 17128-0412. When filing federal copies of forms 1099 with the IRS from the state of Pennsylvania the mailing address is. In these instances a gig worker who received 600 or more of these types of payments may receive Form 1099-MISC which provides a summary of those payments.

Department of the Treasury Internal Revenue Service Center Austin TX 73330. CSV format and contain a data element for each column specified below. File a copy of the Federal Form 1099-MISC with the payee by.

There were no Pennsylvania state withholdings for that income. E-File Pennsylvania 1099-MISC and 1099-NEC directly to the Pennsylvania State agency with Tax1099. We support 1099-MISC 1099-NEC and 1099-Rs with the State of Pennsylvania.

You can distribute 1099 form copies to payees via postal mail or TaxBandits Online Access Portal if needed. E-filing is the best option for hassle-free filing. We file to all states that require a state filing.

It should contain a minimum of 34columns of data. 1099-MISC As a gig worker you may also receive monetary prizes awards or compensation while performing gig services. A pop-up window will appear.

The Employer W-21099 Menu allows you to enter or edit information that was filed manually or uploaded in e-TIDES. Recipients Tax Identification Number on 1099-MISC form is incorrect in relation to the recipient name on the 1099-MISC form The Compensation amount listed in Box 7 of the 1099- MISC form is inconsistent with the information provided on those claims received. DOR recommends that 1099-MISC withholding returns and monies be remitted and filed electronically via the e-TIDES system.

1099Rs with code 3 or 4 are not taxable in PA unless with code D. Another pop-up window will appear. 1099-MISC1099-NEC Income Records CSV 1099-MISC - Tax Year 2019 and Prior.

It also expanded the requirements with respect to when a copy of Federal Form 1099-MISC is required to be filed with the Pennsylvania Department of Revenue. For complete filing information it. Select the 1099-M Miscellaneous Income Records CSV radio button and select the Browse button.

The file you upload needs to be a Comma Delimitedfile ie. When filing state copies of forms 1099 with Pennsylvania department of revenue the agency contact information is. Select the Choose File to Upload link.

The PA state return will exclude the taxable portion of the distribution due to death and you will receive a refund or credit for the amount of. You would need to enter the 1099R in TurboTax as received. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. Customers report 1099-MISC information directly to the state of Pennsylvania. You can e-file 1099 forms with the State of Pennsylvania.

Form 1099-G is a federal form that the Internal Revenue Service requires be provided to taxpayers to remind them of the Pennsylvania income tax refunds or credits they received the previous year. The 1099-G will affect the filing of your federal income tax return if you itemized deductions the prior year and claimed state income tax paid as a. Your New Jersey W-2 is excluded from Pennsylvania taxes so that income and taxes would not be part of the Pennsylvania reporting.

Let us manage your state filing process. Can I e-file 1099 forms with Pennsylvania. On your 1099-MISC income the amount in Box 7 - Non Employee Compensation is the Federal and State PA amount.

And acted upon by MA during the tax year in question. Beginning January 1 2018 anyone that makes the following payments is required to withhold from such payments an amount equal to the tax rate specified per 72 PS. Electronic submission is available through the Departments e-TIDES system.

7302 currently 307. PA Department of Revenue PO. 1099-MISC PA Filing Requirements and Schedules The DOR stated in its February 5 announcement that it expects payors and lessors to file the related 1099-MISC forms with boxes 16 and 17 completed timely in January 2019.

IRS approved Tax1099 allows you to eFile Pennsylvania forms online with an easy and secure filing process.

Https Www Revenue Pa Gov Generaltaxinformation Tax 20types 20and 20information Employerwithholding Documents Efw2 Efw2c Reporting Inst And Specs Pdf

New Form 1099 Nec Replaces 1099 Misc For Reporting Non Employee Compensation For 2020 Boyer Ritter Llc

New Form 1099 Nec Replaces 1099 Misc For Reporting Non Employee Compensation For 2020 Boyer Ritter Llc

New Pa Rules For Non Resident 1099 Misc Withholding

New Pa Rules For Non Resident 1099 Misc Withholding

How To File And Pay Sales Tax In Pennsylvania Taxvalet

How To File And Pay Sales Tax In Pennsylvania Taxvalet

Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2009 2009 Pa 40w2s Pdf

Pennsylvania W2 1099 Forms Online Electronic Filing Printing

Pennsylvania W2 1099 Forms Online Electronic Filing Printing

How To File And Pay Sales Tax In Pennsylvania Taxvalet

How To File And Pay Sales Tax In Pennsylvania Taxvalet

Pennsylvania S 1099 Misc Withholding Tax Requirements What To Know

Pennsylvania S 1099 Misc Withholding Tax Requirements What To Know

Pa Schedule W 2s Eliminated Drake20

Pa Schedule W 2s Eliminated Drake20

Update Pa Department Of Revenue Releases New Guidance On New 1099 Misc Pa Withholding Requirements

Update Pa Department Of Revenue Releases New Guidance On New 1099 Misc Pa Withholding Requirements

Https Cdn2 Hubspot Net Hubfs 127975 Brunell 20 20pa 201099 Misc 20guidance Pdf

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

New Reporting Requirement For Pa Businesses Franty Co Certified Public Accountants

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Pennsylvania State Filing Page 1 Line 17qq Com

1099 Pennsylvania State Filing Page 1 Line 17qq Com

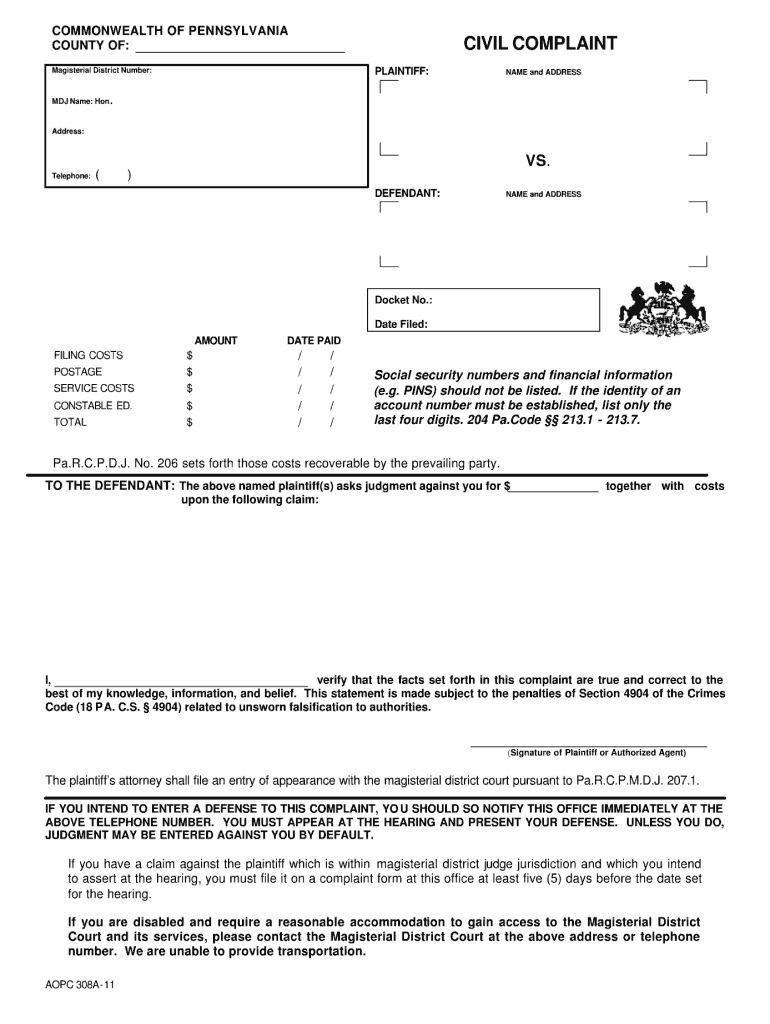

Pa Aopc 308 A Fill Online Printable Fillable Blank Pdffiller

Pa Aopc 308 A Fill Online Printable Fillable Blank Pdffiller

How To Change Your Pennsylvania Registered Agent For Free

Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2016 2016 Pa 40w2s Pdf